3 great steps to building long-term wealth with UK shares

Image source: Getty Images

Looking for ways to create life-changing wealth? Here are three strategies I can use to try and maximize my returns on UK shares.

Slash tax costs

The first step I will take is to set up a tax efficient investment vehicle. There are currently two on the market that protect people from both capital gains tax (CGT) and dividend tax.

The first is the Individual Savings Account (ISA). Under this section, investors can buy shares, trusts, and funds through a Lifetime ISA and/or a Stocks and Shares ISA.

Another option I have is to open a Self-Invested Personal Pension (SIPP).

Over a few decades, these products can save people tens of thousands of pounds in tax. It's one of the reasons why the number of Stocks and Shares ISA investors has increased by 27% in the last 10 years, to 3.8m today.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice. Students are responsible for conducting their own due diligence and obtaining professional advice before making any investment decisions.

Separate the things I carry

With this setup, I will be looking to build a diversified portfolio that provides strong and stable returns year after year.

This will involve buying a mix of value, growth, and equity stocks spanning multiple sectors and geographies. Such a strategy would help me manage risk and capture a wide range of growth opportunities.

I don't have to buy a large number of stocks to gain diversification, however. I can also choose to buy a fund or trust that invests in a number of different assets.

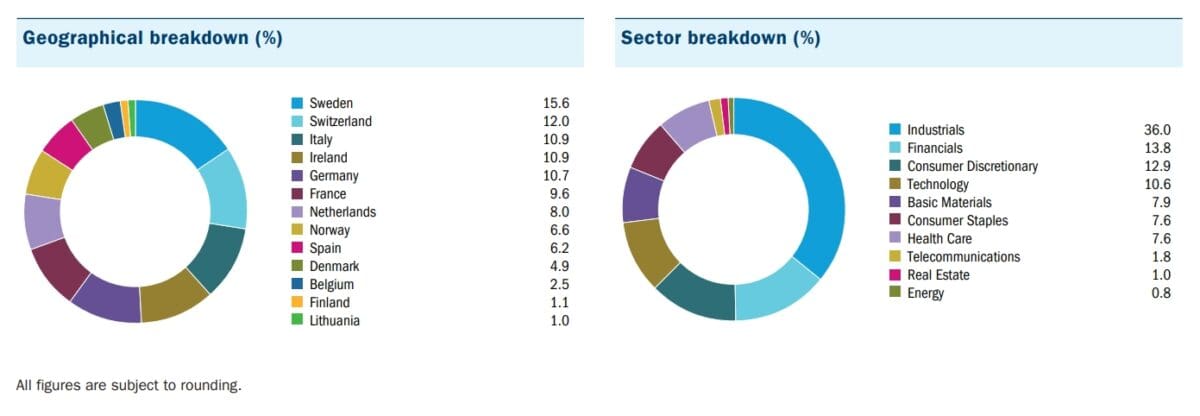

I European Assets Trust (LSE:EAT) is one such financial instrument. It has been going since 1972, and invests in small and medium-sized companies in many countries and industries.

On the other hand, the trust's focus on smaller companies may result in disappointing returns during an economic downturn. This has been the case recently as Europe's major economies have stagnated.

But with inflation easing, now would be a good time to open a position. As the trust notes: “Europe's small and powerful companies have made strong gains among global stock markets over the past 15 years..”

And I think the trust offers excellent value at current prices. At 83.4p per share, it trades at a 13% discount to its net asset value (NAV) per share.

Investors can also get a good yield of 6.7% at today's rates.

Reinvest any gains

The final step in my quest to create long-term wealth would be to reinvest any gains I receive. This way, I can take advantage of compounding, where reinvested profits make more money over time.

Essentially, this means that I earn the interest (or dividends) I receive as well as my initial investment. The more shares I buy, the more benefits I get. Over time, this snowball effect can cause my portfolio to swell significantly.

Let's say I invest £10,000 in a dividend yielding 5%. In the first year, I made £500 in dividends, which I used to buy more shares. This gives me a portfolio worth £10,500, which at the end of the second year will give me an improved £525 in dividends (based on that 5% yield).

After 10 years of growing my portfolio in this way, I will be receiving around £814 in annual dividends, assuming the stock price and dividend yield remain stable. And my total investment would be worth £16,289 compared to just £10k.

Source link