I can withdraw £464 a month from UK stocks to aim for a million

Image source: Getty Images

Becoming a stock market millionaire is the stuff of dreams. Or is it? I think it is possible to turn this dream into reality by investing in UK stocks with high growth potential.

Pursuing this goal requires risk tolerance and financial commitment. However, there are many stocks listed in the London Stock Exchange which can deliver the returns needed to achieve the desired seven-figure portfolio.

Here's how I would aim to earn a million with £464 a month to invest.

Ambitious goal

Achieving a £1m portfolio will not happen overnight. In fact, it will take many years. But it doesn't have to last a lifetime. Just relying on savings accounts won't cut the mustard. I will need to buy shares.

Twenty years ago, the FTSE 100 it delivered an annualized return of around 6.9%. With every smart stock pick, this is beatable. But I don't want to be too forceful when predicting what my UK stock portfolio could deliver.

So by my calculations, I'll settle for an 8% annual return. I feel this strikes the right balance between ambition and realism. Of course, it is not guaranteed that I will achieve this. There is a risk that my portfolio may not perform well. In this case, I will need to invest more money, or extend my time horizon.

But let's assume that my assumption is true. If I protected this rate of growth by investing £464 a month I would reach my goal in 35 years. That means if I start investing at age 30, I'll be a millionaire in time to enjoy a happy retirement at age 65.

Combination refund

With these caveats and considerations in mind, here's what my journey to millionaire status might look like.

Okay, maybe not. Only in a perfect world would my return be this linear. In fact, there will be good years and bad years. That's par for the course in stock market volatility.

However, the graph makes an important point. The orange parts of the bars show how important compounding (interest on interest already earned) is to achieving my goals. In later years, it will do much of the heavy lifting, even in our imperfect, changing world.

Finding growth stocks

Now for the more exciting stuff. Which UK stocks should investors consider buying?

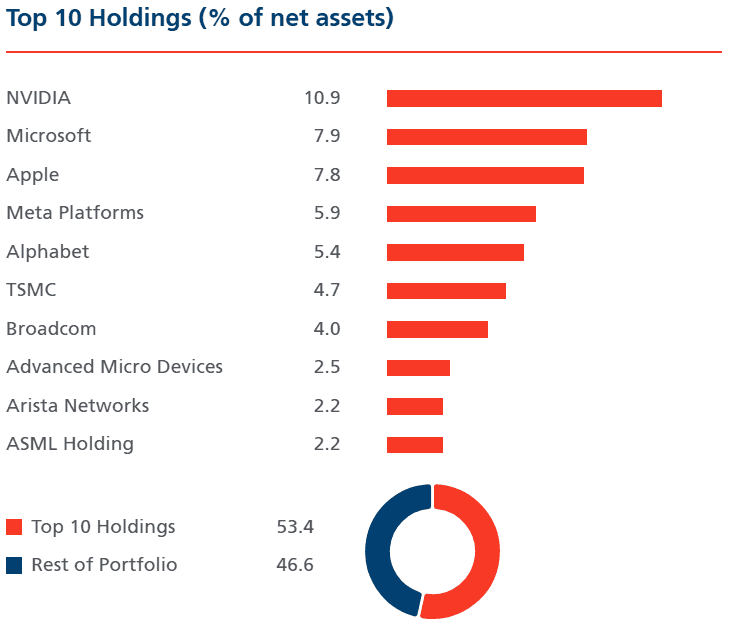

However, one growth stock I would consider for a diversified portfolio is Polar Capital Technology Trust Company (LSE:PCT).

This investment trust focuses on technology stocks around the world. It delivers exceptional returns and the share price has increased 110% in five years.

The portfolio has many familiar words, some of which I already have.

Artificial Intelligence (AI) is likely to be a key source of economic growth in the future and I think this trust is well placed to benefit given the nature of its assets. Many of the stocks he invests in are heavily involved in generating the infrastructure that is powering the AI revolution.

In addition, investors considering the shares may get them at an 11% discount to the current net asset value. That gap may not last.

Admittedly, the tech industry knows the market hype. Speculative valuations are common, especially in the AI space, and investors have to deal with a large number of falling stocks along the way. But the risk often comes with the reward.

Source link