23% off! Should I buy more CrowdStrike shares in my Stocks and Shares ISA?

Image source: Getty Images

It's always a little surreal when your Stocks and Shares company ISA starts trending long-term around the world. That's what happened to me recently with a cybersecurity company CrowdStrike (NASDAQ: CRWD).

This is the kind of company I want working behind the scenes, keeping its customers safe from cyber threats with its Falcon cloud platform. If its name is on everyone's lips, I can imagine a massive cyberattack.

As we know however, that is not the case from a few days ago. A faulty software update crashed at 8.5m Microsoft Windows computers, disruptive airplanes, banks, TV stations, and hospitals around the world. It was the only big IT in history.

Following this, the price of CrowdStrike dropped by 23%. Is this my chance to buy more shares?

Home name (for wrong reason)

The first thing to note is that there will obviously be some valid claims arising from this spectacular failure. Delta Air Linesfor example, it had to cancel more than 4,000 flights.

The event even caused volatility among major online underwriters across the primary and insurance markets. Barclays he said:At present, due to the short duration of the accident and its innocuous nature, we can expect [insurance] sector impact of $1bn or less.”

While this was disturbing, and certainly embarrassing for CrowdStrike, a major cyberattack could have been worse. That would eliminate reliance on the company's security capabilities.

Then again, there is still incalculable reputational damage. That will take time to measure.

All we know is that Elon Musk said so Tesla has already removed CrowdStrike from its systems. Others may follow and that will obviously have an impact on the company's growth.

An important platform

In retrospect, the widespread impact of this event highlights how important a company's security platform ultimately is. It now serves 538 Fortune 1000 companies, while its artificial intelligence (AI) technology is getting stronger as it uses more data.

Between FY19 and FY24 (ended January), revenue grew more than 10 times.

In Q1 FY25, the company generated record free cash flow of $322m, up from $227m last year. That was 35% of revenue of $921m, which was up 33%.

It has been rolling out more AI features, with 28% of its customers using seven or more of its 28 cloud modules, up from 23% a year ago.

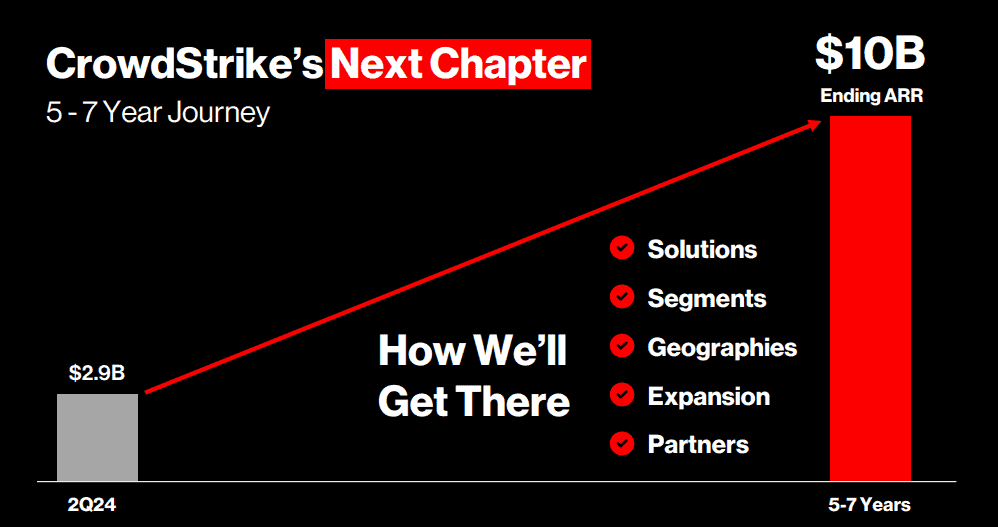

Looking ahead, the company is targeting $10bn in annual recurring revenue (ARR) over the next five to seven years. At the end of Q1, ARR stood at $3.65bn.

Of course, this target was made before the software update update was interrupted.

My move

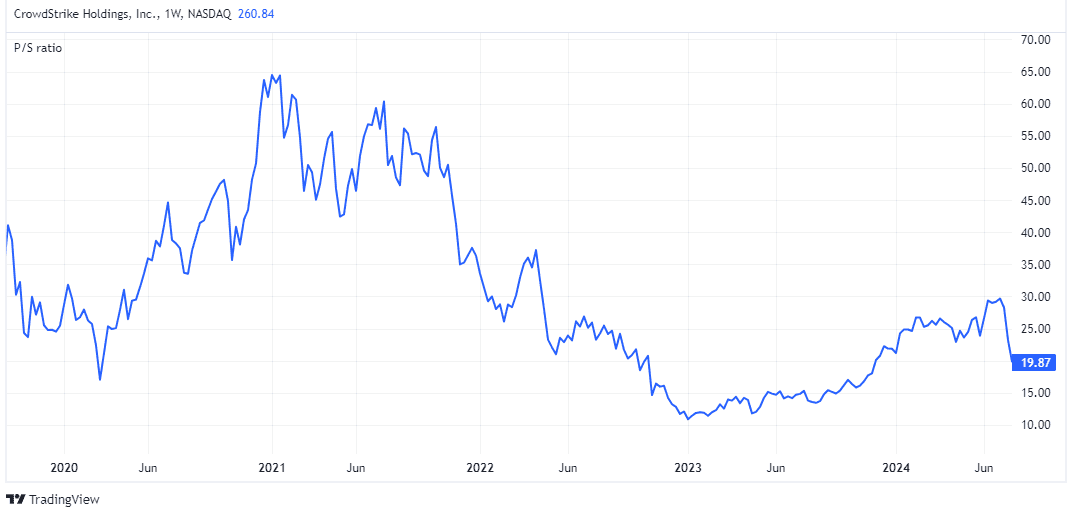

CrowdStrike trades around 20 times, even after the 23% drop. So this is an expensive stock – one that is perfectly priced.

However, things are not right. Growth rates may decrease if there are problems with renewal and attracting new customers. During that time, the company may have to make certain price concessions or restructure how its software interacts with devices, putting pressure on near-term profits.

Still, this is a highly-traded cybersecurity stock. If it continues to fall, I will consider investing more. But I would like to wait for Q2 in August to hear management speak.

Source link