Why the FTSE 100 may outperform the S&P 500 as the Santa Rally begins!

Image source: Getty Images

Past performance is no guarantee of future returns. But new research from eToro suggests now might be a good time to load up FTSE 100 shares.

The Footsie is up 1% so far in December in what some say could be the start of a Santa Rally. Markets are rising on hopes of imminent interest rate cuts by the Federal Reserve, and tax cuts under returning President Trump.

History shows that December gatherings are not rare. According to eToro, “stock market investors enjoyed nearly a quarter of their annual gains in December“. And UK investors in particular benefited greatly from the year-end surge in capital markets.

FTSE is doing very well

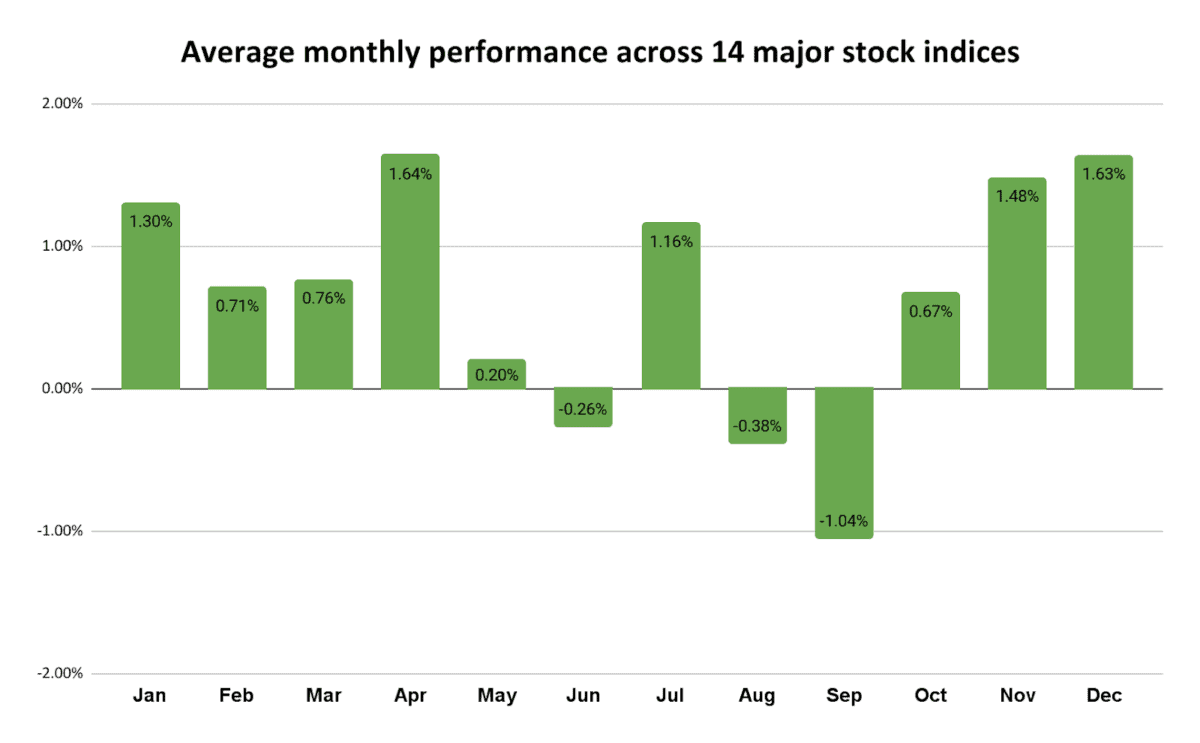

Broker at Toro looks at the performance of 14 major global indices over the past 50 years. It showed that “December returned an average of 1.63%, comfortably surpassing the average monthly return of 0.57% from January to November“.

Encouragingly for UK investors, the FTSE 100 has left almost every other major index in its wake over the past holiday season.

It has returned an average December of 2.29% since its inception in 1984, outperforming other months of the year at 1.93%. On average, 36% of Footsie’s annual profits are made in the last month of the year.

The average return for December is better than 1.28%. S&P 500 has given in recent decades. Hong Kong only Hang Seng The index provided the best average return for the last month among all major global indices, at 3.09%.

The top stock I’m considering

As I said above, past performance is not a reliable indicator of the future. And right now, fears about US trade tariffs, China’s struggling economy, and war in Europe and the Middle East are all threats to this year’s Santa Rally.

However, despite the great risks of the economy and the country, I feel that stock investments should be seriously considered, whether that be in December or any other month of the year.

This reflects the higher long-term returns that investors enjoy compared to holding money in cash. Someone who bought an FTSE 100 tracker fund in 2019, for example, would have enjoyed a solid annual return of 6.2%.

Buying some undervalued stocks this December can provide the best returns. Phoenix Group (LSE:PHNX) is one cheap stock I am considering for my portfolio.

By 2025, annual revenue is expected to increase by 22%. This leaves it trading at a forward price-to-earnings (P/E) ratio of 9.4 times.

In addition, the FTSE company also has a price-to-earnings growth (PEG) ratio of 0.4. Any sub-one reading indicates that the stock is undervalued.

Finally, the dividend yield on Phoenix shares is a market of 10.8%.

Despite the threat of high competition, profits here can rise as falling interest rates increase consumer demand. Phoenix’s value should also rise as demographic changes drive annuity sales, both now and in the long term.

This is a stock I am considering buying for my own portfolio. I think it could see some serious dividend growth in December and beyond.

Source link