If I had invested £5k in this fantastic FTSE 100 stock 4 years ago, this is what I would have today

Image source: Getty Images

As one of the consistent beneficiaries of FTSE 100, The Compass Group (LSE: CPG), is an investor’s dream.

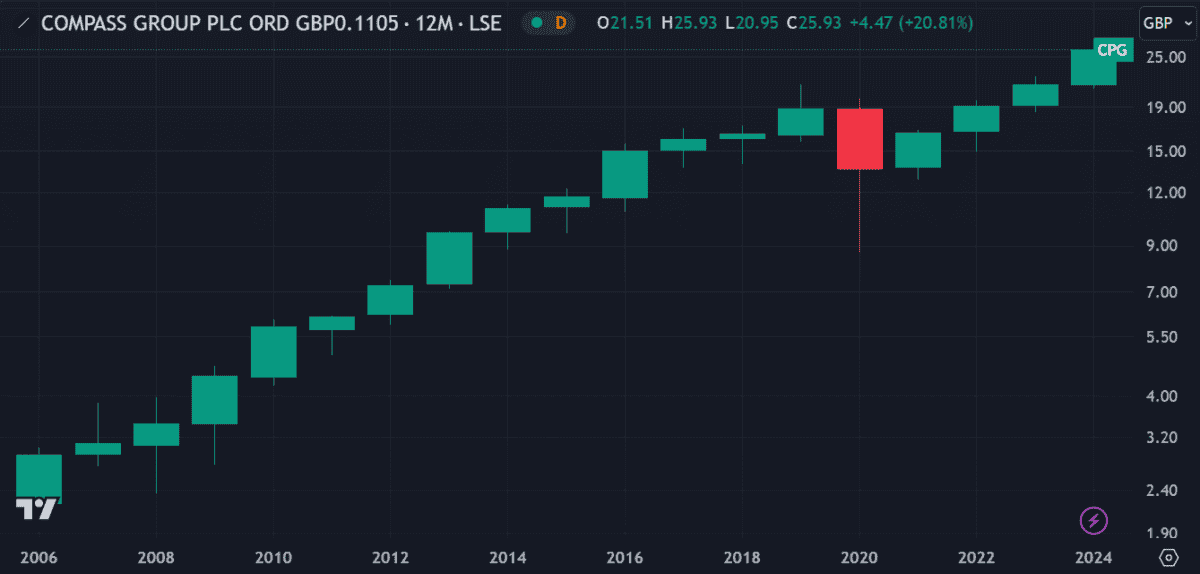

Between 2006 and 2019, it closed higher every year and increased dividend payments every year without fail.

Then in 2020, the Covid pandemic ended his winning streak. The stock fell 27% that year and the company was forced to cut dividends.

Recovery was quick though. It returned profits the following year and began to rise rapidly. Today, the stock trades at around £26 – a 145% increase from a November 2020 low of around £10. That’s an annual return of 25% per year!

The dividend yield has returned an average of 1.5% over that period. Using those averages, a £5,000 investment would grow to £12,800 today, with dividends reinvested.

If that kind of growth continues, the same investment today could be worth more than £50,000 in 10 years. But is that a reasonable expectation? I decided to take a closer look.

Strong security assurance

As Europe’s largest food contract company, Compass Group is a brand that enjoys consistent demand. It not only supplies food to schools, offices and hospitals but also to remote locations such as offshore oil platforms. Since 1941, it has acquired 35 food service companies worldwide, employing more than 500,000 workers.

Basically, if food is served, the Compass is probably involved. That alone suggests it is a reliable investment.

So what’s the catch?

However, Compass is sensitive to recession and inflationary pressures, as evidenced in 2020. Increased food and labor costs combined with potential supply chain disruptions can eat into earnings. In addition, its global reach makes it vulnerable to financial fluctuations and regulatory changes.

Recently, this has affected revenue, leading the company to stabilize operations by exiting certain markets. These market changes may continue to cause price volatility, which potential investors should consider.

Strong results

Compass posted strong Q3 2024 results last week, with growth driven by high customer retention and new business across key regions – particularly in healthcare and education. This growth helped raise revenue, meet the company’s annual forecasts and strengthen its global leadership in food services.

Net income grew to $31.5m compared to a net loss of $3.8m in Q3 2023, while sales rose 11.8% to $582.6m.

As the revenue forecast will increase, the price-to-earnings ratio (P/E) is expected to decrease from 32 to 27. This will bring you more in line with competitors, improving the stock’s value proposition. The future return on equity (ROE) is predicted to be more than 30% over three years, which is probably the strongest indicator of a company’s performance.

My decision

It is true that some stocks have benefited from the measures introduced to improve the post-Covid economy. However, Compass’ recent performance is not unprecedented. Between 2006 and 2016, it enjoyed consistent growth, delivering annual gains of 17% per year.

Barring another pandemic, I see little reason to suggest we can’t do the same again. It may not turn £5k into £50k in the next ten years but it should do well. Does that mean I plan to buy the stock? You can bet your Christmas pudding I am!

Source link