If I invested £10,000 in Greggs shares, how much income would I get?

Image source: Getty Images

The UK stock market is full of high yield stocks that make great income options. Many pay more than the average 3.5% yield. But growth is important when looking at the shares of an income portfolio.

One of my favorites FTSE 250 stocks is Greggs (LSE: GRG). The popular high street bakery chain has delivered impressive performance since 2014. It has risen 434% in the last 10 years, beating the wider UK market.

But past performance is not indicative of future results. So how much can a £10k investment today benefit me in the future?

Let's take a look.

A strong foundation

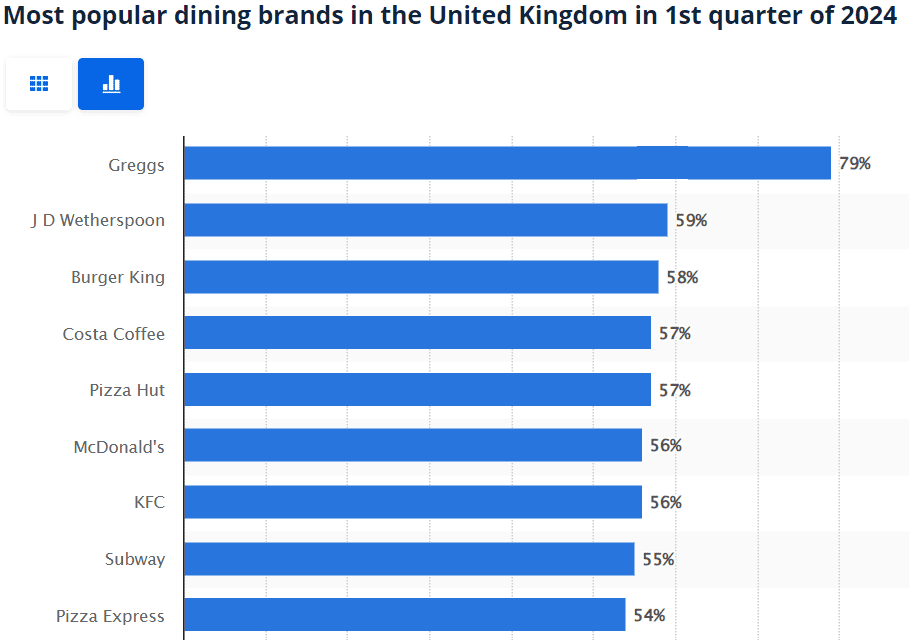

There is no doubt that Greggs is the most popular and innovative British brand. A pie and sandwich shop for many hungry workers come lunchtime. According to Statista, it was the most popular restaurant brand in the UK in Q1 2024, beating US rivals such as Burger King no. McDonald's.

In addition, it is one of the most productive. Since 2006, the number of Greggs stores in the UK has almost doubled. It now has nearly 2,500 stores on highways and stations and airports across the country.

With a market cap of £3.25bn and £1.8bn of revenue last year, it's fair to say the company has a good foundation for future growth. However, its 2024 half-year results revealed a decline. At £55.1m, net income was down 8.6% from H1 2023 and earnings per share (EPS) fell from 59p to 54p.

Measurements and predictions

If you look at various metrics, the share price may be overvalued. It is 43% above fair value based on future cash flow estimates and the price-to-book (P/B) ratio indicates that the shares are 6.5 times the company's book value. That's rare among popular stocks but can limit growth in the short term. It may be necessary to post the best results to bring more buyers to this level.

Analysts expect revenue to increase by 22% over the next two years, while revenue is expected to grow by around 13%. The 12-month average price is just over £33, which is a 4.3% increase from today's price.

Assignments

Divorce-wise, Greggs had a good record before Covid. Payments increased between 2000 and 2018, with a pause in 2013. They were phased out in 2019 and reduced by one year in 2020. However, they came back with a vengeance in 2021, nearly doubling 2018's payout.

However, at 2%, the yield is low and will not bring much additional value. It will pay just £20 a year on a £10,000 investment. However, if we assume an average annual price growth of 5% and reinvested dividends, the pot can grow over time.

With those figures, it could be up to £20,000 after 10 years and pay dividends of £370 a month. It's not much, but it can be earned more than a regular savings account.

Final thoughts

I think Greggs is a solid and reliable value stock but he is not a low earner. My worry I think it has the potential to expand in Europe but it may be difficult to find a place in the US.

I love my Greggs stock and I'm a regular customer so I plan to hold on to it. But I don't buy more. I am worried about how it will develop going forward.

I hope it has a plan.

Source link