Construction Industry Trends and Data for August 2024

Our monthly construction industry trend report combines industry data with our insider findings from the award-winning National Business Capital team. With extensive experience in the construction industry since 2007, we are excited to share our latest results and data with the community.

Our mission is to provide business leaders and decision makers with the necessary information and data to make well-informed decisions in their business operations.

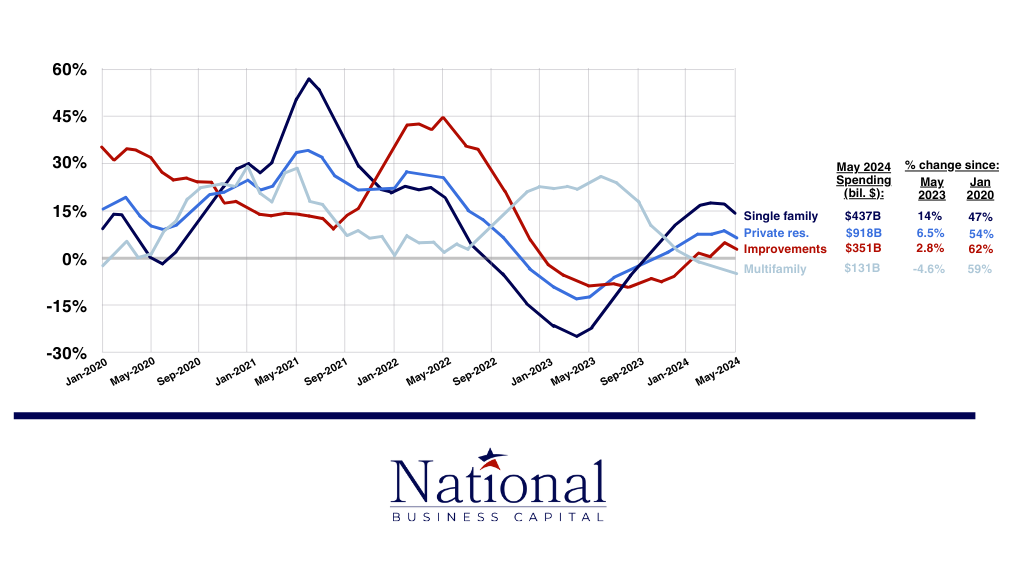

Residential Construction Sector Use (2020 – 2024)

Residential construction trends highlight industry performance in key sectors and speak to the broader housing market.

Source: AGC

August 2024 – As home buyers deal with rising costs, the construction industry has worked hard to create new inventory. Multifamily housing costs have remained positive since 2020, while single-family, detached residences, and development project spending have been flat from September 2022 to January 2024. The negative 16-month trend is likely a combination of factors from housing trends.

Single-family and detached homes have grown rapidly in value and decreased significantly in supply over the past 4-5 years. Persistently high interest rates have discouraged sellers from moving from lower rates to new mortgages, while higher demand has boosted home prices. This slowed the housing market in these areas, pushing construction activity toward multi-family buildings, which were more popular as people rented instead of bought.

Houston, Texas, ranks first in new housing construction among all US states by 2023. This urban trend is expected to continue until 2024, as strong economic growth and job prospects attract buyers from across the country. However, some areas, particularly those in the Northeast, such as New York, have seen housing construction decline significantly. For example, Rochester, NY, and New York, NY, saw -4.90% and -14.20% year-over-year changes in active listings, according to Yahoo Finance.

We believe that this will not be a long-term trend. As the Federal Reserve lowers interest rates and more homeowners become comfortable with new mortgages, we will likely see spending trends for single-family and private residences return to normal within the construction industry.

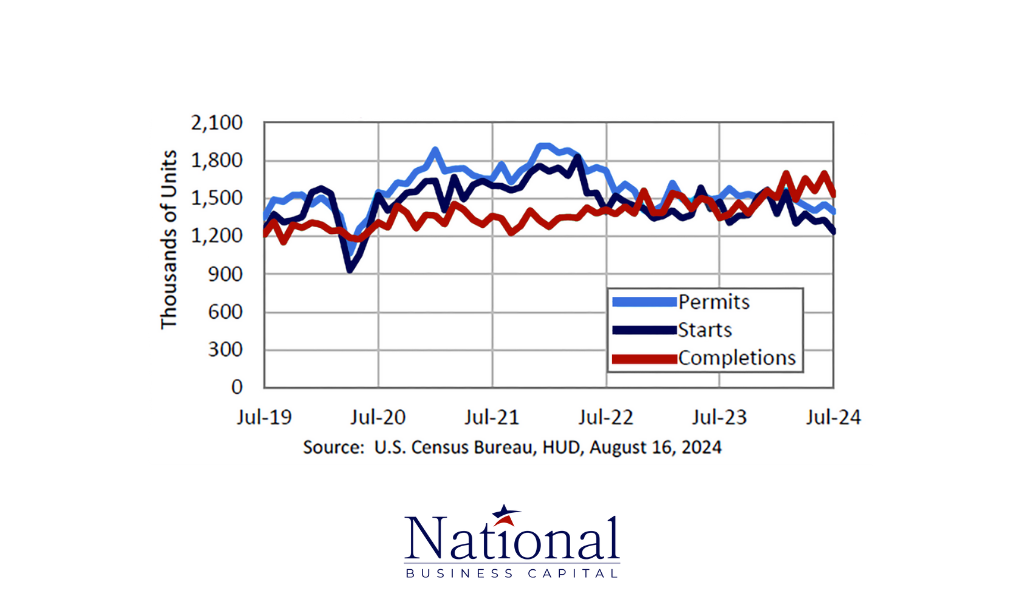

Source: Census.gov

When we dig deeper into construction trends, we find that permits, starts, and completions follow a parabolic trend for 2024. With the exception of multifamily housing costs, all other segments expanded slightly in early 2024 and contracted toward the mid-point. a year. This expansion/contraction trend can be found in the same January to July period of previous years, although 2020–2023 all saw a much higher peak than 2024.

It's an election year. With so much change in the vote, new housing approvals are likely to have fallen as the housing market awaits November's results. However, the lull in approvals, coupled with slowing growth in all residential sectors, could also signal a significant sector-wide slowdown caused by high costs, low confidence, and a difficult economic climate.

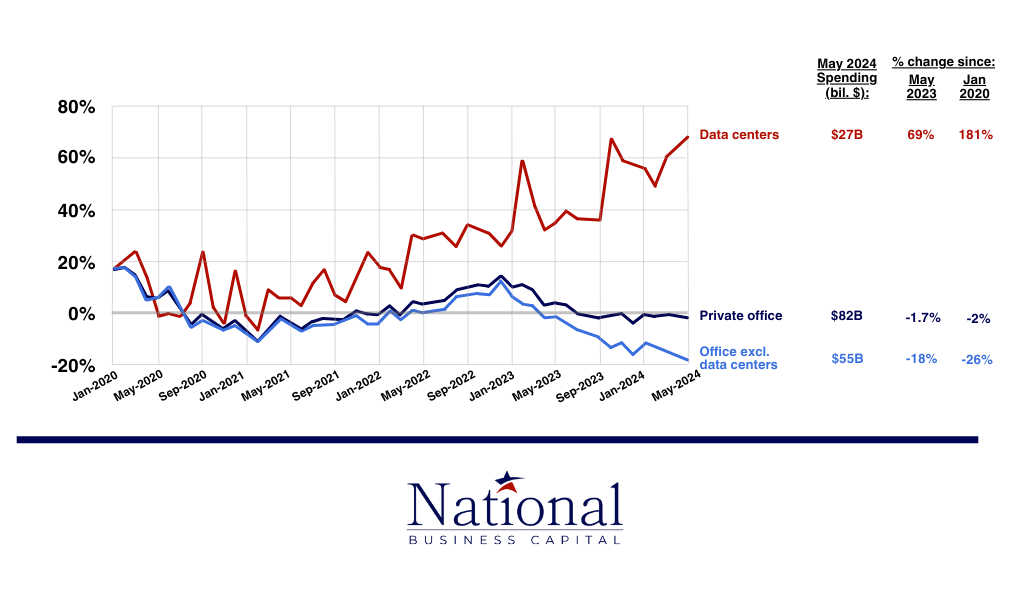

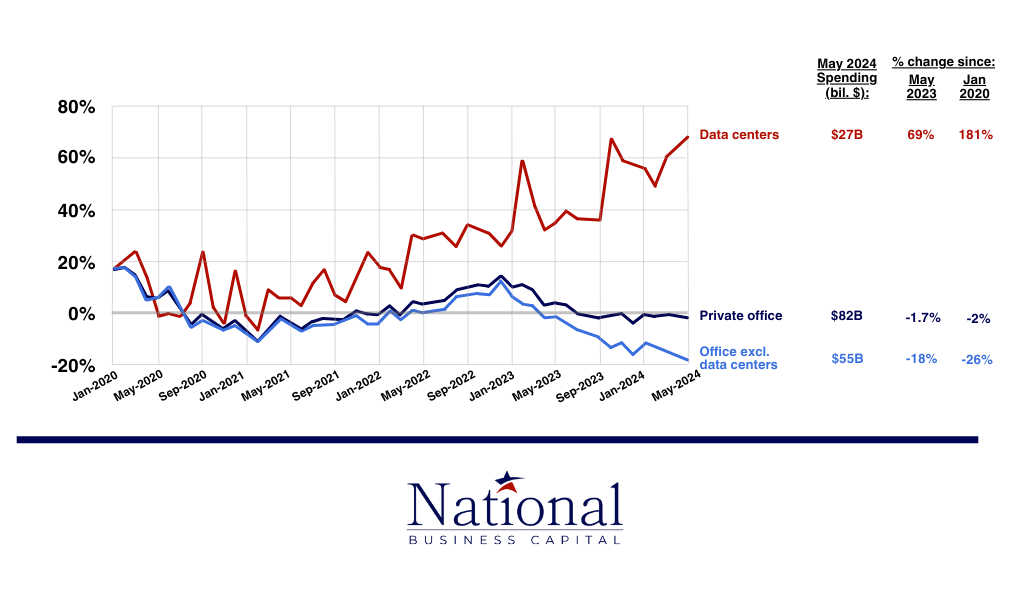

Additional Data Center Fees; Construction of Private Office Created (2020 – 2024)

As the CHIPS and Science Act continues to push the industry into data centers and other electronic manufacturing systems, understanding spending trends opens up a unique perspective on industry focus.

Source: AGC

August 2024 – As we touched on in the July monthly report, the CHIPS and Science Act has changed the focus of the construction industry significantly. Data center construction spending is up ~10% from early 2024 and 45%+ from 2022 enactment.

Government focus, and a changing perception of the need for business offices, has shifted spending away from private offices and other office developments. Real estate, especially the large corporate offices that paint the skylines of big cities, has seen a significant trend since the adoption of “work from home” policies following the pandemic.

These spending trends are likely to continue unless there are major changes in the way we view personal work and our focus on AI development. Data center utilization may decrease as services are finalized, as well.

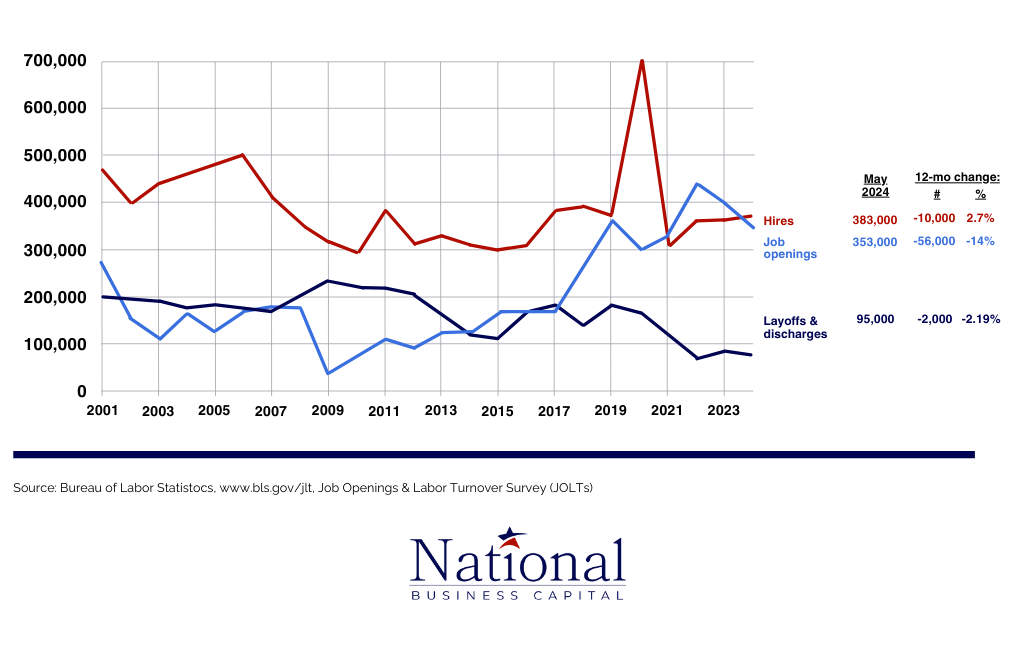

Construction Hiring Trends

Construction employment trends, including job openings, hiring, and layoffs, provide a unique perspective of the industry's workforce and highlight potential challenges.

Source: AGC

August 2024 – Check employment trends every month. Zooming back on the chart to look at year-over-year employment trends gives a much clearer picture of how far we've come overall.

Focusing on monitoring and uncovering trends, it is interesting to see that, in volatile areas, the data seems to change direction in some way. In 2019, the inflection point led to a different trend, while the inflection point in 2021 saw a different result. Considering we've just passed another inflection point, there could be big changes in hiring and job openings on the horizon.

We hope for a good relationship where employers and job opportunities grow together. It will be difficult if job openings outpace employment data, as this raises operational challenges on a sector-wide scale.

Most notable, however, is that layoffs and layoffs are at their lowest levels in more than 20 years. Job openings have grown significantly since 2001, indicating that the industry itself has grown rapidly over the past two decades. Hiring trends are somewhat different. Employers have generally declined since 2001 but have remained stable, except for a few spikes.

We have a lot to unpack about rental properties. By 2024, some industries report struggling with new hires due to increased labor demand, a lack of skilled/specialized workers, and an aging workforce overall. Others have not experienced the same challenges, suggesting that hiring concerns exist for each.

National Business Capital's Construction Recap (August 2024)

Each month, we will provide our unique perspective on the short to mid-term outlook for the construction industry. Our insights come from a combination of available industry statistics, internal data, and the common sense of the construction clients we work with every day.

- Authorization Dollars Increased 26.5% from July to August – Permits for construction companies continue to tighten. Lenders rely heavily on the industry as a whole, which includes strong requests from company to company. While the industry may have been dealing with post-pandemic challenges in early 2024, it is clear that companies have found their footing and started operating.

- Construction Finance Volume Increased 21.49% from July to August – On the heels of major approvals, construction companies are also moving forward with their approvals with confidence. Total revenue increased by 21.49% month-on-month, driven by a higher dollar amount of revenue and a more significant number of converted transactions.

- Investments From Construction Firms Up 15% From Jan 2024 – Strong credit, high revenue, and high profitability reflected the requests received by National Business Capital in August 2024. Companies are working hard to improve growth, which is reflected in all their business metrics.