10.5% yield! Here is the Phoenix Group dividend forecast until 2026

Image source: Getty images

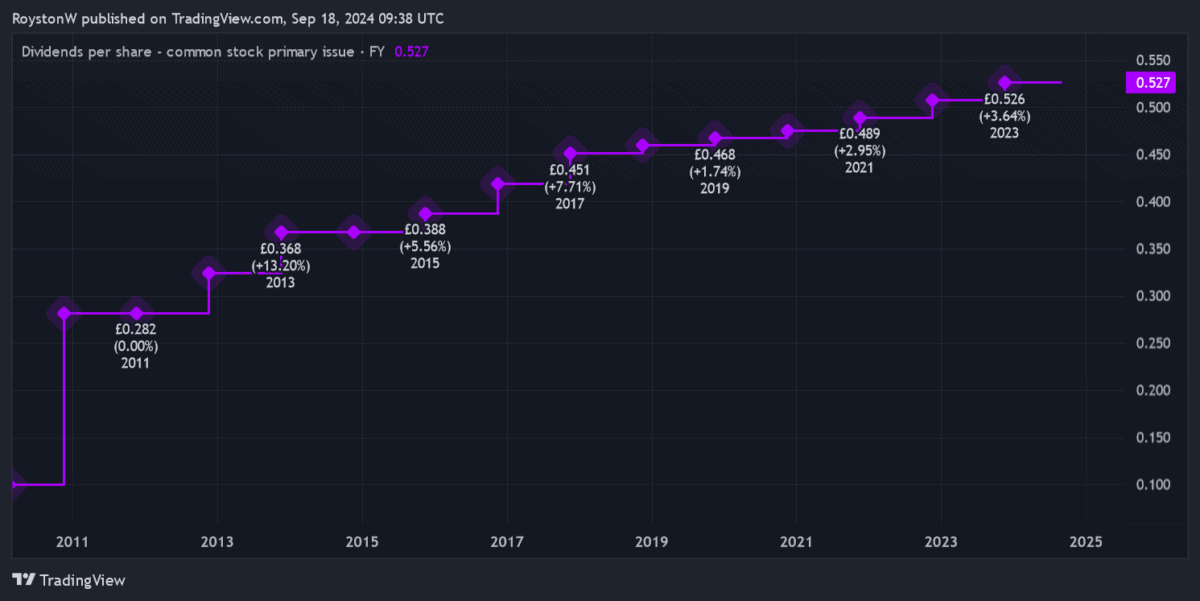

Phoenix Group (LSE:PHNX) has proven to be one of the FTSE 100The best dividend stocks of the last decade. It even continued to increase shareholder payouts during the Covid-19 crisis when other blue-chip stocks were cutting, canceling and postponing dividends.

Footsie's home to many great dividend growth stocks. The Sage Group, The Ashtead Group again Halma several blue-chip stocks with long records of unbroken dividend growth.

However, these companies do not offer market-mashing dividend yields for Phoenix stocks. These eventually rise to 10% in the medium term, as the table below shows.

| A year | Dividends per share | Share growth | Dividend yield |

|---|---|---|---|

| 2024 | 54 p | 3% | 9.9% |

| 2025 | 55.7 p | 3% | 10.2% |

| 2026 | 57.3 p | 3% | 10.5% |

The prospect of FTSE 100-beating profits in the period excites me. Footsie's forward dividend yield is sitting at 3.5%.

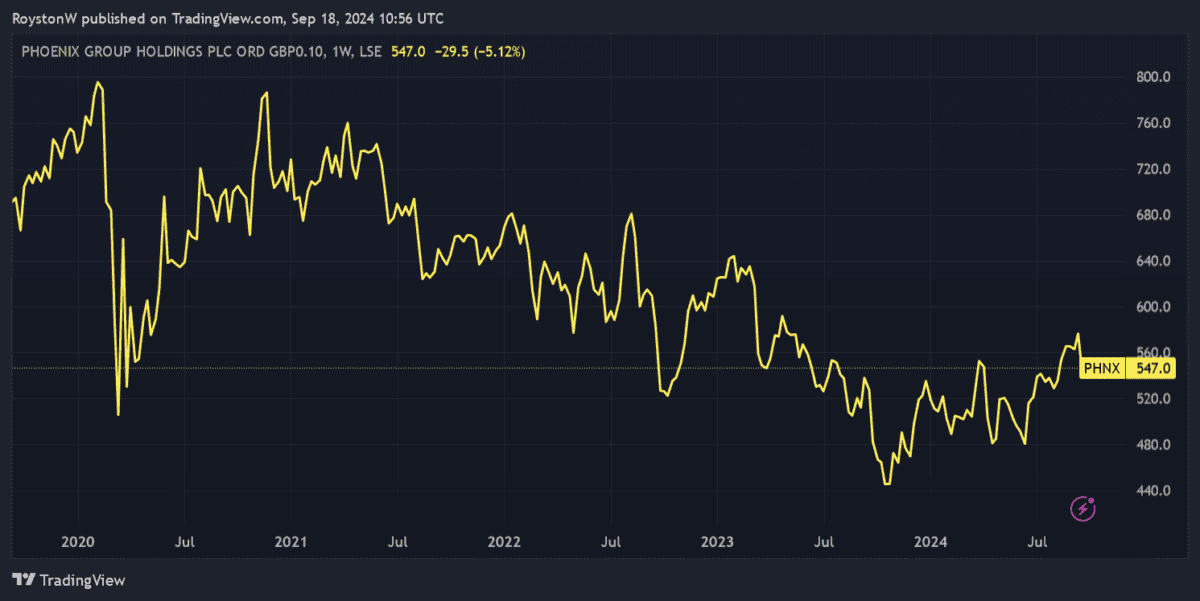

But the benefits are not guaranteed, and I need to consider how true these predictions are. I must also consider other factors that affect the Phoenix investment case. Large shares may be worthless if the company's share price falls.

Here is my opinion of great financial resources.

A bad omen

To be honest, my initial take on Phoenix's dividend prospects is not encouraging. I looked at the profit cover, which shows how well the expected payments cover the expected profits.

Like dividend forecasts, profit margins can also miss their mark. So reading 2 times and above gives investors a strong protection.

In Phoenix's case, forecast earnings of 44.9p per share in 2024 are actually below with expected earnings per share of 54p.

The relationship changes from the following year, but the budget cover of 1 times and 1.1 times in 2025 and 2026, respectively, is not strong.

Good forecast

That said, I wouldn't say Phoenix's poor dividend coverage is a dealbreaker. Earnings per share have often outpaced dividends in recent years, but this has not affected the company's ability to pay large and growing dividends.

Past performance is not a reliable guide to the future. But looking at Phoenix's balance sheet gives me hope.

As of June, its Solvency II ratio was 168%. This was within the company's target of 140% to 180%.

Phoenix is a money making machine. And as a potential investor I am encouraged by its ability to consistently meet – or even beat – its revenue generation targets.

Strong earnings in the first quarter, for example, led the company to seek “we are confident of delivering at the end of our target range of £1.4bn to £1.5bn by 2024.”

High dividend yield

As a result, I am very excited about Phoenix's dividend forecasts for the next few years. My main concern is whether its share price will struggle until 2026. Difficult economic conditions and the ever-present threat of market volatility can have a negative impact on business.

However, as a long-term investor this is not a dealbreaker for me. I believe Phoenix's share price will rise steadily over time as demographic changes drive demand for retirement products. I actually think it could go up in value as interest rates go down.

And in the meantime, I can look forward to a very sweet profit. This is a share I will seriously consider the next time I have money to invest.

Source link