UK investors are very worried about Nvidia stock! Here is the reason

Image source: Getty Images

Nvidia (NASDAQ: NVDA) stock regularly appears among the top buys and sells on major UK investment forums. It’s been two years.

In the past week, it was the third most bought stock AJ Bell and the second continues Hargreaves Lansdowne. Only MicroStrategy see more action, in terms of buying and selling.

However, it seems that more UK investors are buying than selling. Why are they so worried about Nvidia shares? Let’s talk.

The momentum

One simple reason why some will jump on board is because of the bullishness of the stock price. It increased by 173% by 2024, and 2,397% in five years. That kind of performance is sure to catch eyes and turn heads.

Undoubtedly, some will be motivated by FOMO (fear of missing out). But as Warren Buffett says: “The dumbest reason in the world to buy a stock is because it’s going up.”

Income growth

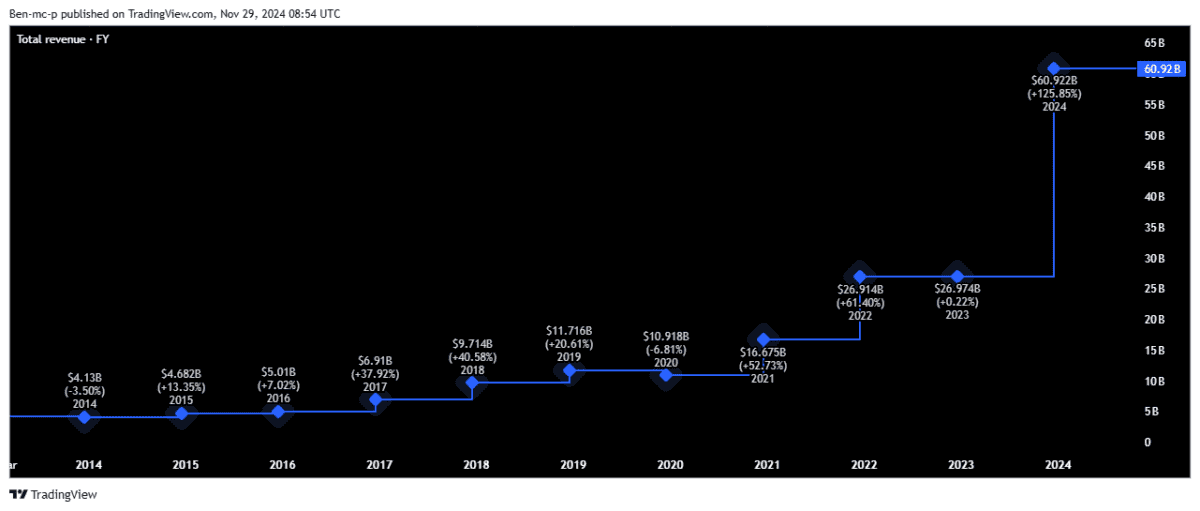

However, most experienced investors will already consider Nvidia’s fundamentals as a company. The most striking thing to note about the chip maker is how quickly the top line has grown.

After the release of ChatGPT in late 2022, revenue has exploded. Indeed, Nvidia reported more in the last quarter ($35.1bn) than it did in all quarters combined between 2017 and 2019!

Technology companies of all sizes are greedily developing Nvidia graphics processing units (GPUs) because they are the best choice for training and running AI programs.

Over time, income growth is the main driver of stock prices. Nvidia forecasts to top $200bn by 2026!

Margin expansion

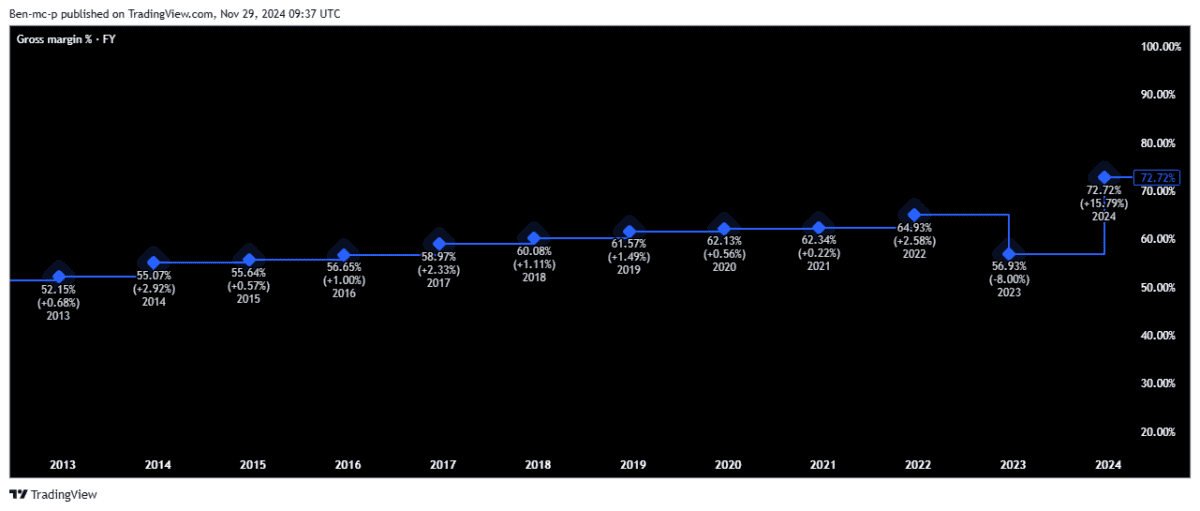

Another reason why investors are moving forward in stocks is down to increasing profit margins.

The company enjoys very strong pricing power due to the incredible demand for its GPUs. And economies of scale reduced production costs as sales prices increased.

Gross margin is now over 70%, up from 60% in 2018.

A powerful narrative

The most important thing for Nvidia is the overall growth story around AI. It’s definitely the most exciting technology development since the Internet.

To be fair, founder and CEO Jensen Huang is doing a world-class job of fueling interest in AI. His visionary language when discussing its scale can make investors salivate.

In Q3, he wrote: “The age of AI is in full swing, driving global change in Nvidia computing… AI is transforming every industry, company and country..”

This is one danger I see though. If the narrative suddenly changes, due to a decrease in the cost of AI equipment or an increase in guidance, then investor sentiment may turn sour quickly.

Also, for large-scale AI adoption, costs will have to come down significantly, especially when it comes to training programs. Nvidia’s margins are likely to come under pressure in the coming years.

Because of this uncertainty, I sold my Nvidia shares earlier this year. I would consider reinvesting only if the stock is oversold.

Silly takeaway

In conclusion, Nvidia ticks almost all the boxes as to why the stock is rising so dramatically.

We have strong revenue growth, margin expansion, high valuations, and a compelling story focused on unprecedented technological change.

Given all this, it’s no wonder that many UK investors are very confused about Nvidia shares!

Source link