Can Lloyds share price hit £1 again?

Image source: Getty Images

For a major bank that made billions of pounds last year, it may seem strange that Lloyds (LSE: LLOY) change hands for pennies. It wasn't always like that. In 2007, before it was hit by the financial crisis, Lloyds' share price was over £3.

Lloyds has been a strong performer over the past year, with the share up 32% in value. So, could it hit the £1 mark again?

Far from its former glory

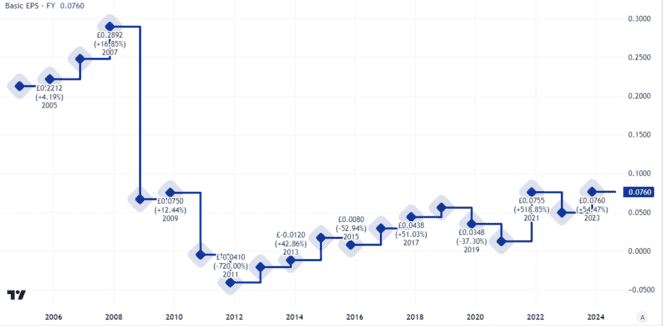

It is easy to understand why Lloyds is nowhere near the price it reached in 2007. Its underlying earnings per share are significantly lower than they were then.

Created using TradingView

From an income perspective, too, the dividend is nowhere near what it used to be.

Created using TradingView

Still, while the years of the pandemic saw incomes drop, the broad trend over the past decade has been upward, as this chart shows.

The banking giant has a lot going on. First, it operates in a strong and profitable market. Mortgages, for example, are likely to be in high demand for decades to come and possibly even longer beyond that.

It also has several advantages that help its earning power. It enjoys economies of scale, as the nation's largest mortgage lender. Lloyds has a large customer base, well-known brands and operates in a market with limited competition due to high barriers to entry.

How to inform the bank of dark horses

However, all of that was true in 2007 as well.

Since then, much has changed in the way British banks are funded and run. I think Lloyds is better placed now than it was then when it comes to dealing with the housing market crash. That's a real risk, in my opinion, as the real estate market cycles again so soon we'll see a big drop again.

That helps explain why the Lloyds share price-to-earnings (P/E) ratio looks cheap right now.

I believe that investors are taking on the risk that income may decline, perhaps significantly, if the economy weakens. Indeed, the first half of this year saw profits fall by 15% compared to the same period last year, although at £2.4bn it was still great.

Where things can go

Getting to £1 per share would mean a P/E ratio of around 13, which I still think might be reasonable. a lot of FTSE 100 firms trade at such a rate. However, for that to happen, I think one of two things must happen.

Either way the perception of risk needs to be downward and not upward. That could happen in the future but I don't see it anytime soon as the UK and global economy remains weak.

Otherwise, Lloyds needs to increase its earnings per share. That's possible but the evidence so far this year points in the other direction – and I don't expect a big enough jump in earnings over the next year or two to justify Lloyds' share price rising by nearly two-thirds, which it would. all you need to do to hit £1.

I doubt Lloyds will hit £1 in the next few years and I have no plans to invest.

Source link