As investor sentiment fades, is the stock market about to crash?

Image source: Getty Images

UK share prices have risen sharply in 2024 following years of underperformance. I FTSE 100 again FTSE 250 both have gained about 7% since the start of the year. But the prospect of a stock market collapse continues to vex investors as the fourth quarter continues.

In fact, Saxo Bank research revealed “a significant change in market sentiment compared to previous periods, as investor confidence in global markets is declining.”

What is the probability of a stock market crash? And what should I do?

Emotions are sinking

Saxo interviewed 712 of its customers. Its report stated that “while many respondents remain optimistic, there are growing concerns about inflation, interest rates, and sovereign risk, all of which continue to change market expectations over the next three months..”

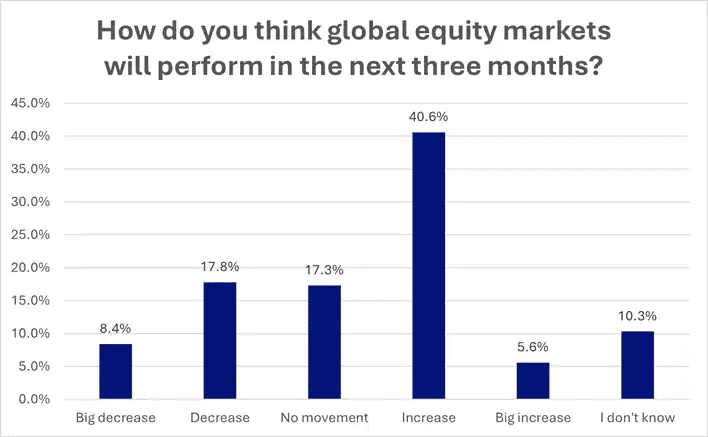

As the chart shows, investors remain optimistic about the direction of the stock market in the fourth quarter. About 40.6 percent of those surveyed expect share prices to rise this time.

However, client confidence is declining at an alarming rate. Saxo said 42.1% of respondents expected stock markets to rise in Q3, which was down significantly from 50.5% during Q2.

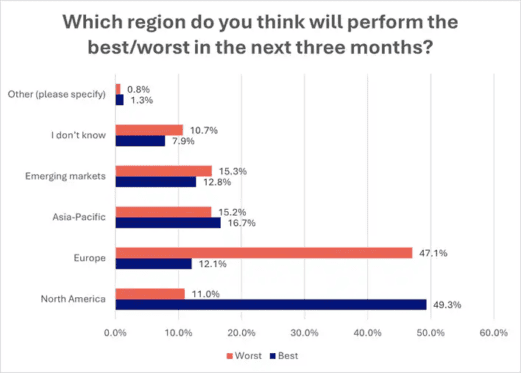

Worryingly for UK investors, bankers believe European equity indices will underperform this quarter.

A whopping 47.1 percent of those surveyed think Europe will be the biggest underperforming sector. This is up significantly from 25.9% making the same forecast in Q3.

Thinking like Buffett

So what happens next? The truth is that no one knows. Trying to predict the near term direction of the stock markets makes a fool of the most experienced investor.

This is why I plan to continue buying stocks in my portfolio. As a long-term investor like Warren Buffett, the prospect of short-term turbulence doesn't put me off.

In fact, if the stock market crashes, I'll be looking for bargains. While past performance is no guarantee of the future, I am reassured by the stock market's consistent ability to bounce back from shocks.

Take the FTSE 100, for example. It has recovered well from many crises since its inception in 1984 to post a record high of 8,474.41 earlier this year. These include the dotcom bubble, the 2008/09 financial crisis, the Brexit referendum, and the Covid-19 pandemic.

One deal for the FTSE 100

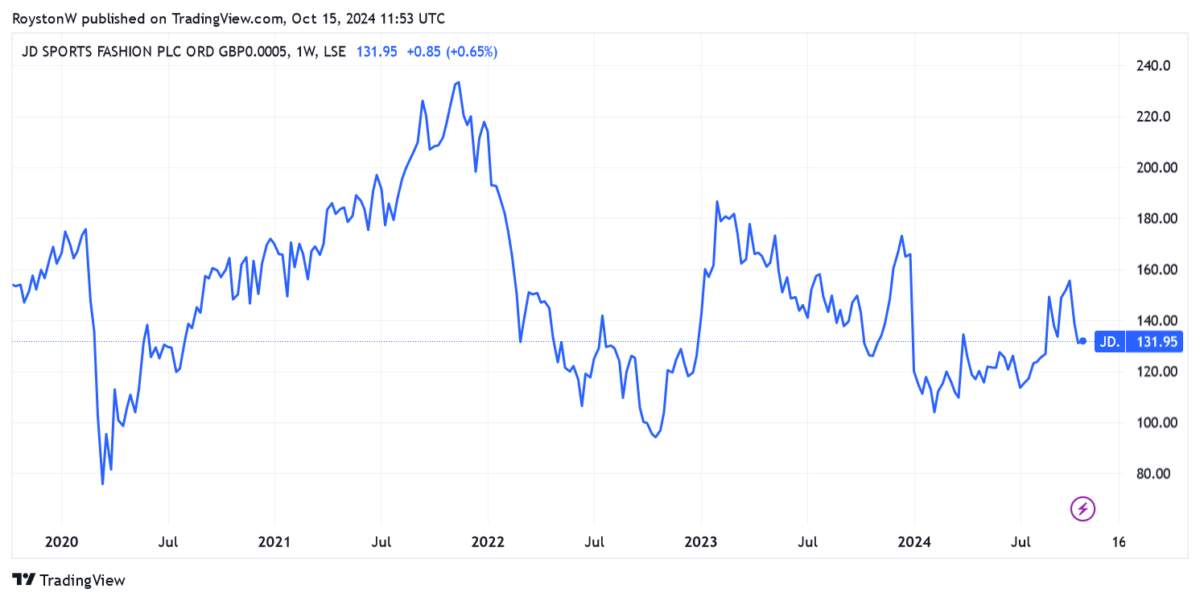

JD Sports Fashion (LSE:JD.) a losing Footsie share I'm already considering buying for my portfolio. After a shock drop in mid-January, the seller remains about 20% cheaper than at the beginning of 2024.

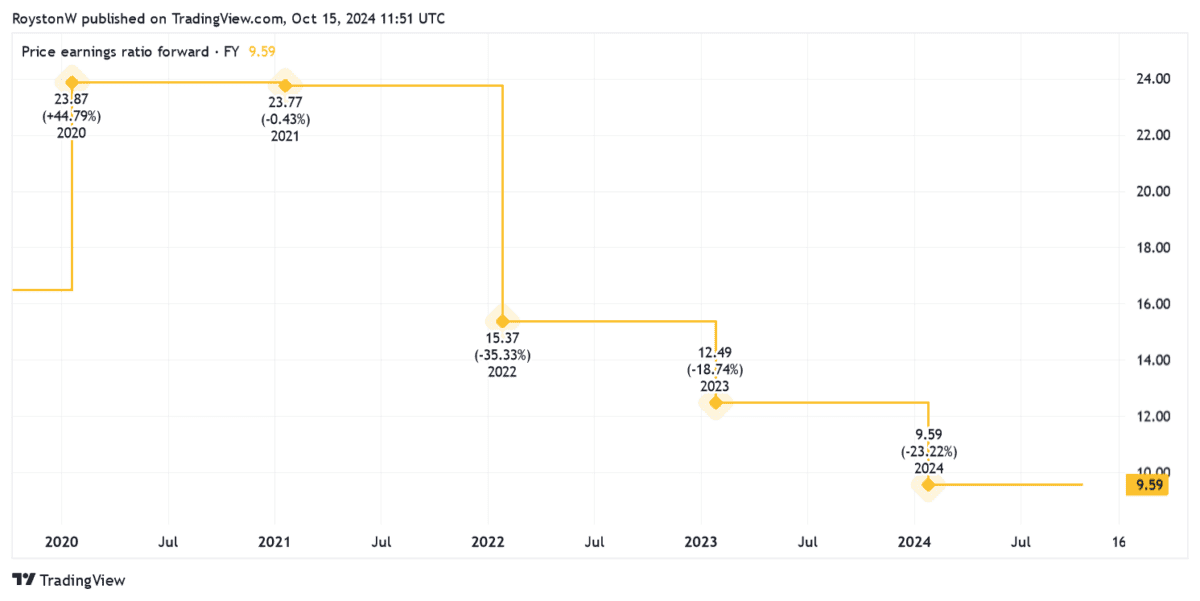

As a result, it trades at a forward earnings ratio (P/E) of just 9.6 times. As the chart shows, this is well below the reading of the previous five years.

JD's share price fell in January as it warned of a profit loss due to sluggish sales. This remains a threat going forward, but one that I believe is focused on the company's low valuation.

Trading at the sporting goods giant is also showing signs of recovery. Organic sales were up 6.4% in the six months to July, making pre-tax profit a better than forecast £405.6m. Profit was £397.8m down on last year.

I think JD can deliver strong long-term returns as the sports fashion segment grows in the coming years.

Source link