Construction industry trends and insights for September 2024

Our monthly construction industry trend report includes the latest industry data and our insider findings from the award-winning National Business Capital team. With extensive experience in the construction industry since 2007, we are excited to share these findings and expand upon them with our unique expertise.

Our mission is to provide business leaders and decision makers with the necessary information and data to make well-informed decisions in their business operations.

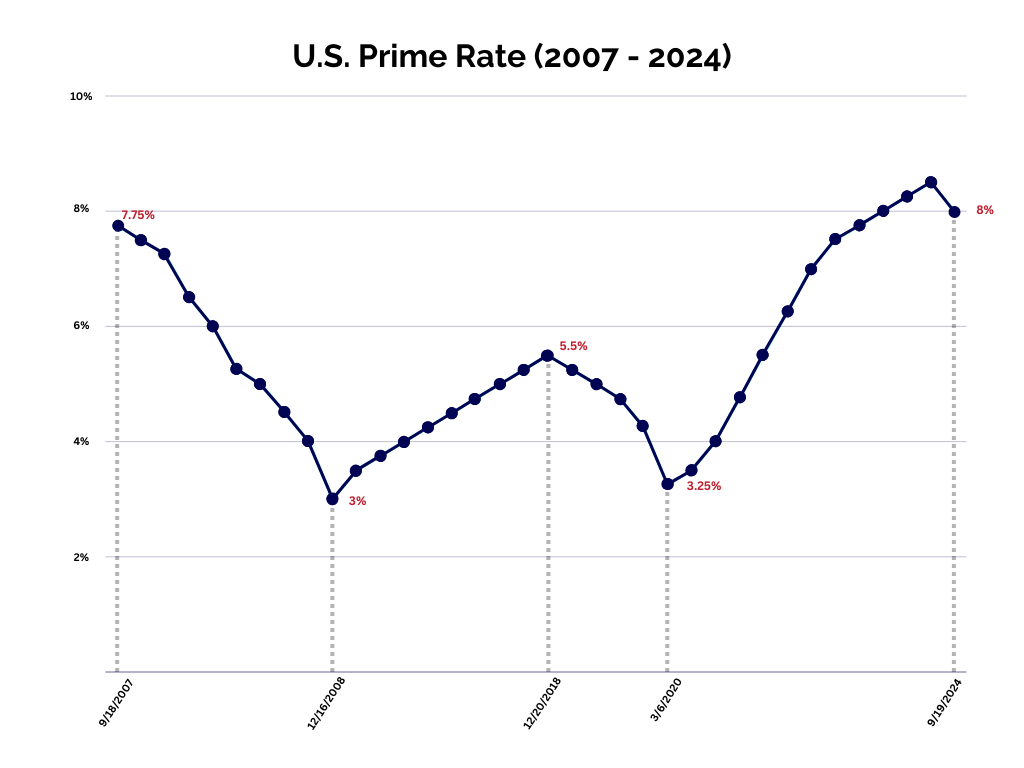

Federal Reserve Cuts Key Rate by 50 Basis

Data provided by JP Morgan Chase

September 2024 On September 19th, the Fed lowered the key rate by 50 basis points from 8.5% to 8%. This move shows that their fight against the inflation that hit the economy after Covid has improved and that the economy is ready to recover.

The rate cut also marks the end of a three-year tightening cycle, during which the rate reached its highest point since 2001. As the prime rate goes down, the cost of capital will be worse and more restrictive for the construction community and so on. industries.

Access to cheap money can encourage construction activity across the country. With access to working capital, equipment loans, and more, construction companies can purchase materials, hire specialized workers, and operate at a higher level with new machinery and equipment. We believe this will increase construction capital significantly over the next 2-5 years.

Considering that lack of access to finance has hampered the construction industry, the Fed's decision is good news for the community. When construction companies can spend more money outside of their own cash, they can make larger bids for projects, qualify for larger projects with infrastructure investments, and streamline day-to-day operations to complete projects – and collect profits – faster.

However, we still have to argue whether it is a horse-drawn carriage. Many economists use construction activity as a concrete metric of economic health, so it's important to note that devaluation by itself will not immediately stimulate construction activity. Instead, it restores confidence in the market, which should increase demand for construction projects by making them more attractive and feasible for business decision makers.

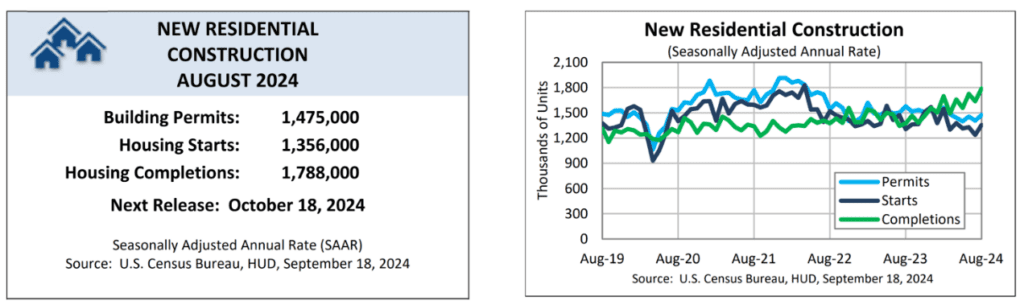

Rate Cuts x Housing Construction

Another aspect of price cuts for construction companies to consider is how they affect the housing market. Since the Fed's rate of interest reduction is lower than last month, we can only predict with historical data.

Source: Census.gov

September 2024 – The latest data available – August 2024 – suggests that approvals and starts are trending downward while completions are in the opposite direction. Given the uncertainty of the market heading into the election season, it is possible that approvals and initiatives have been delayed because decision makers are waiting for certain weather.

Looking ahead, however, price cuts may cause changes in housing market activity. As mortgage rates drop, homeowners may consider cashing in on the hot housing market by selling. With more supply available, we believe this will break the gridlock that is hindering housing market activity.

Both veteran and first-time home buyers will take advantage of the new inventory and, before long, begin investing in renovations. Repair work will see a significant increase in demand as this trend continues, although performance will depend on material prices.

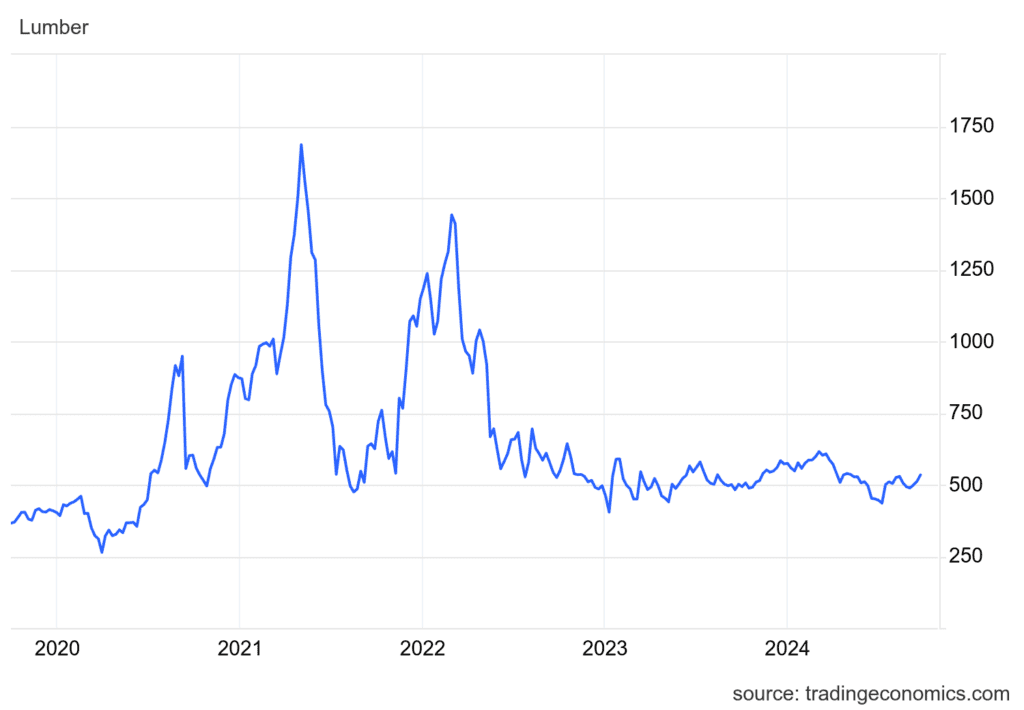

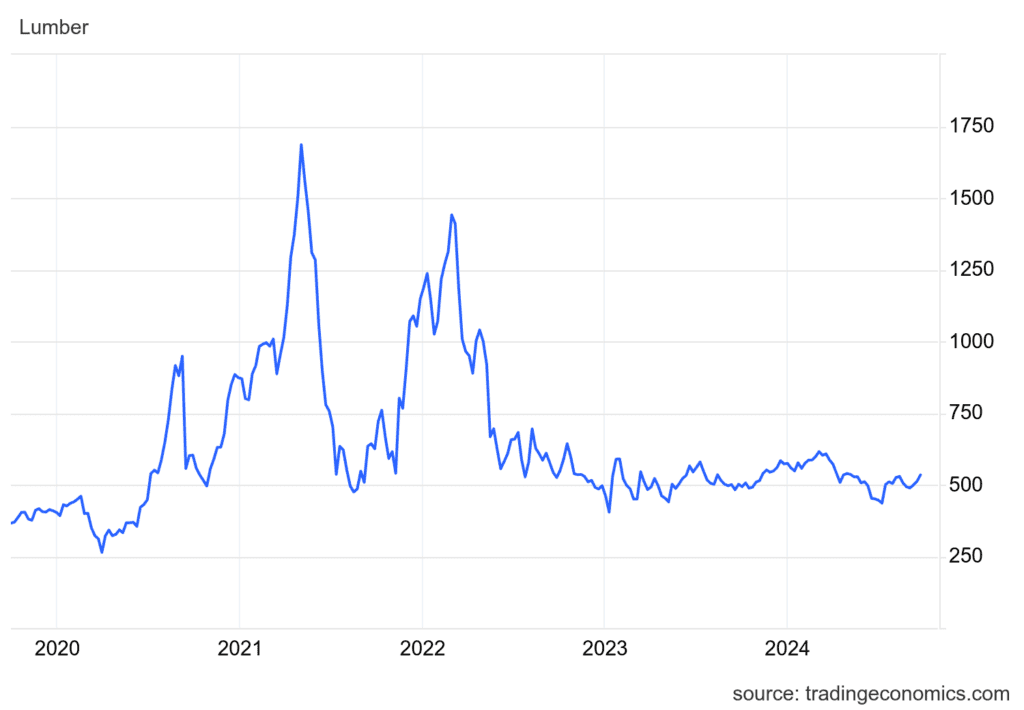

Lumbar Costs (2020-2024)

*Years in USD/1,000 Board Ft.

Source: TradingEconomics.com

Lumbar, one of the most important materials in many construction sectors, has seen significant fluctuations in the last five years, especially from 2020 to 2022, when prices have increased significantly.

We have seen a softening of prices since then. However, recently, we have seen a 21.1% increase in lumbar costs.

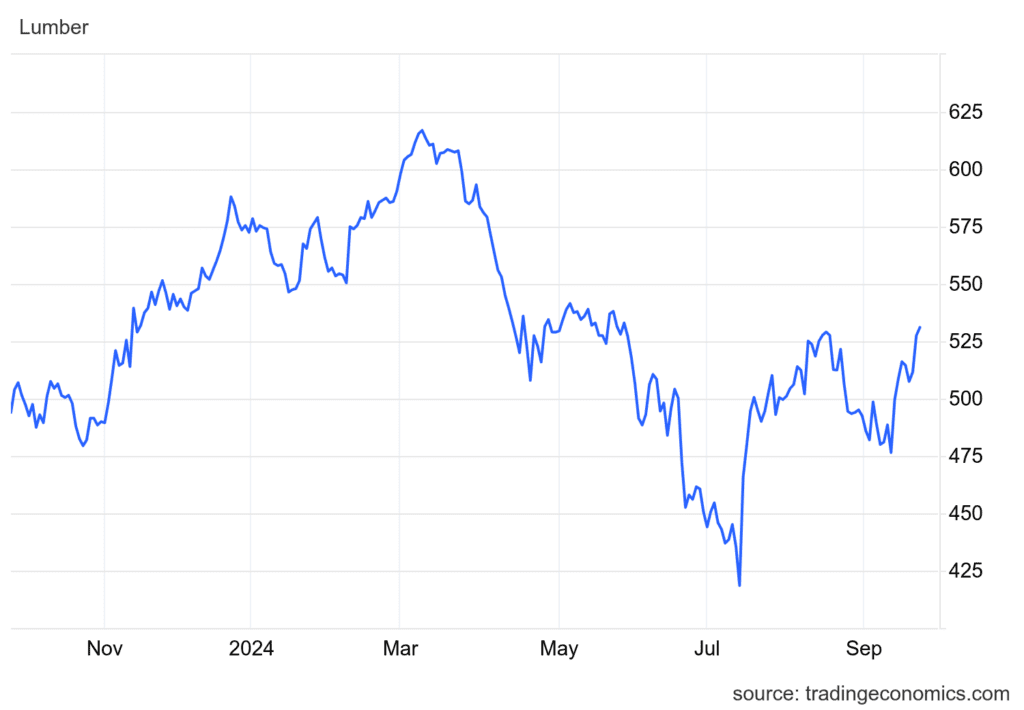

Lumbar Costs (October 2023 – October 2024)

*Years in USD/1,000 Board Ft.

Source: TradingEconomics.com

The graph above shows lumbar costs over the last 12 months. After falling in the middle of the year, prices are rising again after coming out around August.

Construction companies must stay informed about material prices so that they can estimate the cost of the work and protect their money accurately. Time projects around lower material prices may strengthen income. If costs are high, construction companies may also subsidize the purchase of these materials to keep them running smoothly, especially now that the Fed has started lowering rates.

National Business Capital's Construction Recap (September 2024)

Each month, we will provide our unique perspective on the short to mid-term outlook for the construction industry. Our insights come from a combination of available industry statistics, internal data, and the common sense of the construction clients we work with every day.

- 23.75% Increase in the Volume of Construction Funds – Construction companies earned 23.75% more this month compared to August. Approvals are high, and businesses are moving forward with more confidence in financing offers. The continued growth in the volume of funds, as mentioned in our previous reports, is good news for society.

- Construction Companies Are Sure About Their Plans – This month, we have seen a large increase in construction companies planning their expansion. While we have seen some companies choose to wait for opportunities in the past, and even some are now waiting to see the results of the election, decision makers are starting to move forward with confidence.

- Mixture of Business Activities in the Industry – Construction companies in the northeast have begun to reduce their operations and prepare for the winter months, while companies in the southern states are preparing for increased activity.