10 reasons is not a million

It seems that it feels that the only reason for people cannot be a billing workers hard enough. The fact is that hard work is the best you can do by being a billion. That doesn’t mean you don’t have to work hard. He does. But you also need to avoid many fikes and financial decisions that end up with real cause many people cannot build wealth. The fact is that you do not have to have a big income for more than one million dollars, but you have to make good financial decisions (and prevent wrongdoing).

It is important to note that one problem may not be the last of the millions, but a combination of the many actions and decisions you have done. Also, yes, something is different from the rules, but are people who defeat the lottery – and do you really bet your retirement in winning the lottery? Here are 10 reasons that may be the resulting cause why you are currently not currently:

Trying to achieve the expectations of others

Nothing will keep you achieve your financial goals faster than to make your own expectations for other people instead of. This is often known as trying to ‘keep up with Joneses.’ The simple fact that if you try to live as a million before you have genuine resources, you may be billion. Instead, he will only build a lot of debt and spend money on impressive impressions anyway. Trying to comply with Joneses where your income can compete with Joneses is a sure way to clean up the opportunity to create wealth.

You have children

This maybe it will not be a very popular thing in the list why you are not a million, but the fact is that children are expensive. The costs associated with children can be reduced to some extent when you have already built a certain treasure and plan to have your children, but often not in many couples.

In fact, according to the Census Bureau in 2000, homeless homes for children under 18 have the size of $ 534,400. Contrary to these cities with one of the children or many under 18 had the right quality of $ 381,400.

Having children when you are young with limited currencies will have a lot of effect on your productivity building. This is because children often raise houses, food costs and educational expenses. With unique interests are very important for wealthier creation, and its stone that soon starts to save and invest, better. When this happened, all additional funds were gone without reliance on child care instead of investment in the construction of wealth.

You spend more than you do and you can’t invest in

There are no secrets, and there is certain of the magic, when it comes to the basics of one’s finances. To keep your money in order, You need to spend less than your income you receive. If you fail to do this simple item, no matter how much you make, you will always find that you don’t have enough money to make conclusions.

It also comes in addition to this. Spending less time that you find is not enough itself to build wealth. You have to keep and keep it actively and invest in all the money you do. In fact, the amount that does not record matters above your Refunds. This is important for two reasons:

First, you can control the amount you are planting, but you can’t control the amount of returns you receive.

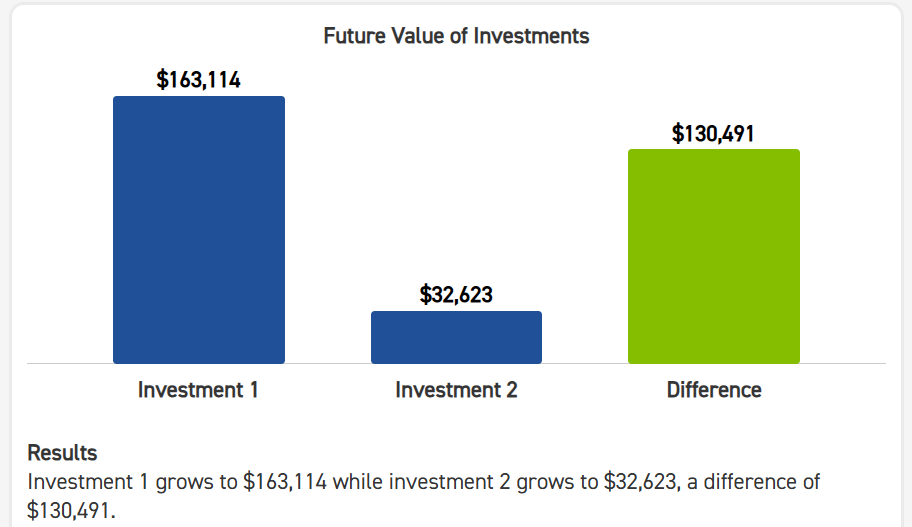

Second, all things are more common with the amount you can grow, how much will your investment amount. For example, in comparing two investment conditions. One investor invests $ 10,000, and the other invests $ 2000. They both receive 7% return to their 40 years. The difference in their investment by the end of 40 years is very remarkable.

A good rule of the thumb is: Try to plant at least 20% of all the payschecks you have found and put it in long-conservation and investment.

You don’t pay first

One of the most important steps you can take to make sure you are willing to pay yourself before paying someone else. If your goal is to save 20% of your income, you need to pay 20% from your paycheck before paying some charges or charges you can have. If you try to pay after your other costs, you will fail to cross the end of the month period (if not always), and then you fail to save as hope as you had hope as you had hope as you had hope as you had hope. By paying first, he makes the commitment that wealth is an integral part of your whole plan, not something of hope to be.

Your house is very large

Some people think that buying a big house is a good investment. While this can be, buying more house than you can do a good way to make sure you cannot create real treasures. The problem is that when you buy a lot, your cost of the house are big again. The Greatwhub will refer to major tax payments, expensive monitoring, many items purchased to fill the house, high insurance payments and all costs. The real way to create wealth is to buy your needs and budget, and take all the money you receive by unproductive house to invest and create wealth.

You put things in the longest

Just because there is a new and glossy version of the gadget you purchased every year or two ago does not mean that you need to buy that new gadget. If you are the type of person who resides that you have placed the products that have access to life to buy new and very small and smaller gadgets.

Often the richest things to buy healthy has a long life. This reduces the cost of these items later. Instead, people who struggle to be millionaares may have improved electronic buyer. Below is an example of the iPhone 15, which is usually improved.

Always adhering to the lack of

The unification comes in many ways – including lack of financial, time indulgence, food shortages or food.

In all cases uniformity uses your limited naked bandwidth, leaving you a little energy to deal with anything else. The shortage also creates a sense of urgency and often forces you focus on immediate problems. This means for long planning takes a backback to deal with immediate needs. Infusion and increases oppression, causes you to have a little tolerate and lower your children’s time and family. Concerning

Scarcity, especially endless shortage, reduces your ability to build wealth. This is because of long-term planning, relationship structure and reduced pressure is required to make good investment decisions, and to resolve effective income challenges.

To find out more from this look at the best Richhababs.net readers – has good financial tensions of financial stress.

Failed to take care of your health

Nothing will get your treasure faster than sick. While you may be able to control all features of your life, there are some steps you can take to make sure you are as healthy as possible. Right food, physical exercise, taking preventive methods, finding annual intervention and medical problems before they are really bad to lure them in a healthy life. If you take care of her health better, a better chance of being able to create wealth, and keep the wealth just like you.

You get a divorce

As soon as marriage can be a good way to help build wealth, get a divorce, often the opposite. In fact, getting a divorce is one of the best ways to destroy the wealth that has built for that time. That does not mean that you should live in a marriage for financial reasons, but it is important to know that divorce is usually an important role of wealth, and the divorce will disrupt the most well-established strategies for a million.

Do you have one or more evil habits

The bad practice is whatever takes money away from you without giving more to return. Classics smoke, gambling and drinking alcohol, but a bad habit can be easily that a cup of costly coffee or troops who drink daily and drinking daily. It doesn’t even have to buy things. Being lazing and sitting in front of TV for five hours a day rather than work to improve and a bad habit that harms creating wealth. According to the number of bad habits you have, and how much they call it continuously, these individuals are limited to a billion.

Bonus reasons:

You are not teachers

The courses of rich people often show that the relevant eligible people use a fixed amount of time to learn work skills. According to the author Tom Corley, the wealthy spend at least 30 minutes a day involved in work-related learning. This allows them to improve their skills, and they made a further success in transforming time to money, improve market returns, or to run their businesses (here).

You don’t exercise

The rich work travels for hours. On average they work more than 50 hours a week. To save this goal, the wealthy tend to exercise at least 30 minutes a day with aerobically. This can include running, jumping wires, walking or biking. Exercise allows your brain neurons to grow and produce sugar. Glucose gasoline of the brain, which is where you grow well. Also, as a result when people use more, they often do much (about Harvard University).

Wrap this – even if you aren’t rich now, you can still do

Serve is not easy – but it works. Or not wealth now, if you take good habits, keep and invest in money, live in the huge storey), you should be able to be rich. You have not been warned, if the rich takes work for years but it is lovable and a great reward. .

For funny funny advice learned, consider:

Conversations with burglary, or where you can hide your home

Here are the signs of a rich person

Ten changes you can do to lose weight and save money

(Photo with Enktuvshin Service)

Source link