That's why I think Vodafone's share price could drop the company's value by 50%!

Image source: Vodafone Group plc

I Vodafone (LSE:VOD) price is currently (14 August) around 74p. It was last above 80p in September 2023. Since August 2023, the shares have risen in value by a measly 2.5%.

The stock seems to be going nowhere.

But I believe there is some evidence to suggest that the company is seriously undervalued. However, I think it will take a while before a sufficient number of investors are persuaded to push up the share price. Let me explain.

Evidence

Deutsche Telekom is the most important telecommunications company in Europe. For the year ending December 31, analysts' consensus forecast is for earnings per share (EPS) of €1.81. At the current (14 August) share price of €24.85, the price-to-earnings (P/E) ratio is 13.7.

Vodafone is currently undergoing a restructuring exercise. Excluding parts the group is currently looking to sell, analysts expect EPS of 9.22 euro cents (7.89p) for the year ending 31 March 2025 (FY25). If correct, this implies a P/E ratio of 9.4.

If Vodafone were to earn twice the same amount as its German rival, its share price would be 46% higher (108p).

It's the same story when it comes to benefits. Deutsche Telekom forecast to pay 0.85 cents per share in 2024. This gives a current yield of 3.4%.

Vodafone is expected to return 4.50 euro cents (3.85p) to shareholders in FY25 – a yield of 5.2%.

As UK company shareholders know all too well, profits are not guaranteed. Vodafone cut its premium by half in 2019 and announced another 50% cut – in FY25 – in May.

A company's profits are intended to compensate for the risks associated with holding its shares. If Vodafone shareholders were comfortable with the 3.4% yield, its share price would be 113p — a 52% increase over its current level.

Investor experience

As a Vodafone shareholder, I am tempted to think this is wrong.

But it's only part of the story. Deutsche Telekom recently reported its 26th consecutive quarter of EBITDAaL (earnings before interest, tax, depreciation and amortization, after lease) growth in the European Union. And it has increased its earnings in Germany for 31 consecutive quarters.

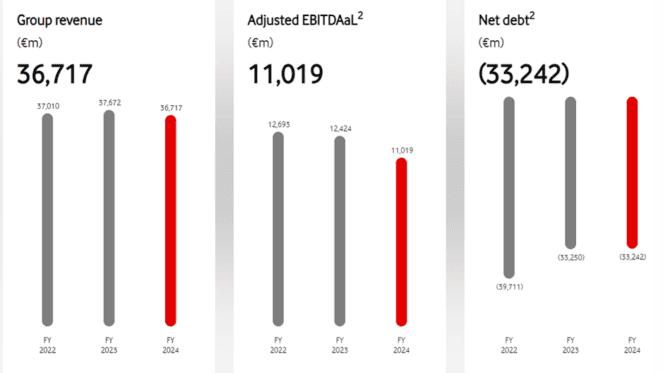

During this period, Vodafone's share price fell by almost two-thirds. Vodafone group revenue in FY24 was lower than FY22. And its EBITDAal – adjusted to take into account the shrinking group – was less than €1.67bn.

I'm sure this explains the difference in the pricing of the two companies. One is growing while the other is being restructured.

But by exiting Spain and Italy, Vodafone is trying to deal with its huge debt and improve its return on cash that lags some of its peers.

I'm looking forward

And if Vodafone's restructuring proves successful – and can show it's growing again – then I see no reason why its share price can't rise by around 50%.

But it will take time. Its results for the first quarter of FY25 showed some signs of recovery. Revenue increased by 3.2%, compared to last year. And EBITDAaL was almost 2% higher.

However, one swallow does not make it through the summer. Several quarters of additional revenue and earnings are needed before – I believe – investors will look at the company in a positive light, like Deutsche Telekom.

Source link