£20,000 in savings? Here’s how I would aim to turn that into an income of £903 a month

Before the government’s latest Budget, there were rumors that the £20k annual allowance for Stocks and Shares was at risk. This was a concern because many investors use this to generate tax-free income.

However, the Budget came and went and the £20,000 remains the same. Good news for everyday investors.

Here, I will explain how I can aim to turn this amount into a secondary income of £903 every month.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice. Students are responsible for conducting their own due diligence and obtaining professional advice before making any investment decisions.

Income vs. growth investment

There are several different ways to build a portfolio. I may choose to invest only in high yield stocks (only those that yield, say, more than 5%). These blue-chip stocks are unlikely to go up much in value, but they can give me solid dividend income from the liquidation.

Of FTSE 100the likes of a high street bank Lloydsinsurance Legal & Generaland a tobacco firm Imperial Brands spring in the mind.

Alternatively, I can try to increase the size of my portfolio with growth stocks. These businesses pay little in the way of revenue (if any), and instead focus on investing to capture growing markets.

This path will probably lead me to the US stock market, where almost all of the world’s best growing companies are listed. Think about it Amazon, Microsoft, Nvidia, Netflixand so on.

After a few years of growing my portfolio, I will be in a better position to generate higher income from equity stocks.

Both strategies have challenges though. Income investing comes with the risk of dividend reduction or cancellation, just like investors Vodafone found out this year when the telecommunications giant cut its payout by 50%.

Meanwhile, what might seem like a great growth stock can quickly turn into a dud if the company’s growth evaporates.

The third way

An exciting trend can be found in companies that are still growing well but also pay increasing dividends. Another example is this Coca-Cola HBC (LSE: CCH), whose shares I recently bought.

This is a strategic bottle partner The Coca-Cola Companywhich gives it a high quality portfolio of products. It distributes these products in 28 countries, covering developed and emerging markets in Europe and parts of Africa.

In the first half of 2024, the company’s revenue grew by 13.6% year-on-year to €5.18bn. It also expects full-year earnings to grow by 11-13%.

Currency exchange risks are real here, however, given the different areas in which the company operates. It’s good to remember that.

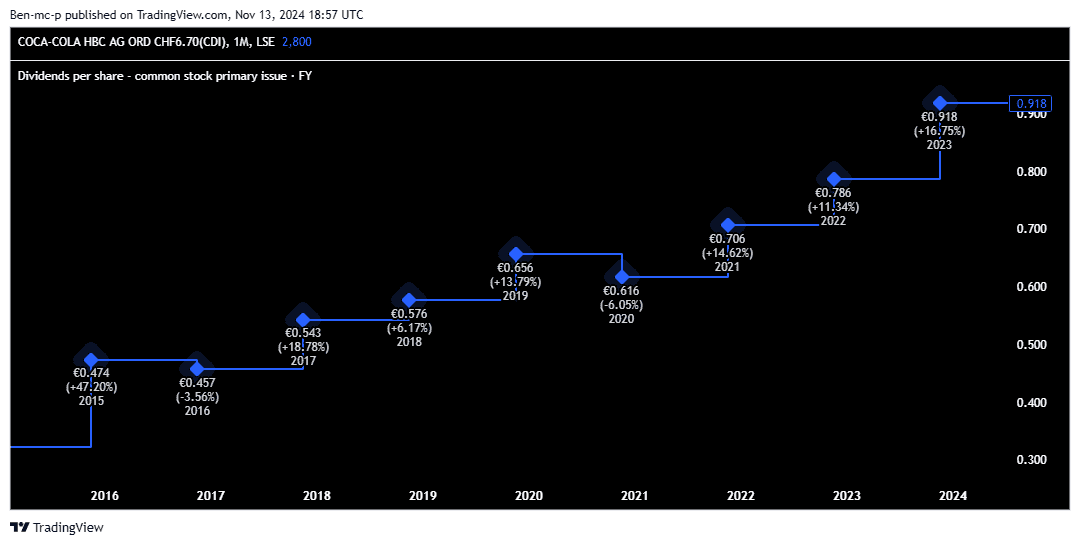

However, I like that this growing business also pays a dividend. The initial yield may seem modest at around 3%, but last year the payout increased by 19%!

By 2025, the dividend is expected to grow by around 9%. So I think this is a good example of a company that offers both share price and revenue growth potential.

Below, we see the company’s strong dividend record.

Generating money

In accordance with AJ BellCoca-Cola HBC stock has returned about 10% annually over the past 10 years. There is no guarantee that it will continue, but an overall portfolio that returns 10% on average can create a nice pot.

In this case, the £20,000 ISA would grow to £216,694 after 25 years, assuming I reinvest the benefits along the way. That is a very good result.

And the income from that? That would be £10,835 a year – or £903 a month – if my portfolio was yielding 5%.

Source link