2 FTSE 250 stocks I think could explode in 2025!

Image source: Getty Images

I am looking for the best FTSE 250 growth stocks worth buying today. Games Workshop (LSE:GAW) and Greggs (LSE:GRG) are near the top of my buy list.

That's why I think their share prices may go through the roof in 2025.

Games Workshop

Games Workshop is not expected to deliver impressive profit growth in its 2025 financial year. In the 12 months to May, City analysts expect the result to grow by just 2% year-on-year.

But make no mistake, this will still represent an impressive result given last year's record profits. This is still one of the hottest growth stocks in the FTSE 250, in my opinion, and one that I believe could eventually close the gap on the FTSE 100.

New news about Games Workshop's film and TV content partnership with Amazon could increase its shares significantly next year. Since December, the company has been working with the streaming giant to adapt its dream screen. It's a strategy that can increase both product sales and profits higher.

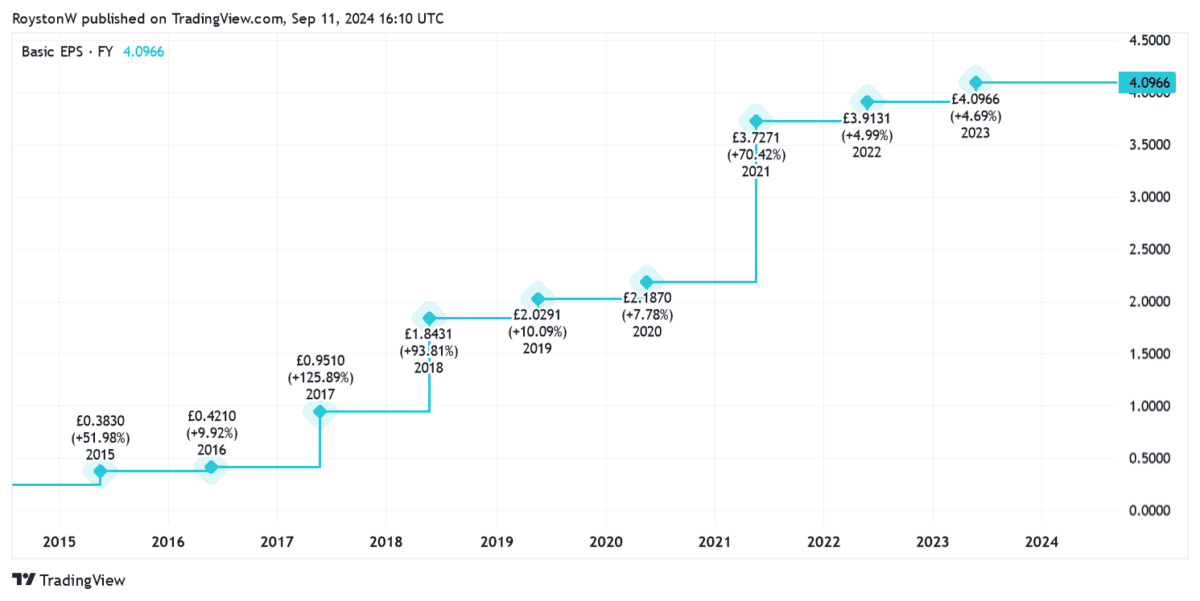

As you can see, the company has grown its revenue every year between 2014 and 2023. And it was up an impressive 12% last year, to 458.2p per share, helped by a new blockbuster. Warhammer 40,000 product release.

The business has plans to open more stores in North America and Europe as well, to keep the line growing.

Games Workshop's share price is up 6% so far in 2024. I expect even bigger gains next year, although the meaty price-to-earnings (P/E) ratio of 22.3 times may be a drag on performance. It may actually cause the price to drop if trading conditions worsen, which is likely.

Still, on balance, things look good for the entertainment giant next year.

Greggs

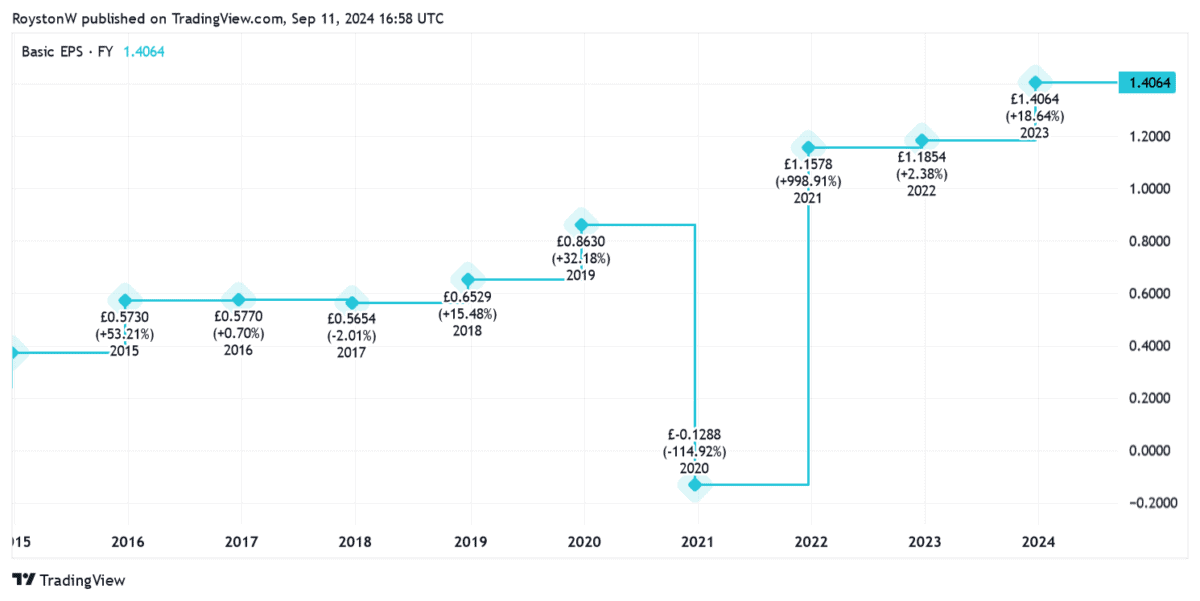

The baked goods giant, Gregs, hasn't had the same kind of steady revenue growth as Game Workshop. Of course, profits took a hit during the violence as the company was forced to close stores during the lockdown.

But apart from the Covid-19 crisis, this FTSE 250 stock has delivered the most solid profit growth during that period, as the chart below shows.

The income is due to a significant increase in the number of stores Gregs operates. And with store openings continuing at a healthy clip, City analysts expect earnings to rise 7% this year before rising to 10% by 2025.

The baker now sells delicious food from more than 2,500 stores. That's a 52% increase from the number seen a decade ago, and Greggs isn't done yet. It hopes to have 3,500 stores up and running eventually.

It is encouraging that the company is also investing heavily in its online channel to bring more growth. It is also working to open two new production sites in the next few years to increase capacity. Of course there are operational risks that can hinder the company's growth strategy however.

Greggs' share price has risen a staggering 19.6% since the start of 2024. I expect another strong performance in 2025.

Source link