I check the charts to see where easyJet's share price is headed

Image source: EasyJet plc

As an easyJet shareholder, the future of the company is important to me. And right now, it's not looking good. The share price has fallen 47% in five years, as it has underperformed FTSE 100 three years ago.

Not that I'm thinking of selling my shares. Instead, I wonder if now is a good time to buy more, so I lower my average spend per share.

First, I have to try to find out where the stocks are headed.

To do so, I learned the key metrics used to predict growth potential. A common growth factor includes:

Income and salary

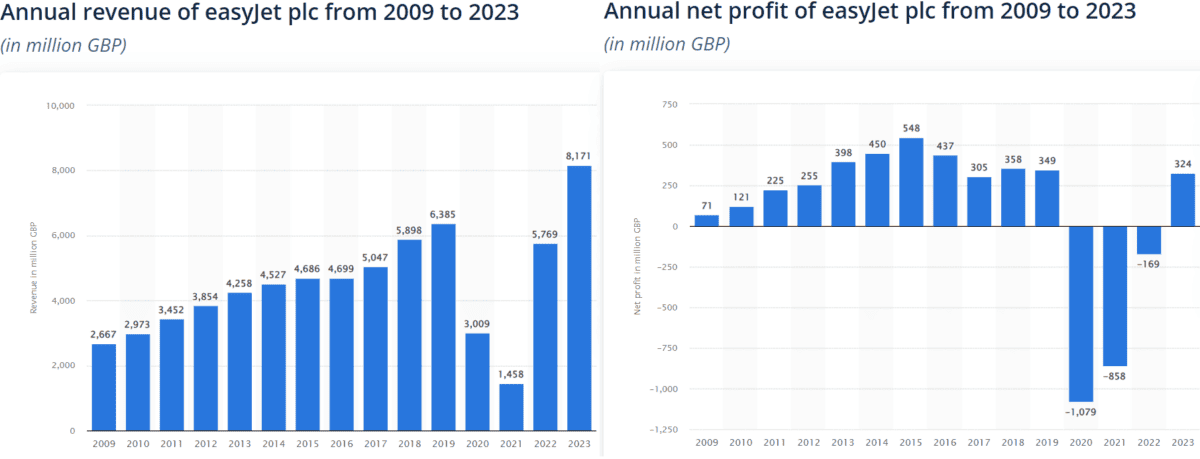

Revenue is the total income earned by a company, while net income is the profit left after expenses, taxes and other expenses.

Airlines were among the hardest hit firms during the violence and like many others, easyJet is still recovering fully. It was also profitable this year, with a turnover of £324m – the lowest in five years. But an event like this can make us unprofitable again, putting us into debt.

Meanwhile, revenues remain high, at £8.17bn.

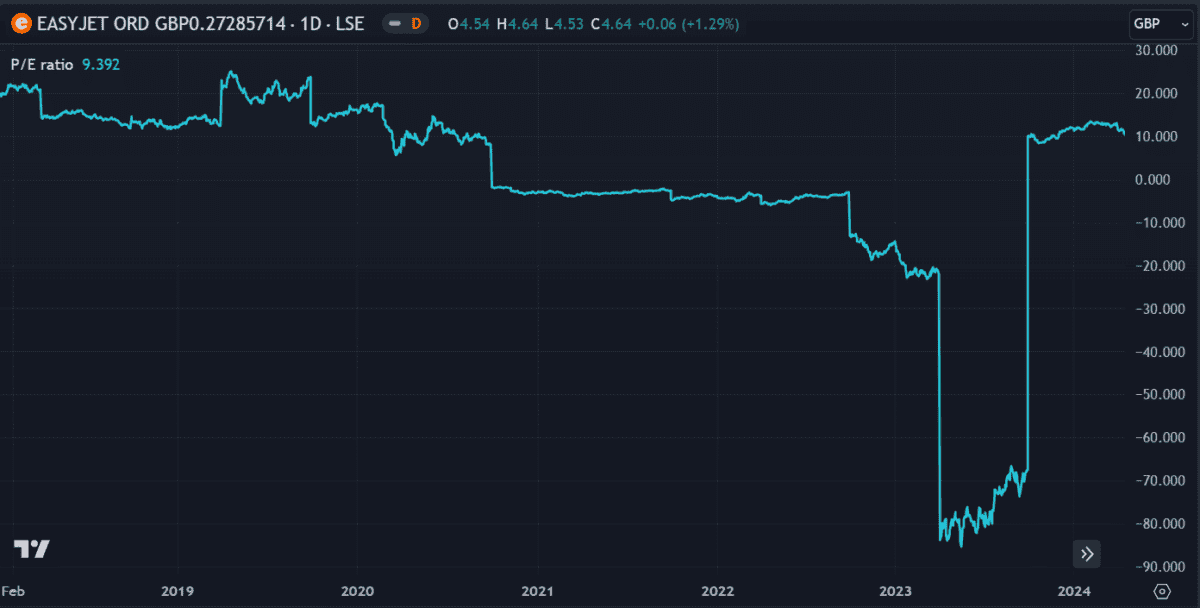

The P/E ratio

easyJet's P/E ratio looks low at 9.3, considering the UK market average is around 16.5. But budget travel is a very competitive industry in Europe and easyJet faces tough competition from rivals. Ryanair, Wizz Air again Jet2. Currently, its P/E ratio is higher than Jet2 and Wizz Air.

On the other hand, this could indicate that investors have high confidence in the airline. But it also reduces its growth potential by comparison. However, with revenue forecast to grow by 33%, its forward P/E ratio may drop to 7 over the next 12 months.

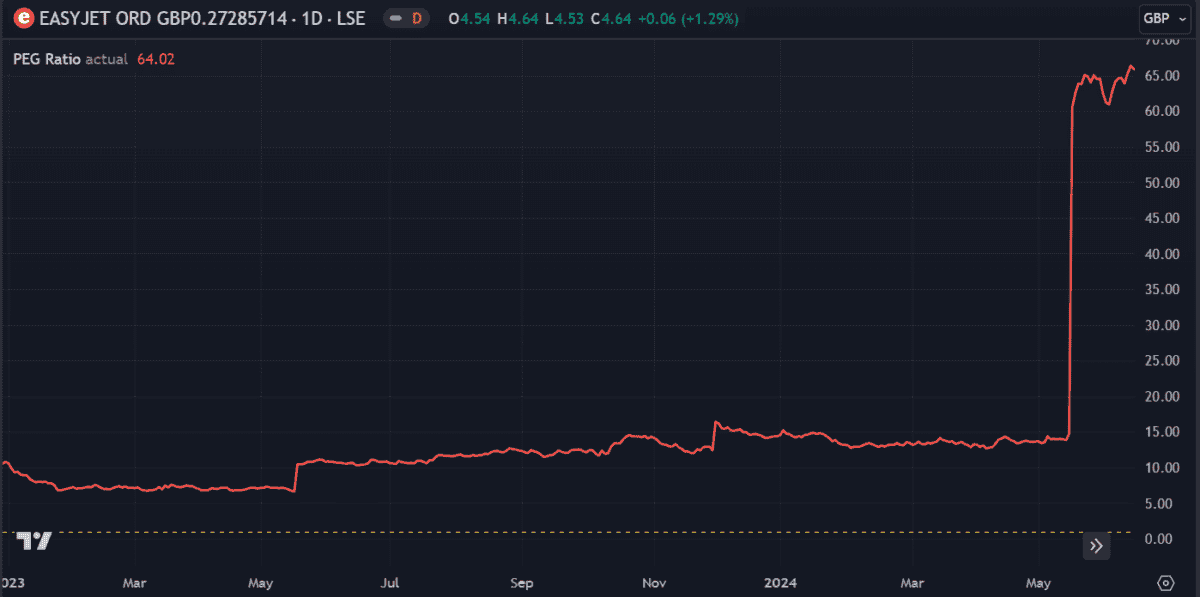

PEG ratio

The PEG ratio compares price to expected earnings growth to measure what kind of return an investor can expect. If this metric is 1 (or 100%), revenue and price are expected to increase proportionally. Any number less than 1 is good, as price is expected to exceed earnings.

easyJet currently has a positive PEG ratio of 0.64 (shown on the chart as 64%). But its growth is threatened by any disruption in the domestic economy that could cause consumers to cut back on unnecessary spending.

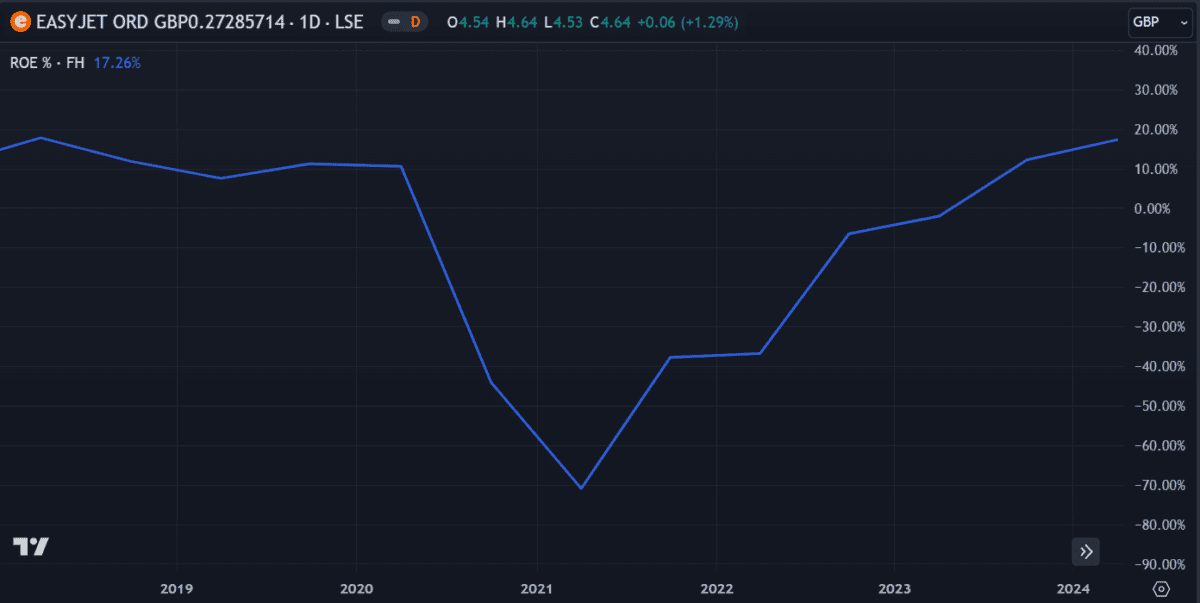

ROE

ROE is a measure of a company's financial performance, calculated by dividing net income by shareholders' equity. EasyJet's ROE has recently risen to pre-Covid levels of around 17%.

While the improvement is impressive, it remains well below the industry average of 30%. Hopefully its growth will continue, causing the share price to follow.

An important point

Several metrics in these charts show growth potential. In the latest quarterly earnings report, passenger numbers were up 8% and profits were up 16%. This was encouraged by the growth of the airline's new 'holiday' offer, which proved popular.

At the same time, the stock price continues to struggle and the stock carries several risks. I bought EZJ shares when the airline reopened as it seemed to be the most promising UK airline at the time.

So far, I'm disappointed in the performance and not motivated to buy more. But since neither airline is offering anything promising, I'll hold my shares for now and see where it goes.

Source link