6.5% to 8.2% yield! These FTSE 100 and FTSE 250 shares could generate an income of £1,480 in 2025.

Image source: Getty Images

I'm looking for the best dividend stocks to buy with passive income in 2025. But I don't just aim for short-term returns. I look for companies that can pay a large and growing dividend over time.

Here are two from FTSE 100 again FTSE 250 on my radar today:

| FTSE 100/FTSE 250 stock | 2025 dividends per share (f) | Return yield |

|---|---|---|

| Rio Tinto (LSE:RIO) | 310.4 p | 6.5% |

| Supermarket Income REIT (LSE:SUPR) | 6.13p | 8.2% |

If the forecasts are correct, a £20,000 total investment spread evenly across these shares will provide dividends worth £1,480 in 2025 alone.

Here's why I would buy them for my portfolio if I had cash to invest today.

Rio Tinto

The Rio Tinto share I already have in my Stocks and Shares ISA. And following the recent heavy share price weakness I am considering increasing my stake.

As well as boasting that huge 6.5% dividend yield, the mega miner is also now trading at a low price-to-earnings (P/E) ratio of 8.9 times.

Profits are at risk as China's economy – the planet's raw material eater – experiences an extended recession. But I think the cheapness of Rio Tinto shares at the moment reflects this threat.

I definitely believe that the income here will increase significantly in the long run as the goods need to increase. This will be driven by themes such as the rise of artificial intelligence (AI), the rise of renewable energy, and continued spending on cities and infrastructure around the world.

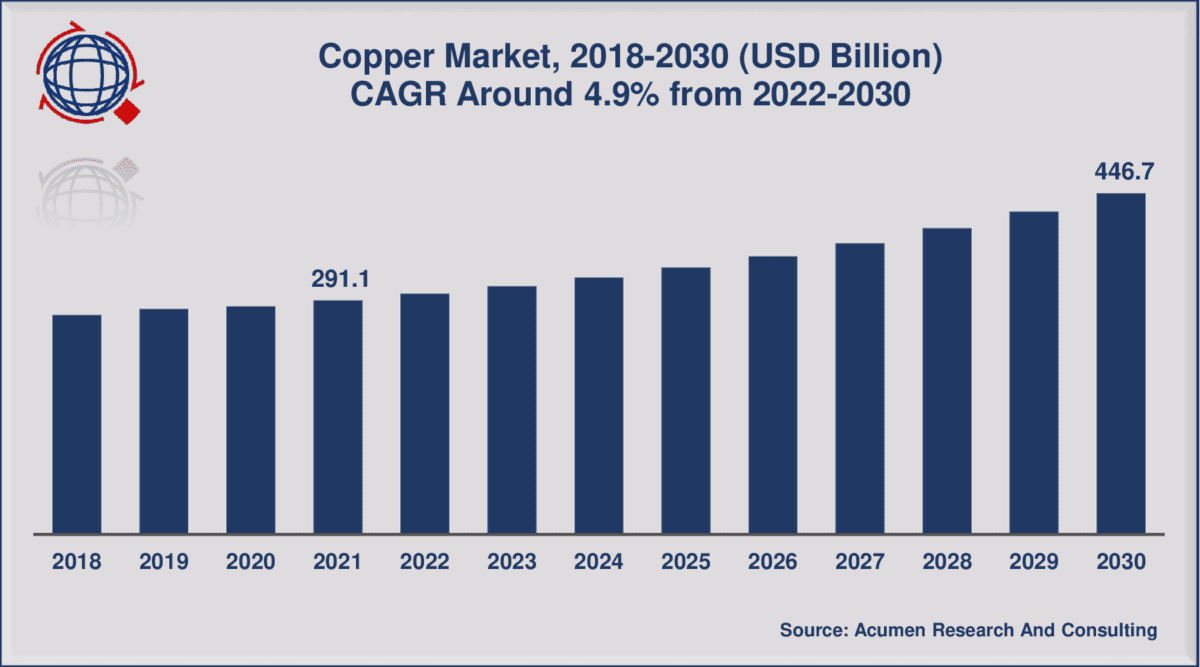

And so now would be a good opportunity to buy the dip. As the chart below shows, Rio's copper demand alone is likely to increase significantly until at least 2030.

In the meantime, I think the strength of Rio's balance sheet should help it continue to pay big dividends even if revenues are below capacity. Its net-debt-to-EBITDA ratio was just 0.4 times as of June.

Supermarket Income REIT

Rio's dividend yield for next year rose above the FTSE 100's leading average of 3.5%. Supermarket Income REIT is even more impressive for the fiscal year ending next June, north of 8%.

Real estate stocks like these can be great ways to earn a second income. Under REIT rules, these companies must pay a minimum of 90% of annual rental income in the form of dividends. This is in exchange for certain tax benefits.

Real estate stocks like these aren't always rare buys though. As interest rates rise, yields come under pressure as asset prices fall and borrowing costs rise. This could put profits under pressure.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice.

However, with more depreciation in the next 12 months, now would be a good time to consider Supermarket Income REIT. I love it because of its focus on the most sustainable part of the real estate market, which in turn provides sustainability at all points of the economic cycle.

It also has its own heavyweight employers (inlcing Tesco again Places to stay in Sainsbury) locked in long-term contracts, which provide the benefit of increased visibility. The company's weighted unexpired lease term (WAULT) is approximately 12 years.

Source link