15% off this week! Is there a new opportunity in this gem of profit with 8% profit?

Image source: Getty Images

After a trading update revealed a 20% drop in Q3 revenue, ITV (LSE: ITV) shares fell 15% earlier this week. Is that cause for concern – or does the 8% dividend yield make the shares attractive?

I’m looking closely.

In a commercial update released on Thursday (November 7), the broadcaster reported various financial results for the first nine months of 2024. Its ITV Studios division saw a 20% drop in revenue, impacted by the American writers and actors strike.

Group revenue fell 8% to £2.74bn compared to £2.97bn in 2023, with lower ITV Studios revenue dampening growth in gross advertising revenue (TAR).

However, the broadcaster says it is still on track to achieve a record profit by the end of the year. Chief executive Carolyn McCall said: “Our cost savings program is well underway and today we are announcing further cost savings on top of the previously announced £40 million of cost savings through reengineering, improved efficiency and streamlining.“

In contrast, its ITVX broadcast platform showed strong growth, with broadcast hours up 14% and digital advertising revenue up 15%. To improve profitability, the company also announced a further £20m of cost savings.

Business development

ITV Studios has recently acquired a majority stake in prominent UK drama producer Eagle Eye and acquired an option to adapt Philippa Gregory’s novel. Wideacre on television. Both developments should be good for business.

It also listed a bunch of new ITX dramas. Examples include something interesting Playing Funwith James Norton, and a contemporary crime drama Joanand the real life game Until I Kill You.

Long time favorites like Ice dancing, Big Celebrity again Deal or Not continue to attract a wide audience across its main channel ITV1 and ITX

Dividend track record

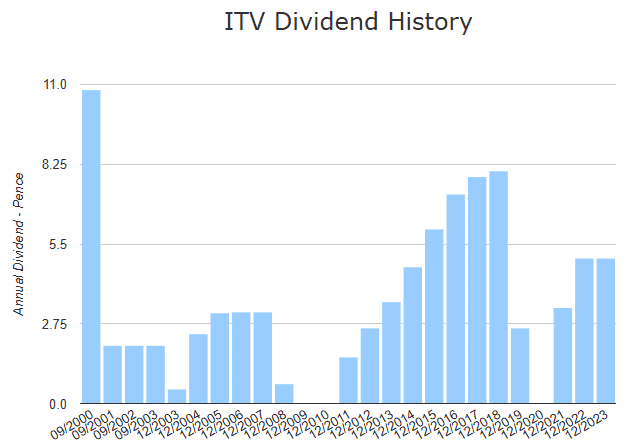

One of my biggest concerns about ITV in terms of dividends is its short payout record. When the economy is good – like between 2011 and 2018 – the benefits are reliable. But if not, the broadcaster is quick to cut and reduce.

After the 2008 crisis, dividends were completely cut for two years and in 2020 they were cut again. While this does not negate the positive returns brought in by other years, it is not exactly reliable in terms of passive income.

A dividend cut can scare investors and hurt the stock price, which can lead to losses.

To avoid cuts, it must successfully capture broadcast audiences and generate sufficient revenue for digital content. This can be a challenge, as it faces strong competition from the same big players Netflix, Amazon Prime once Disney+.

My decision

The decline in revenue is worrying but I think there are a few factors that make ITV still attractive. At least it has a low price-to-earnings (P/E) ratio of 7.6. It also has a respectable dividend yield of 12.11% and a low debt-to-equity ratio of 39.5%.

Even though my current stocks are down a bit today, I plan to take advantage of this opportunity and buy some while they are cheap!

Source link