Cheapest dividend stock and ETF to buy to target £1,200 income

Image source: Getty Images

I'm looking at the London stock market for dividend stocks and exchange-traded funds (ETFs) to buy today. And I think I've found a few exceptional candidates for long-term income.

It's not just that the following has it FTSE 100-Beating dividend yield now. I expect them to provide a large and growing dividend over time.

Here's why I would buy them if I had £20,000 to spare ready to invest. Based on current dividend yields, it could make me £1,200 in extra income this year alone if I split my investment 50-50.

A cheap ETF

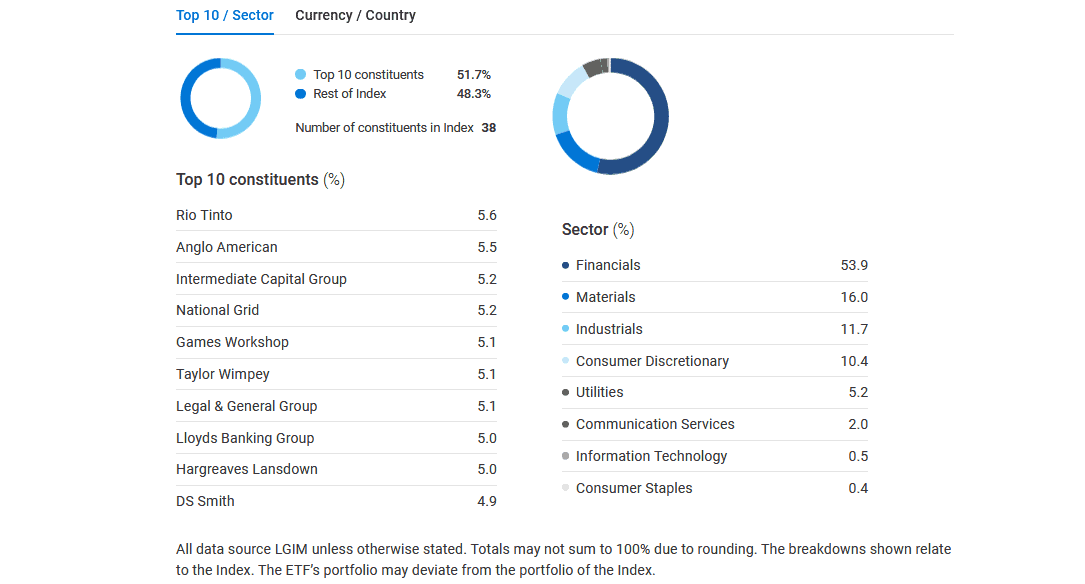

As its name implies, the IL&G Quality Equity Dividends ESG Exclusions UK ETF (LSE:LDUK) focuses on British companies with strong records from an environmental, social and governance (ESG) perspective.

It invests in a basket of stocks – 38 at last count – excluding those that have “poor balance sheet, income statement and/or ESG factors“. Although returns are never guaranteed, the first two can make the fund a reliable source of income.

Major assets here include miners Rio Tinto again Anglo Americanfinancial service providers Lloyds again ICGand service business National Grid. This wide diversification can help it provide smooth returns over time.

Another downside to this fund is its low fees compared to other ETFs. This can make it more difficult and expensive for investors to enter and exit positions.

That said, I still think it's still worth a closer look at this point. The dividend yield is currently 4.5%, about a percentage point higher than the broader Footsie average.

Buying the FTSE 100 dip

The insurance giant Aviva (LSE:AV.) is a FTSE 100 shares that I already have in my portfolio. I am thinking of increasing my stake once I have money to invest with it, because of its good value.

You see, Aviva's share price has fallen dramatically from over 500p in the last six weeks. I think this represents an attractive dip buying opportunity.

As the chart below shows, its yield is a dividend twice FTSE 100 average of 3.6%. And it rises slightly over the next two years amid City's forecast for dividend hikes.

| A year | Share of each share | Share growth | Return yield |

|---|---|---|---|

| 2024 | 35.43p | 6% | 7.4% |

| 2025 | 38.11 p | 8% | 7.9% |

| 2026 | 40.83 p | 7% | 8.3% |

On top of this, Aviva shares trade at a discounted forward price ratio (P/E) of 10.5 times. And its price-to-earnings (PEG) multiple remains below the 1 watermark, at just 0.5.

The financial services company generates a lot of cash, making it an attractive target for equity investors. With a strong Solvency II ratio (205% as of June), we look to be in a good position to meet the payment forecasts shown above.

I expect Aviva to deliver large and growing profits over time as the growing aging population drives demand for retirement and protection products. Having said that, the intense competition in its markets can affect the company's ability to implement this. But I like it all the same.

Source link