2 of the best US growth and dividend stocks to consider!

Image source: Getty Images

The US offers a large selection of stocks that investors can buy to build a diversified five-star portfolio. By focusing primarily or entirely on Wall Street-listed companies, investors can manage risk in a meaningful way while aiming for maximum returns.

Growth stocks are often at the forefront of innovation and can capitalize on new trends and consumer habits, leading to greater profits and therefore share price growth.

Dividend stocks, meanwhile, have little earning potential. But they are generally less volatile, and can provide consistent returns at all points in the economic cycle.

With this in mind, here are two of my favorite US stocks from each category.

Growing up

Dell Technologies (NYSE:DELL) has been providing computer hardware and software for 40 years. And now it's looking to Artificial Intelligence (AI) to take marketing to the next level.

To capture this, it is investing heavily to provide full-stack AI solutions that include the fields of client devices, servers, storage, data protection, and communication.

As part of this drive, it recently introduced Dell Factory with Nvidiausing the latest technology to provide full-fat products and services to accelerate enterprise adoption of AI.

It also provides xAI-programmed supercomputer servers, according to the startup's founder, Elon Musk.

I like Dell stock because of its relative cheapness compared to many other AI stocks. It trades at a forward price-to-earnings (P/E) ratio of about 16 times, even after recent gains. This compares favorably with other technology stocks (Nvidia, for example, trades at a multiple of 43.4 times).

It's early days, so predicting the winner(s) of the AI battles is a difficult task. But the ambitious steps Dell is taking may make it one of the leading lights in the industry.

Assignments

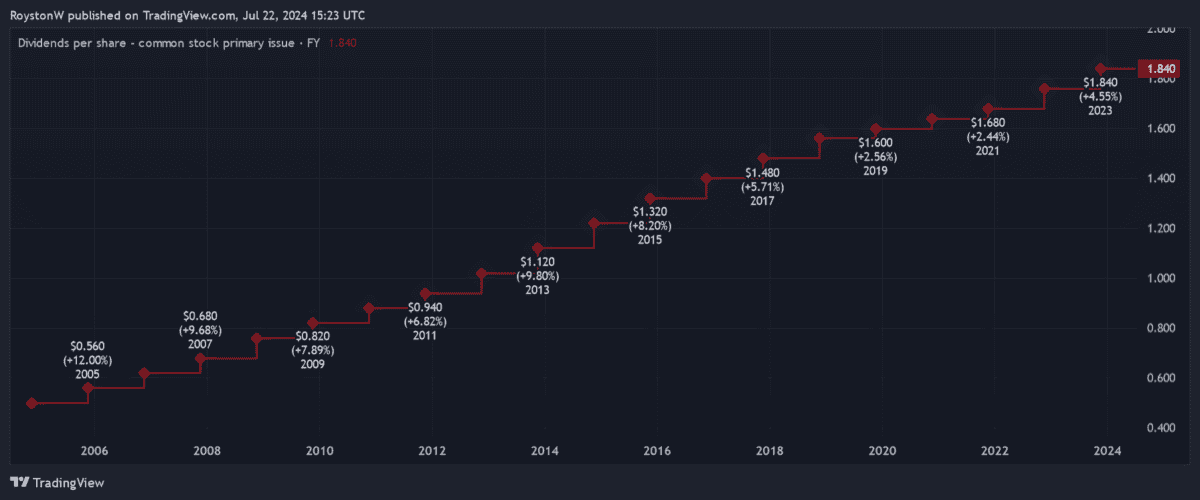

It is drinking a giant The Coca-Cola Company (NYSE:KO) is one of the world's true Dividend Aristocrats. Shareholder payouts here have risen every year for an incredible 62 years.

This is due to the unique product strength of Coke and its many soft drink labels. They are always in high demand in all areas of the economic cycle. Even in tough times, the prices of these goods can be increased to help the company cut costs and increase earnings.

Extreme competition in all its categories is dangerous. However, Coca-Cola's huge investment in marketing and product innovation means it is currently one step ahead of the pack.

This year it was introduced Coca-Cola Spiced in the US and Canada to capitalize on the growing consumer demand for spicy foods and beverages.

City analysts expect shares here to continue rising until at least 2026. It means that this year the company has a healthy dividend yield of 3%, supported by expected earnings growth of 14%.

And in 2025 and 2026, the yield on Coca-Cola shares rises to 3.1% and 3.3% respectively. All three forward yields beat the S&P 500 an average of 1.3% for a healthy grade.