Trends in the construction industry (November 2024)

Our monthly construction industry trend report includes the latest industry data and our insider findings from the award-winning National Business Capital team. With extensive experience in the construction industry since 2007, we are happy to share these findings and expand upon them with our unique expertise.

Our mission is to provide business leaders and decision makers with the necessary information and data to make well-informed decisions in their business operations. This month, we will focus on 2025 and discuss the impact of proposed regulations on the construction industry.

Preparing for the Impact of Raised Costs on Raw Materials

Last month, President-elect Donald Trump won the presidential election, paving the way for his second term in office. While his victory instilled confidence in the market, many companies are bracing for the impact of his proposed tax plan on their bottom line.

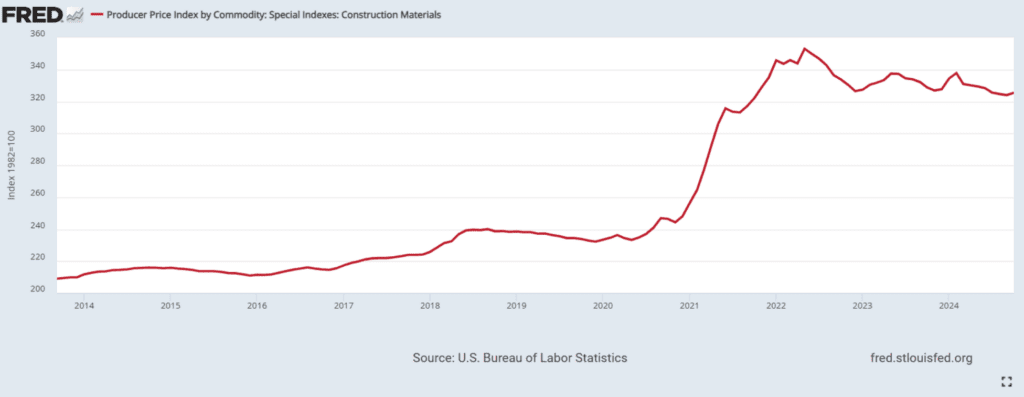

Lumbar Prices (2014 – 2024)

Source: Fred St. Louis

November 2024 – For home builders, the proposed tariffs will further increase the already high price of softwood lumber. Aside from utilities, this plan will also increase the cost of other home-related items, such as air conditioners, garage doors, garbage disposals, etc. Construction companies in sectors outside of home construction may have to deal with these higher costs, as well as greater capacity. high costs for steel and aluminum.

The graph above shows the producer price index (PPI) for all construction materials from 2014 to 2024. As you can see, the last two years have been followed by a slight decrease in material prices – a welcome change for construction companies. However, our new president’s proposed tax plan could reverse this trend by increasing import costs.

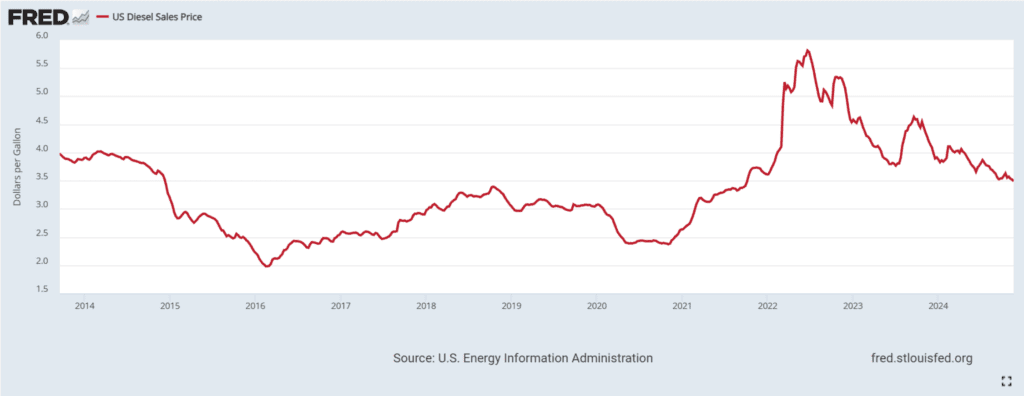

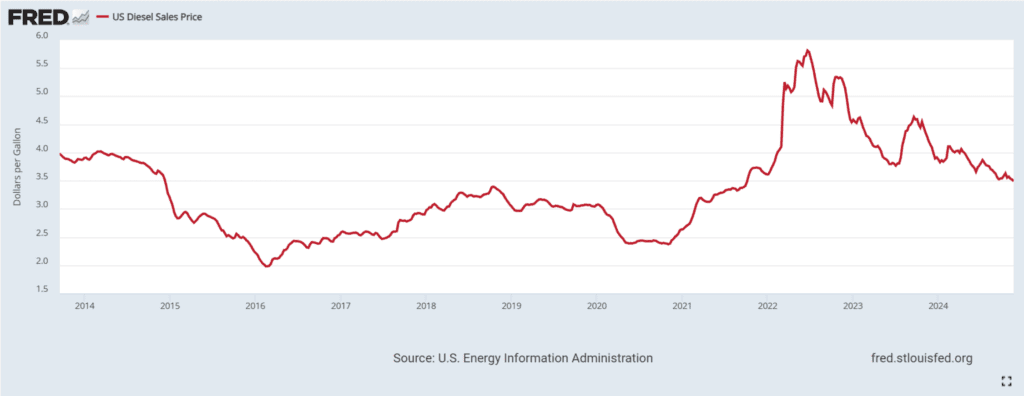

Diesel Prices (2014 – 2024)

Source: Fred St.Louis

November 2024 – Another important price is fuel monitoring. According to Statista, the US imported $164.9 billion in gasoline YTD in 2024. At a guess, under a 20% tax, that amount of oil would be worth $197.8 billion.

Since diesel fuel is such an important part of the industry’s operations, this trend is important to monitor. High overhead – and rapid changes in overhead – can limit profits, especially for large operations. Construction companies in the pricing phase of their projects should consider how a potential increase in fuel costs will impact their bottom line. For those with ongoing operations, speaking with your accounting team will be a necessity.

How Are Companies Responding?

Foreseeing the coming change, many construction companies have quickly purchased the materials they will need in 2025. Many companies that have done so with the National Business Capital have material needs in the new year, and their efforts are to keep costs low as they do. find new supplier relationships.

However, this strategy has its limitations. Material suppliers who receive a high volume of orders may raise their prices, which may destroy the savings of busy ordering. Bulk orders can help secure higher prices on a wholesaler-to-seller basis.

Another challenge with continuous ordering materials surrounds the ability to access funds quickly. Companies with high debts that cannot support a large material order may ask to go ahead with their creditors. However, as more companies follow suit, the lender’s ability to offer an overadvance becomes more difficult.

Francois Bouville, Director of National Business Capital of Institutional Partnerships, wrote an article on this topic, explaining how debt under National Business Capital is an important resource for these companies. Read the full article on LinkedIn here.

One thing we need to be aware of is that there is uncertainty about the speed of how our government will use these costs and which countries the important prices will affect. For example, a HousingWire article discusses how Trump has vowed to impose 20% tariffs against Mexico unless there is progress on the border challenge. It is not clear whether this will be true, and we are not sure whether the implementation of these new charges will increase over time or become fully effective immediately. However, it is important for construction companies to be careful anyway.

Companies starting new operations will have the opportunity to adjust pricing models to match their cost of goods. However, those in the middle of the projects may need to take different steps, either by accessing funds to cover their material costs or talking to decision makers to adjust the contract price. This is especially true for construction companies that specialize in government projects.

Other Trends and Key Issues

- Construction Worker Non-Fatal Injury Rate Drops to Lowest in 10 Years – A Construction Dive article explains that the rate of non-fatal injuries has steadily declined since 2011 to its lowest point in a decade in both the private and public industries. This is good news, not only in terms of helping people but also considering the high cost of insurance for employers.

- Residential Construction Cost Contracts 7.3% YTD – Home construction costs fell by $17.7B, a 7.3% YoY dip, as reported by ConstructConnect. Much of the reduced spending results from a sharp decline in multifamily housing, which is down 24% YTD.

- Interest Rate Cuts Positively Affect Construction Project Abandonments and Delays – The recent 25 basis point interest rate cut by the Federal Reserve undoubtedly boosted confidence in the industry, but it had a noticeable impact on the private sector, in particular. Abandoned projects decreased by 56%, while private project abandonment decreased by 21.7%, according to an article published in Construction Dive.

- Electrical Infrastructure Bottleneck May Slow Data Center Growth – As more data centers reach the final stages of construction, connecting these centers to the power grid becomes an even greater challenge. According to a ForeignPolicy.com article, the power draw in these data centers is exceedingly high, and many infrastructure developers refuse to connect them to the grid because of the risk of blackouts. This sentiment may delay the construction of new data centers in favor of energy infrastructure projects in the near to mid-term.

- Manufacturing, Office Construction, and Residential and Commercial Development Drive Private Industry Spending – A Construction Today article discusses the major drivers of private and public construction costs. In the public sector, the construction of highways and roads, public safety, waste disposal, and water supply drive large expenditures.

National Business Capital’s Construction Recap (November 2024)

Each month, we will provide our unique perspective on the short to mid-term construction industry outlook. Our insights come from a combination of available industry statistics, internal data, and the common sense of the construction clients we work with every day.

- 83% Increase in the Volume of Production Funds – A variety of programs in the manufacturing sector have created a need for capital. Their demand can be seen in the details of the National Business Capital Funding, where the production volume has increased by 83% since October. Many are using our money to get material orders ahead of the upcoming tax changes, while others are investing in equipment to work more efficiently. It’s encouraging to see the industry taking action, and we’re excited to see what the future holds.

- Increase in Roofing Contractors (40%) After Bad Weather in the South – Roofing contractors have faced a lot of work since Hurricanes Helene and Milton changed the lives of many on the East Coast. Their help in recovery efforts has created a need for working capital, and our team has worked closely with them to provide it. Overall, we have seen a 40% increase in roofing contractor clients and expect more in the near future.