Here is one of my favorite FTSE 250 stocks to buy in September!

Image source: Getty Images

I hope to have money in my pocket to invest in the coming days. So today, I am making a list of the best cheap ones FTSE 250 stocks to add to my portfolio.

Here is one of my favorites.

To go looking for gold

Investors have been piling into gold stocks through 2024 to cash in on rising precious metal prices. African mining business Centamin (LSE:CEY), as a result, is up an impressive 29% in the year to date.

Gold has moved from record highs to new highs, hitting all-time highs of more than $2,500 per ounce in recent weeks. Some analysts are tipping bullish prices to continue as well, as central banks begin to cut interest rates, and worries about tensions in the Middle East and Eastern Europe are escalating.

All this means that the likes of Centamin could remain attractive stocks in the near term. However, we would be wrong to think that exposure to gold is a thing just an ingenious temporary game.

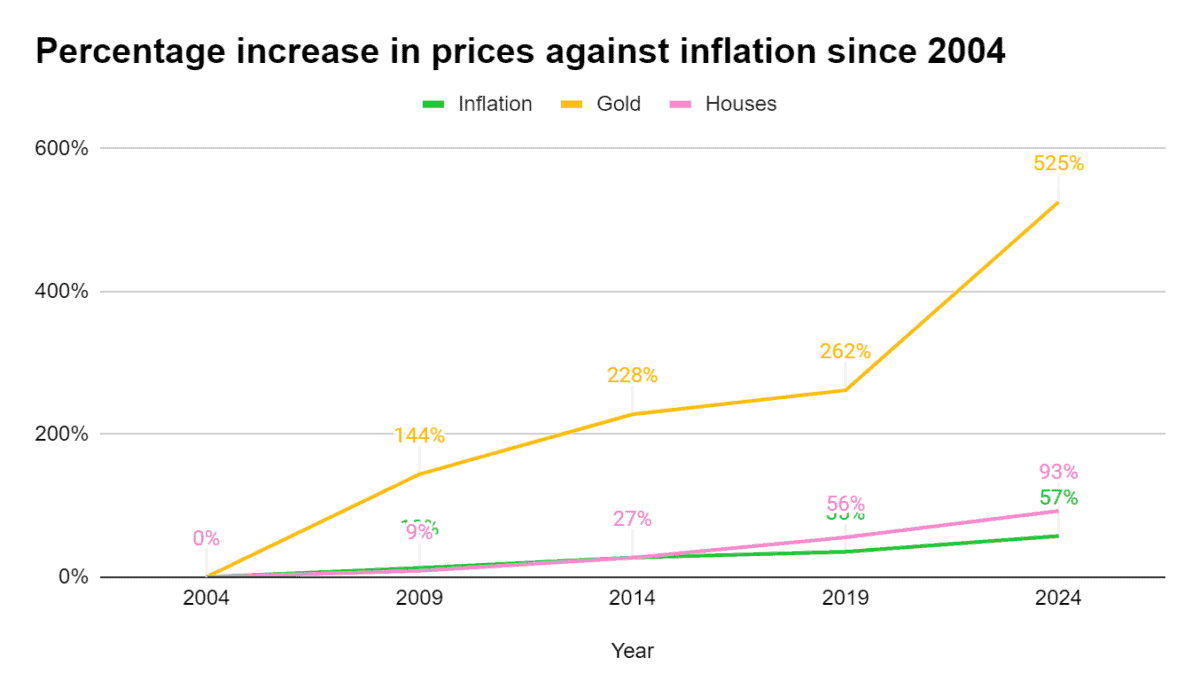

First, as we see above, the price of gold has increased more than 500% in value over the past twenty years. For example, it has risen significantly more than UK Consumer Price Inflation (CPI) and British house prices.

And historically it has been a good idea for investors to have exposure to gold to manage risk. Secured assets like these tend to perform better during economic downturns, offsetting weakness elsewhere in a trader's portfolio and therefore providing smoother returns over time.

Up 1,600%!

But what are the benefits of buying gold stocks like Centamin over the physical metal, or a metal backed exchange-traded fund (ETF)?

After all, buying gold or a financial instrument to track gold protects investors from mining risks.

Centamin may encounter problems in its Sukari or Doropo projects – in the exploration, mining development or production phases – that impact revenues and increase costs.

However, if the mining stock performs well, the investor has the opportunity to make a better return than simply aiming to track the price of the bullion.

This is where Centamin was impressed. While the price of gold has risen 525% since 2004, this FTSE 250 stock – which operates Egypt's largest Sukari mine – has recorded a share price gain of nearly 1,600% over that period.

Total amount

On top of this, investors can earn income if they buy mining stocks that pay dividends. This can give them a good return even if the price of gold fails to rise or fall.

Centamin has been a reliable dividend payer since the early 2010s. And, happily, City analysts expect the miner to raise dividends over the next two years, helped by rising gold prices and increased production at Sukari.

This means dividend yields for 2024 and 2025 stand at a healthy 3.7% and 4.8% respectively.

Despite the increase in share price, Centamin shares still look cheap on paper. On top of those market-beating dividend yields, the commodities giant trades at a price-to-earnings (P/E) ratio of 9.3 times.

All things considered, I think it's an exceptional stock to consider buying right now.

Source link