Construction industry trends for July 2024

Our monthly construction industry trend report combines industry data with our insider findings from the award-winning National Business Capital team. With extensive experience in the construction industry since 2007, we are excited to share our latest results and data with the community.

Our mission is to provide business leaders and decision makers with the necessary information and data to make well-informed decisions in their business operations.

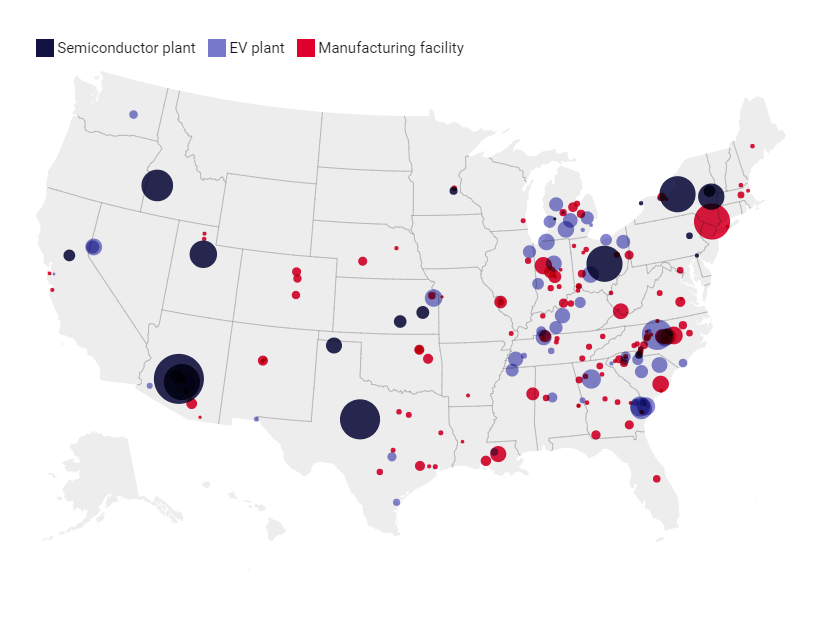

Large Manufacturing Areas

The increased focus on US manufacturing has led to an increase in the construction of new facilities. Understanding the trend from a national perspective provides unique insights into spending, employment, and employment patterns across the industry as a whole.

The source: Construction Dive

July 2024 – The CHIPS and Science Act, passed in August 2022, encouraged the creation of manufacturing facilities. Since then, the nation has seen a huge increase in construction activity in the manufacturing sector, many of which are expensive in scale.

As shown in the map above, the eastern half of the US has higher employment than the west. Considering that this law was passed two years ago, it is possible that the western and central US states have not succeeded in their plans yet. Construction companies should monitor bidding activity in this area if they want a piece of production.

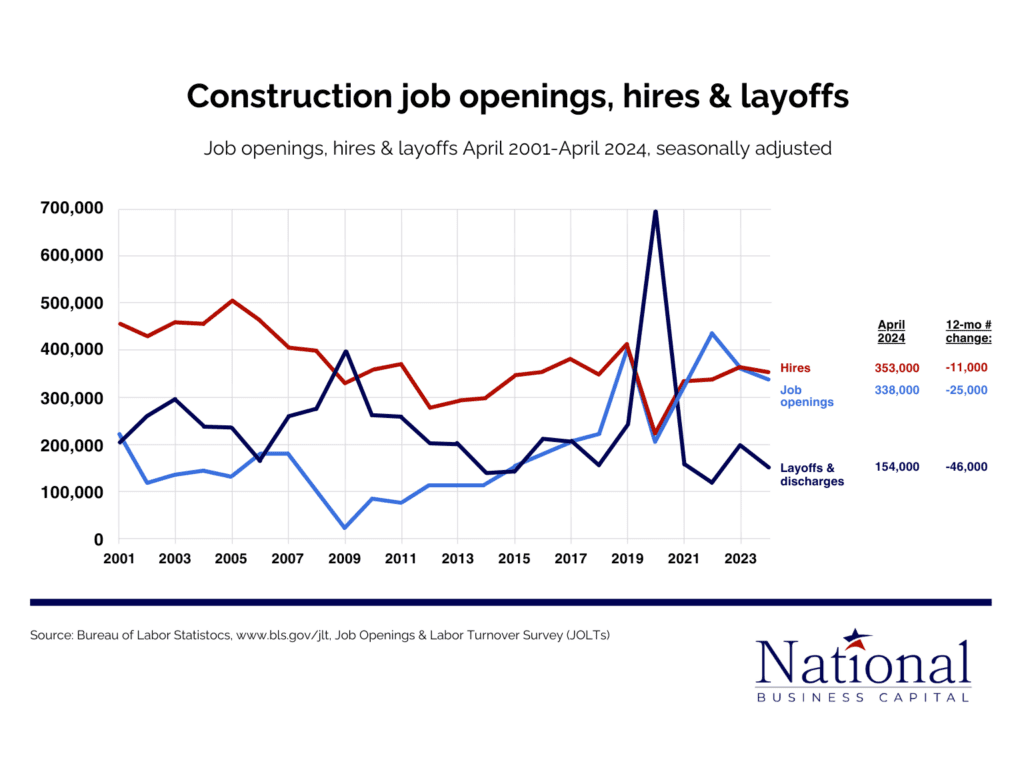

Opening Construction, Employment, and Layoff Practices

Employment figures give an idea of the strength of the construction industry. Job openings and hiring suggest an industry poised for expansion, while layoffs suggest reductions.

The source: AGC

July 2024 – It's hard to ignore the spike in layoffs in 2020, but the data shows a significant drop in layoffs and layoffs since then. As we reported in previous months, job openings rose and then fell, while hiring followed a slightly upward trend.

The decline in job openings is not a cause for concern, in our view, because of the employment data. Employment increased consistently throughout the peak of job openings, suggesting that job vacancies are being filled. The factory does not contract at all; It gets bigger, takes more work, and gets stronger.

It is also important to pay attention to local data, especially as we approach the latter half of 2024. As construction companies and contractors slow down due to the cold weather, job openings and hiring data will begin to slow.

Construction Material Cost Trends (1 Month and 12 Month Change)

Variable cost of goods can have a big impact on a construction company's bottom line. Understanding monthly ebbs and flows can reveal cost savings opportunities.

Cost of Individual Items

| Kind of Things | 1 Month Change | 12 month transition |

| Aluminum Mill Shapes | +4.5% | +9.6% |

| Copper and Brass Mill Shapes | +4.4% | -0.6% |

| Diesel Fuel | -20% | -13% |

Price Indexes for Subcontractors (Non-Residential Construction Work)

| Type of Subcontractor | 1 Month Change | 12 month transition |

| Roofing Contractors | -0.3% | +0.9% |

| Plumbing Contractors | 0.0% | +1.0% |

| Electrical Contractors | +0.1% | -2.3% |

| Concrete contracts | 0% | 0.5% |

July 2024 – Diesel fuel has decreased significantly, since the beginning of 2024 and month after month. Construction companies that use this resource in their operations have been able to reduce their capital and shift their capital to other areas of their business, as noted in National Business Capital's interviews with clients.

However, steel materials have remained high in cost, which has complicated construction projects across the country. Price indices for subcontractors saw little change, except for electrical contractors, who enjoyed a drop in prices last year.

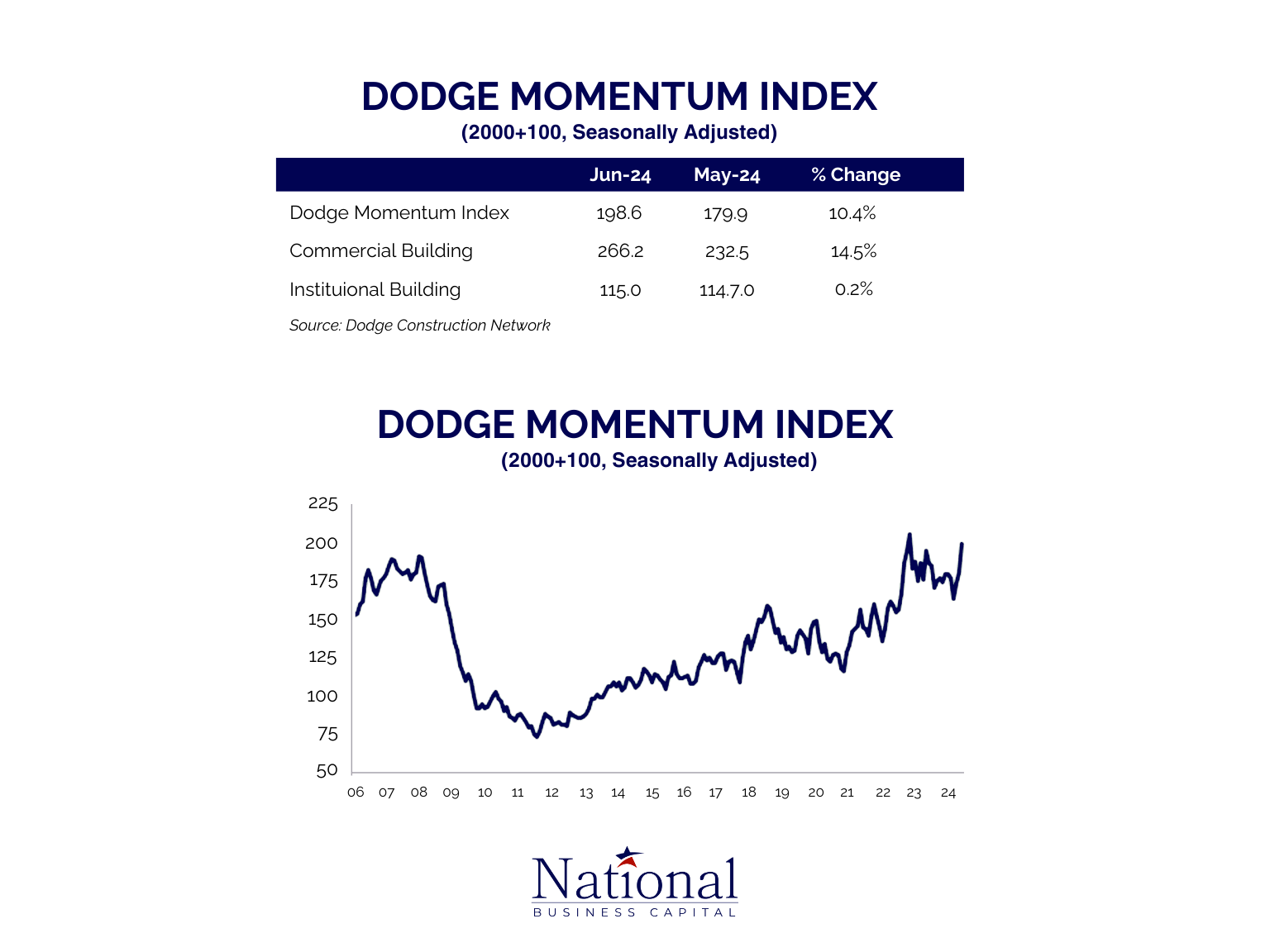

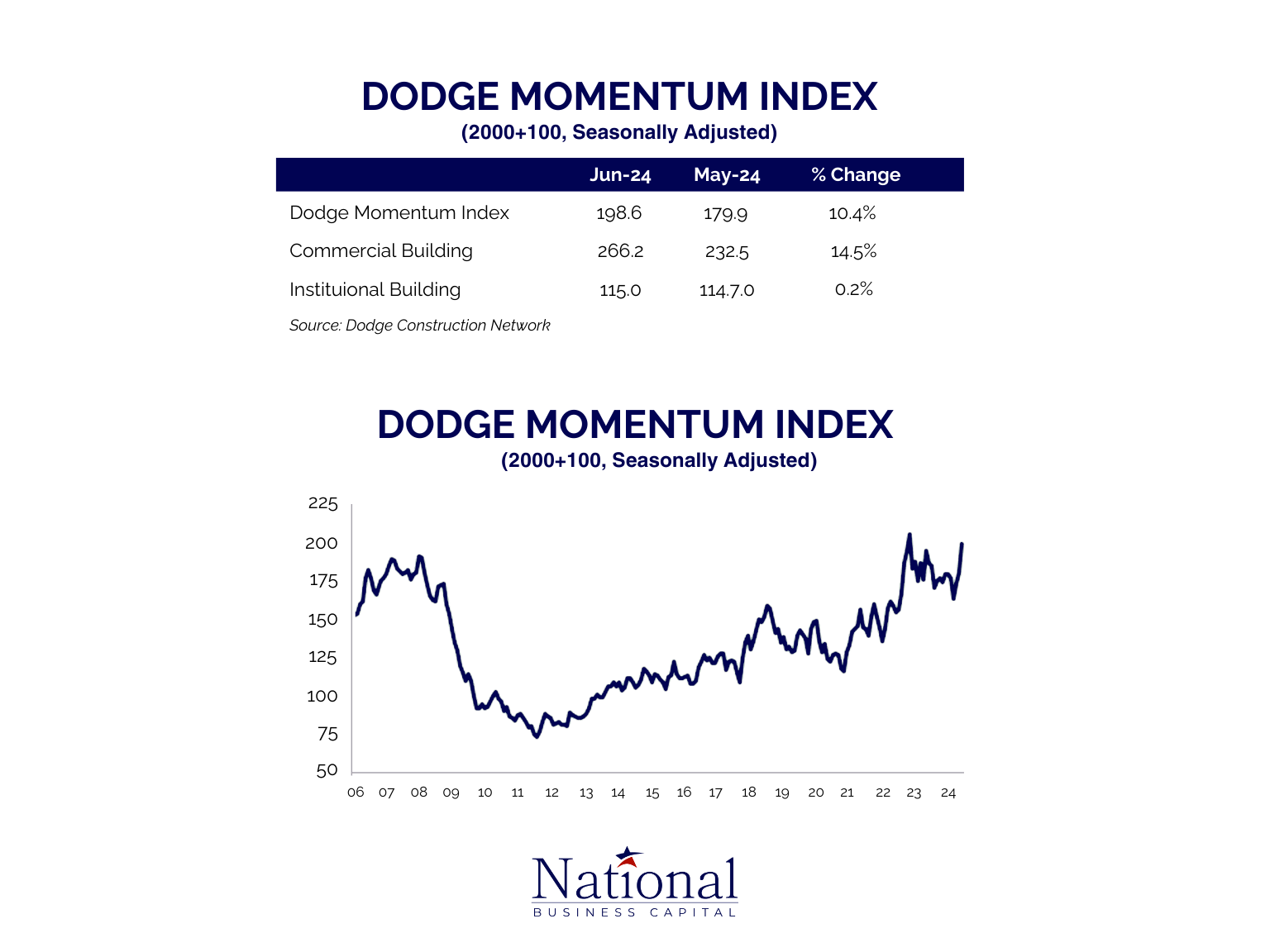

The Dodge Momentum Index

The Dodge Momentum Index, a gauge of non-residential real estate projects in the planning stages, leverages trends over the past 12 months to predict the industry's direction for the coming year.

The source: Dodge Construction

July 2024 – The Dodge Momentum Index (DMI) rose 10.4% from May to June and was 7% higher than the same period last year. The month-over-month increase comes from an increase in projects valued at $100MM+, and a heightened focus on data center construction.

This data supports the growing construction industry trend. Major projects are in the planning stages and moving forward. While there is a risk that these projects will be delayed or put on hold, a flexible pipeline with a variety of work types is good news for the industry after years of uncertainty.

National Business Capital's Construction Recap (July 2024)

Each month, we will provide our unique perspective on the short to mid-term construction industry outlook. Our insights come from a combination of available industry statistics, internal data, and the common sense of the construction clients we work with every day.

- Construction Finance Volume Up 18.7% – The volume of construction funds in the National Business Capital was 18.7% higher in the first half of 2024 compared to the same period in 2023. The increase is due to a combination of high quality financing, rising project rates, higher equipment costs, and a positive industry outlook for lenders. This trend follows the increase in the approval dollar we highlighted in June. Permits were up 71.92% in June, which turned the cost of construction companies higher overall.

- 30.5% Increase in Average Size of Funding for Construction Companies – Similarly, the average size of funds increased by 30.5% from June 2024 to July 2024. The volume of transactions was slightly lower month on month, which speaks of higher approval and volume trends.

- Highest Funding Volume in New York, Texas and California – National Business Capital works with businesses across the country, but New York, Texas, and California all have the highest amount of capital in 2024 YTD. Georgia and Florida hold positions 4 and 5.