Where is Nvidia's next billionaire stock hiding?

Image source: Getty Images

Those are the chips Nvidia (NASDAQ: NVDA) projects continue to power the ongoing revolution in Artificial Intelligence (AI). Amazingly, its stock has risen nearly 24,000% over the past decade.

This means that a £5,000 investment made in September 2014 will now be worth over £1m!

Although it is impossible to predict with certainty which stock will be the next 'million maker' – I wish it was that easy – there are certain characteristics that often accompany such investments.

Here are some of the main ones:

- Country trends: firms in fast-growing or disruptive industries.

- Relentless innovation: high research and development (R&D) spending reflects a focus on innovation.

- Founder mode: founders tend to think for years (or decades) rather than residences like some hired CEOs.

- 'Most important': big winners are likely to be over-represented by conventional metrics.

Founder led by founder

Unsurprisingly, Nvidia ticks all these boxes. Its graphics processing units (GPUs) have powered booming industries such as gaming, crypto mining and, most recently and most importantly of all, AI.

The chip maker spends a ton on R&D and product innovation. Last year, it allocated $8.6bn to R&D, up from $1.8bn in FY18.

Over the past decade, the stock has been overvalued by most traditional metrics. Surprise surprise, it's today again. That's why it's so important, in my opinion, to focus on whether the firm's growth engines are still firing.

Finally, Nvidia is led by visionary founder Jensen Huang. He had the moral authority to take the risk of investing in computer AI a few years ago. In contrast, it is led by a manager Intel delayed to implement the AI revolution.

Today, however, Nvidia's customers are concentrated among large technology firms. If these hold back the use of AI, growth could quickly stall.

Similarity

A stock that I think will also be a big long-term winner Shopify (NYSE: SHOP).

The company's platform allows users to easily create online stores in minutes. It offers built-in tools for inventory management, payment processing, shipping, and more.

While many e-commerce firms have struggled in the wake of Covid, Shopify is still growing. Last year, revenue jumped 26% to $7.1bn. In the first six months of 2024, it increased by 22%. The engine of growth is still exploding.

Importantly for me, the management team is very innovative and long-term oriented. Indeed, Shopify says “building a 100 year old company“.

Last year, CEO Tobias Lütke sold the capital-intensive transportation division of the company. Not only does this improve margins, it allows Shopify to fully focus on developing powerful AI tools.

In the second quarter, brands including Toys 'R' Us, Lionel Messi's Mas+, and Sofia Vergara's Dios Mio Coffee were launched on the Shopify platform.

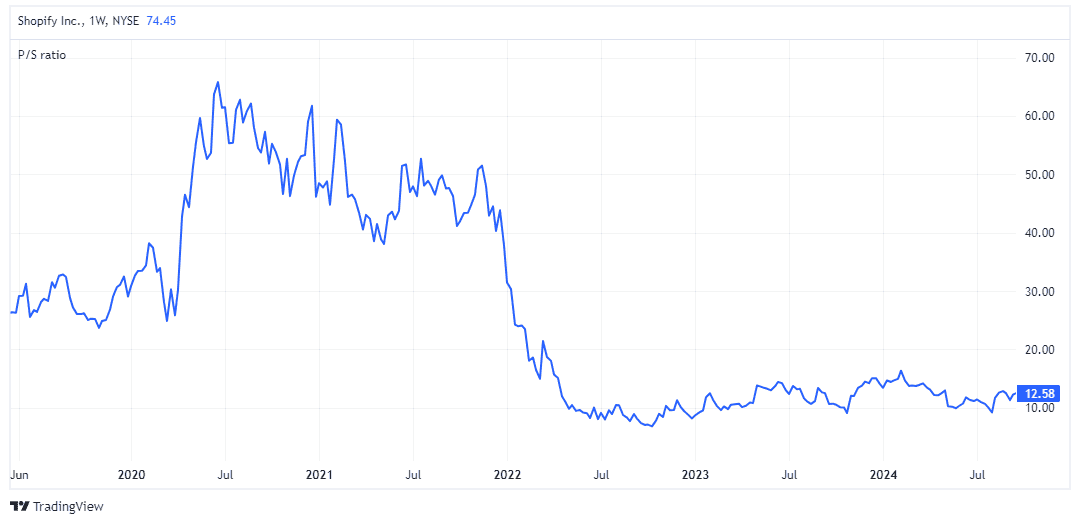

With a price-to-sales ratio (P/S) of 12.5, the stock is not cheap. But it's a big discount over the years.

One risk to Shopify's growth is weak consumer spending amid stubborn inflation. Another would be a recession in the US, its biggest market.

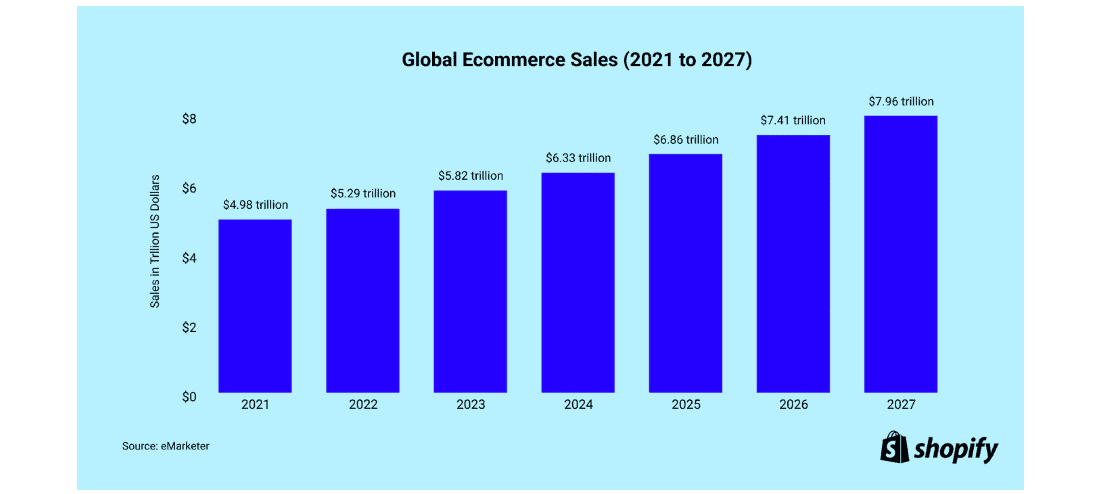

However, global e-commerce sales are still projected to reach around $8trn in 2027, up from $5.8trn in 2023. So the global trend of online shopping continues.

As a clear leader in e-commerce software, the company stands to gain directly.

Ultimately, we don't know where the next millionaires are hiding. But for me, Shopify shares a lot of similarities with Nvidia, which is why it's my third biggest pick today.

Source link