Is social security is the fiction of Genuz? Experts that say

Let’s be with Frank – where most Zers (1997-2012) hears social security, not very confident. With a lot of Headlines warning about the “broken” program and a trust bag “expires,” it is easy to think that during retirement, such as the Internet dialing or BlockBuster.

But is that so? Does social security still exist when reaching for years, or all of us pours out money from a system that will not be with us? Financial experts, economic experts, and policy interviewers have always dealt with this question, and their answers may surprise you.

Current Social Security: Factors More Facts

Yes, the program has financial challenges, but here is what is happening actually:

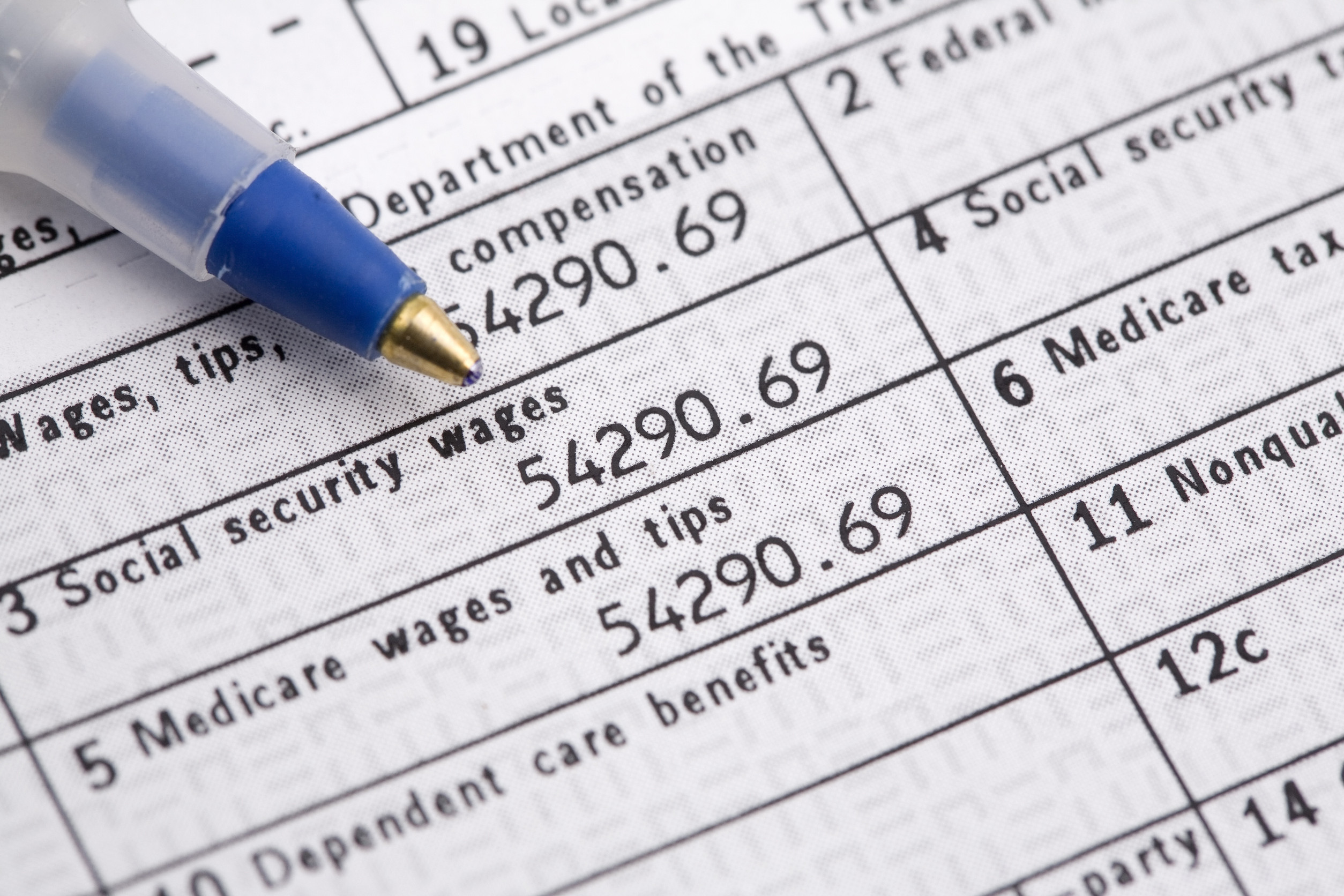

- Public protection is currently supporting about 66 million Americans for tax funded benefits for modern employees.

- According to the latest Trusters report, adult insurance and survivors (Oasi) Stretact Fund-paying retirement benefits – considered to be spilled in 2033.

- Whether the Trust Fund is valid, social security will still be able to pay approximately 77% of the fixed benefits for income tax revenue.

This is important variation. The system does not go can be bound – they simply need a change. In the past, social security increases the decline in the economy, high shifts, and political wars. Congress has been in front, it is not yet very noticed in 1983 when the changes prevents the great difficulty of funding.

Therefore, when people say “public safety go,” they understand how the program actually works. It is designed to continue paying permanent benefits, although at reduced standards if no changes are performed.

Why Z is always a majestic

If you feel hoping about the future of social security, you’re away from one. The 2023 survey from the The tranameder’s center of retirement studies It was found that about 72% of the General Safety people believe that social security will not be there when they retire – more doubts than the millions of years.

Honestly, it is not hard to see why.

Genu Z has chased financial problems that occur, see the topics of the balloon debt, and to testify the bad griding evil in government programs. Many of us graduate up increasing costs, student debt, and market for continuous housing unavailable, which makes believing the traditional financial security nets will return.

As a result, many of these mentally, zers are writing about retirement in retirement. Financial advisers report that small clients often cure community safety as an unexpected bonus rather than a certified salary source – a “beautiful-in-animal” source instead of.

But here is this item: History suggests that extreme doubts can be frustrated.

While past generations are also worried about social security, Congress has acted historically to prevent decreasing. In 1983, when social safety was within the expiry of months, lawlessness passed a bipartisan package that maintains Lolvent program.

Can History Once Repeat? Experts say yes – if the politics will happen.

Math After the future of System

Currently, public safety works on the PAY-As-GO program, which means modern-time employees are retiring today. This was effective in the past when 16 employees were at retirement in the 1950s. Today, that rate dropped 2.7 workers with retee-and is expected to decline.

Social Security Implementation usually takes limited limited growth and migration standards, however increasing it may enhance the cash flow. Under the Requirement of low cost (which take the highest anger, fertility, and product growth), the system can remain lasting longer than between medium.

In comparison with other international pension programs, many developed countries have successfully submitted similar persons by new policy items.

What can change to maintain the program

Remotionals policy experts identify many potential social changes that can increase social security for the retirement of Gen Z. The proposed solutions include:

- Gradually increasing full-retirement age from 67 years of age

- Preparing Cap Cap leading high-income earners (currently set to $ 168,600 in 2024)

- Implement a humble taxation tax deduction for decades ago, or to convert the formula of retired retirement formula in the future.

Each method cares for different effects of excitement and political challenges. For example, raising years of retirement is well reduced the benefits of life and negative effects of low-income employees.

Voting from galllup shows that the American people choose the modest tax rising over the reduction of benefits, but to get the Congress to synchronize the correct interaction of good changes (especially today’s climate of separating the country).

How did Gen z answer

Financial counselors recommend that Gen Z accepted a balanced planning method that agrees to uncertainty without providing future benefits. Building financial strategies think that they reduce public safety benefits – perhaps 70-80% are currently organized – provides a central location between dismissal and overfishing in government programs.

Many financial experts now raise young adults to investigate 15-25% of their retirement income – higher than traditional lesser lifempans and repaired benefits. Of course, it is a tremendous and real statement, but the ability to invest early is the invisible financial plan. Don’t shoot the messenger, but you may have to give a few taco taco nights.

Across myth: to take an informed action

The future of social security for a generation may exist in a particular place between guaranteed and complete revelation, requiring a powerful understanding and good planning. While the system is facing real challenges, the basic system is always working on the right preparation. Young adults should understand retirement attacks with informed monitoring – they ignore the safety of social or beneficial safety will remain unchanged. No matter what, building financial stability and retirement nesting is logical resolutions regardless of what is happening in Washington.

Learn more

Avoid these negative mistakes worth 5 for 5-year security rule

Full-up age of retirement increases

Source link