Forget the S&P 500 – here's an under-the-radar US stock that I think looks like a bargain

Image source: Getty Images

From an investment perspective, i S&P 500 it looks dangerous right now. The heavy focus on some expensive names has more than one analyst predicting weak earnings for the next 10 years.

That could cause investors to turn their backs on the US when looking for opportunities. But I think that's a mistake – aside from the index, there are stocks that I really like the look of.

An oil company

Another example is this Chord Power (NASDAQ:CHRD). Earlier this year, the company merged with Enerplus to form a major oil producer in the Williston Basin.

My thesis here is straightforward. Management reports that its assets will allow it to produce oil for 10 years at low prices and I think this will make for strong returns for investors.

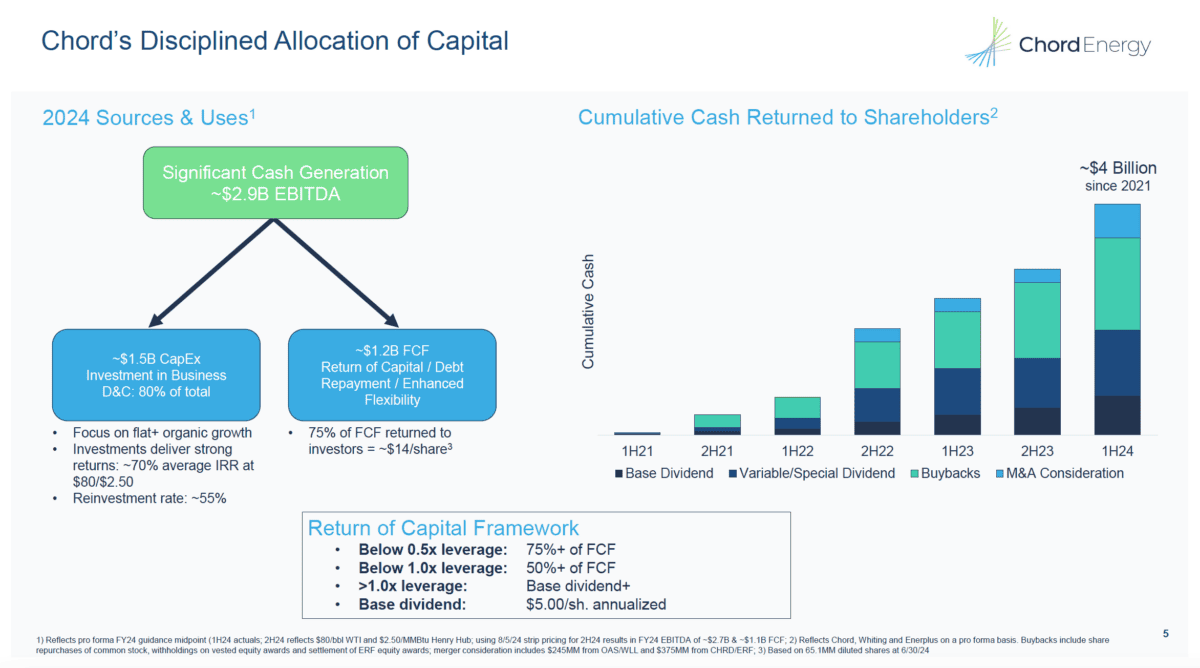

Chord's balance sheet is very strong. And that allows the company to return significant amounts of the cash it generates to investors through dividends and share buybacks.

This sets them apart from other oil stocks and makes them more attractive in my opinion. I think it looks like a profit even when US stocks as a whole are at historically expensive levels.

Production

Chord's position in the Williston means its costs are higher than its Permian-based counterparts. But I think there is still a lot for investors to enjoy.

Back in August, the company expected to generate about $700m in free cash flow this year based on an oil price of $70. And from next year, that should be enhanced by the synergies from the Enerplus transaction.

Since then, West Texas Intermediate (WTI) has fallen to around $67 per barrel. But Chord's market is currently under $8bn, which I think makes things very interesting.

At that rate, there would still be a very good return on free cash flow available to investors even if oil prices were to fall. But there is more to the story than this.

Assignments

Instead of exploration, Chord is looking to return its free cash flow to shareholders. The company aims to keep its leverage ratio below 1 and sets its dividend policy based on how well it achieves this.

Source: Chord Investor Presentation August 2024

Currently, the company has a total debt-to-EBITDA ratio of 0.3. At that rate, 75% of the free cash generated by the company is returned to investors as dividends.

The positive outlook for WTI is a necessary condition for investing in oil stocks at all. But if the price of oil stays above $70 for the next 10 years, things could get very interesting.

If I invest £1,000 today, I think there's a chance I'll get 100% of that back in profits over the next 10 years. And with interest rates falling, there aren't many such opportunities.

A stock to consider?

There are many reasons for uncertainty about the outlook for oil prices. Right now, the biggest threat is probably an increase in production from OPEC at a time when demand is weak.

Investors who are bullish on oil may want to take a look at Chord Energy, however. US stocks can often be expensive, but I think there is still excellent value on offer here.

Source link