Can Rolls-Royce shares continue to perform well in 2025?

Image source: Getty Images

At the beginning of the year, I wrote what I was thinking Rolls-Royce (LSE:RR) shares are not undervalued until 2024. That’s despite the stock nearly tripling by 2023.

Since then, it has risen another 90%. And while I’m still optimistic about the stock going forward, I’m more cautious heading into 2025.

Income growth

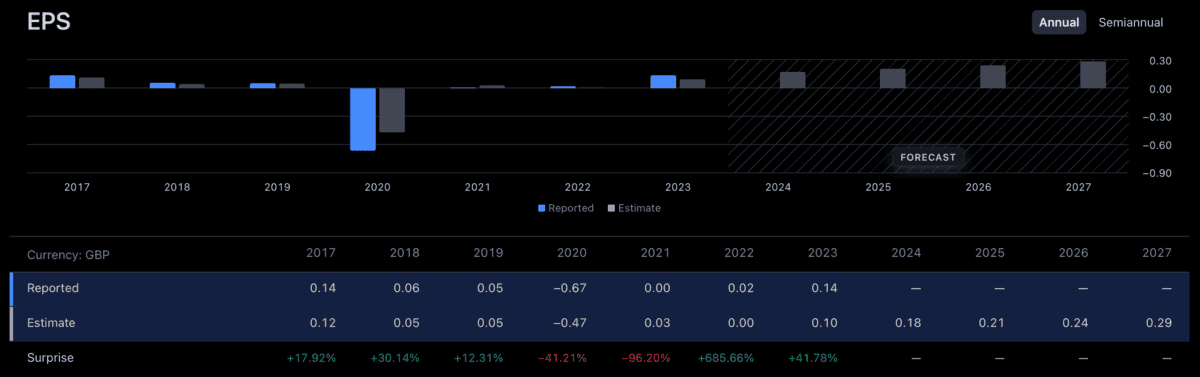

Rolls-Royce remains firmly on the path of growth. Earnings per share are expected to rise from 14p in 2023 to 18p this year – and that’s not just for the Covid-19 recovery.

There are also many reasons to be optimistic about the future. The expansion of thin-body aircraft, the transition to sustainable aviation fuels, and the increase in nuclear power are potential opportunities.

Analysts forecast earnings per share to reach 21p in 2025 and 29p in 2027. I think this may seem accurate.

Rolls-Royce EPS Forecasts

Despite this, some of the reasons I had for optimism in Rolls-Royce shares at the start of 2024 are gone. So it is worth reconsidering the stock from an investment perspective.

Measurement

The main reason is balance. One of the reasons I put forward at the beginning of the year was that Rolls-Royce shares were trading at a discount to their counterparts elsewhere in Europe.

I FTSE 100 the stock was trading at a price-to-earnings (P/E) ratio of 15. But that was lower than the company’s European counterparts, which were trading at P/E multiples of more than 20.

In fact, that’s where the biggest increase in Rolls-Royce’s share price comes from. The stock is up 90% but earnings per share are set to rise 28%.

Because of this, the measurement gap that I saw at the beginning of the year has been closed. So while it’s possible that the P/E multiple could increase further in 2025, I don’t expect it.

Growing up

Another reason I’m bullish on Rolls-Royce shares in 2025 is growth. Over the next few years, earnings per share are expected to grow from 18% to 16% to 14%.

To some extent, this should not come as a surprise to investors as the company is recovering from an unusually difficult period. But I don’t expect 16% earnings growth for the stock to rise 90%.

There are also temporary problems. Problems with both Boeing again Airbus resulted in flights being grounded – and the effect of reduced flying hours at Rolls-Royce is well known.

That makes me wary of the expected 16% wage growth by 2025. I’m not denying that, but the company wouldn’t be the only aerospace engineer to find the environment a challenge.

More performance?

I think there are strong reasons not to expect Rolls-Royce’s share price to repeat its performance over the past few years. But I think it can still outperform FTSE 100.

The rating gap with its European peers has closed, but there is no exaggeration. And while 16% earnings growth isn’t great, it’s still very strong.

Rolls-Royce shares may not be the bargain they used to be. But I think investors can see the stock doing well in 2025 and beyond. I believe the stock is worth considering.

Source link