Take the 52 Week Money Challenge and Make Over $1,378

For people who feel they have saved as much money as possible for their current expenses, but would still like to build a cushion or emergency fund, the 52 Week Make Money Challenge is a great way to increase your income by approximately $1,400 ($1,378) over the course of a year.

It achieves this by having the challenger find ways to make extra money each week on top of their regular income. In many ways it’s like a 52-week savings challenge with an emphasis on making money instead of saving money. There are three types of challenge that can be attempted.

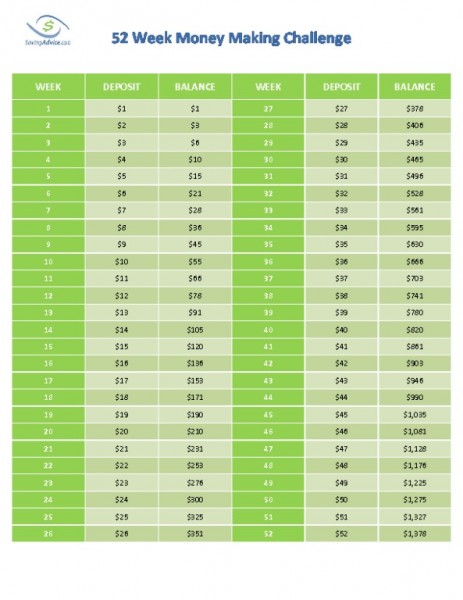

Standard Challenge (Click Image to Print)

The standard challenge is simple and straight forward. In the first week you find a way to earn $1. The next week (week two) you find a way to earn $2. The week after that (the third week) you should earn $3. You keep doing this so that any week during the challenge, that’s the amount of money you need to make. When you finally reach week fifty-two, you should make $52 that week. After all the weekly earnings are added together, you will have made an additional $1,378 over the course of the year.

The standard challenge is simple and straight forward. In the first week you find a way to earn $1. The next week (week two) you find a way to earn $2. The week after that (the third week) you should earn $3. You keep doing this so that any week during the challenge, that’s the amount of money you need to make. When you finally reach week fifty-two, you should make $52 that week. After all the weekly earnings are added together, you will have made an additional $1,378 over the course of the year.

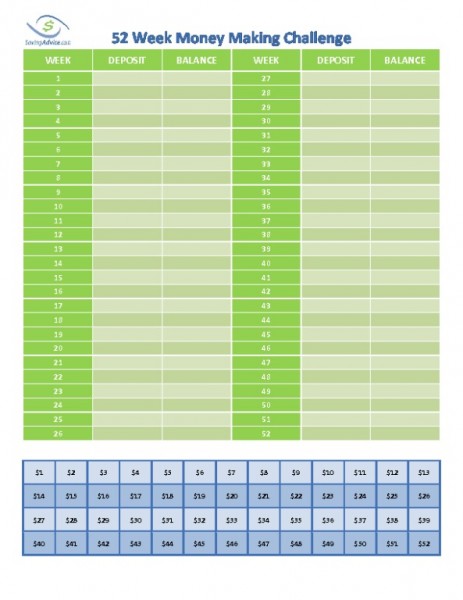

Another Challenge (Click Image to Print)

Another challenge will still make the same amount of money ($1,378) at the end of the year, but it gives you more flexibility when it comes to how much you make each week. Instead of going from $1 to $52 each week of the year, you choose an amount each week. For example, if in the first week you managed to make $35, you would cross the $35 box at the bottom of the sheet, and put $35 on the first week line with the money you earned. No matter how much you earn each week between $1 and $52, cross that amount and add it to your growing income.

Because of the flexibility in another way, it gives many people a better chance of completing the challenge. It’s hard to know how much you’ll be able to make each week, and the alternative takes that into account. The goal should always be to try to gain as much as possible each week, but if life throws you some challenges in the coming months, and you can only gain a little for a few weeks, you can skip it. small amounts without fail in the challenge.

There are three basic ways you can approach this challenge, depending on what you feel gives you the best chance of achieving the goal, and what you are most comfortable doing.

1. One Money

One way to earn money is where you decide on one way to make money for the whole year, and do that every week as part of the challenge. For example, maybe you have a lot of extra stuff lying around the house, and you decide to start selling it as a way to make money. Each week you sell one or more items and whatever profit you make, you challenge. You end up focusing on this one way to make money throughout the year to try to achieve the goal.

This option is the best for most people just because of the beauty of the focus. If you focus on one thing and get better at it for a year, at the end of the year, you will get better at making money from it.

2. Diverse Earners

In this version, you try to do many different small things that when put together, help you reach the goal of the challenge. For example, maybe in addition to selling some of the things you have around the house for profit, you start doing online surveys, babysit on weekend evenings and start knitting baby hats to sell at a fair. Instead of focusing on one way to make money, you explore different ways as part of the challenge. I’ve listed a few ideas at the bottom of this post to get you started if you like this idea.

3. Combination

Another option is a combination of the above two. In this case, you can choose something as the main way you plan to make extra money, and add other opportunities. For example, maybe selling unwanted household items will be your main focus, but you’ll do a survey now and then as an additional resource to add to the challenge.

Whichever way you decide to tackle this challenge, it’s a great way to build an emergency fund that doesn’t involve looking for ways to cut costs. It’s also a great way to keep your entrepreneurial spirit going, and a great way to start creating multiple income streams so you don’t have to rely on one source of income.

So, How Do I Get Challenge Money?

Finally, you may ask, “Okay, how do I make money?” Here are some ideas if you want to get started with single or multiple finder options:

-

- Taking Surveys:Best app in this space: 1Q. 1Q pays you 25 cents per QUESTION, which is the highest price in the “pay to take surveys” space. It won’t fill your day job, but you can pick up the $1 or $2 you need a week for the challenge. You can find it here.

- Selling Your Electronic Data: Due to changes in the laws, your data is now recognized under the law as your location. This means you get paid for sharing your demographic information, web browsing history, transaction data, etc. If you want to do this, consider going with Nielson Opinion Rewards, Savvy Connect, and App Earn. All three of these companies actually pay you for your information. All are very easy to install and pay reliably.

- Investing for Passive Income: Buying stocks, bonds and investing in real estate investment trusts is a great way to make money. These funds usually pay you monthly or quarterly. While you’re at it, consider getting accounts through Robinhood. Robinhood will give you up to $200 in free stock for signing up. You can sell stock or invest in a way that will bring you some money. Registration is easy and takes 15 minutes. You can do it here.

- Find a Part-time Job that Pays Well: Three good part-time jobs that pay well are: mail carrier, personal driving (Uber & Lyft), and real estate agent. Agents usually have to work a lot, but when they do get paid, the hourly rate is usually over $50 an hour – which is great.

For another list of ways to make extra money, consider these:

Check out the SavingAdvice Forum for ways to make money.

PTMoney.com also has a solid list of 52 ways to make extra money.

Financebuzz also has a list with some extra money ideas that can help fuel your challenge.

(Photo courtesy of Nick Ares)

Source link