Is the smallest installment of a business loan or change?

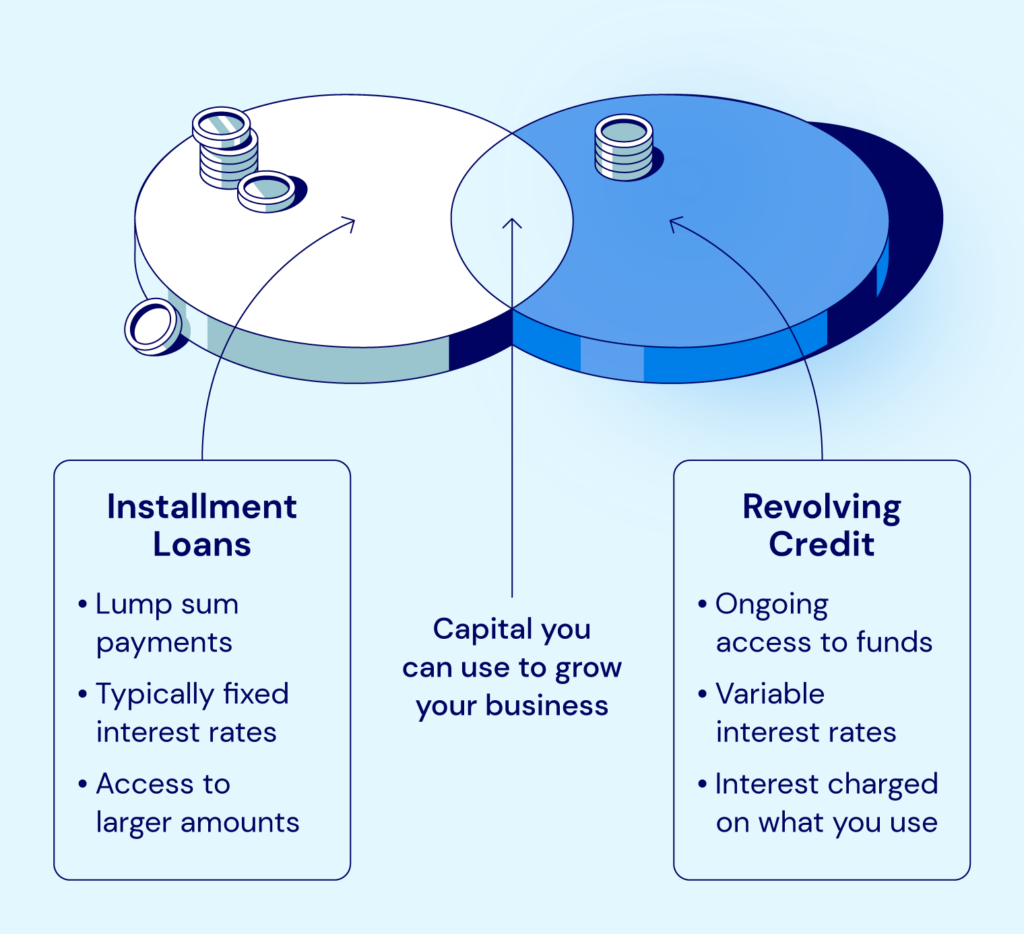

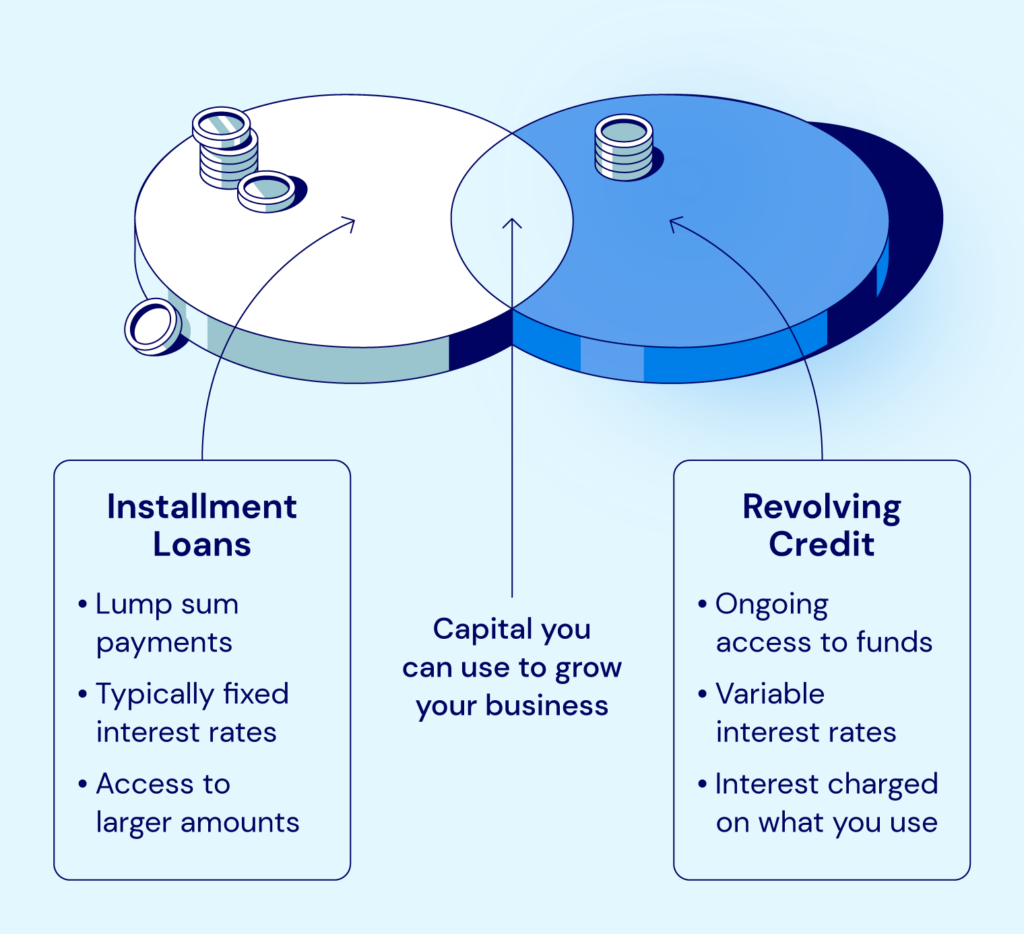

Small business loans are designed to help you get the money you need to start or to use your business. With financial options, such as Care-lined incomeYou will receive cash access at cost-efficient numbers. As you check your options, you probably experience two types of loan: Installing loan and a rotating debt. Therefore, it is a small business loan for installation or rebellious debt? The answer depends on your loan meetings.

Let’s look at the difference between the installation loan and a changing credit and that you should use each type of credit to sponsor your business.

Content

What is the install loan?

Most people view taking small business loans as an installing loan. If you are allowed and accepted this Loan versionThe borrower sends the lump sum to the front payment. You then pay the impending of the installation, as well as any interest taken from the loan, until you pay the full loan.

Benefits and Benefits of Minimum Business Loan

The installation loan provides a few different benefits but not the proper solution to all businesses or all situations. Here are some of the benefits and worses to use these loans.

| Benefits of Input Loan | Invaluation of the installation loan |

|

|

What is a variable debt?

Revolt A Line of Credit Business Loan version you can earn from more than one. Instead of receiving the payment of the payment of the payment, your lender will allow you to borrow a maximum amount known as credit limit. You can borrow a lot of money until the limit, and as long as you pay it, you can continue to lend forever.

This allows you to buy machines, and increase your inventory, and cover the other costs when you need to apply for a loan.

Remember that Requirements for the credit rebels It can vary from Lender on Lender. It is a good idea to compare offers from many lenders to get what is right about your needs.

Benefits and Botter Credit Benefits

Here are a few benefits and difficulties of Business rebel rows that you should know.

| Fluctuation | To change credit |

|

|

Loan money entries vs. Renovating Credit: The Great Difference

Since both loans and renewal of service lines for access to various currencies, select the appropriate tool for your needs can make all the difference. In order to do that, you need to understand the important difference between the loans of the installation and the changing debt.

| Input loan | Rebellion | |

| Interest | Fixed or variable, depending on loan | A variable measure based on current market value |

| How to distribute money | Existing Payment | Money available as required |

| Loan Restrictions | The amount of one fixed time has been received before | Higher business owners can use again and again |

| Renewal | May or may be reversed, depending on lender | Usually updated as long as the lender is now on pay |

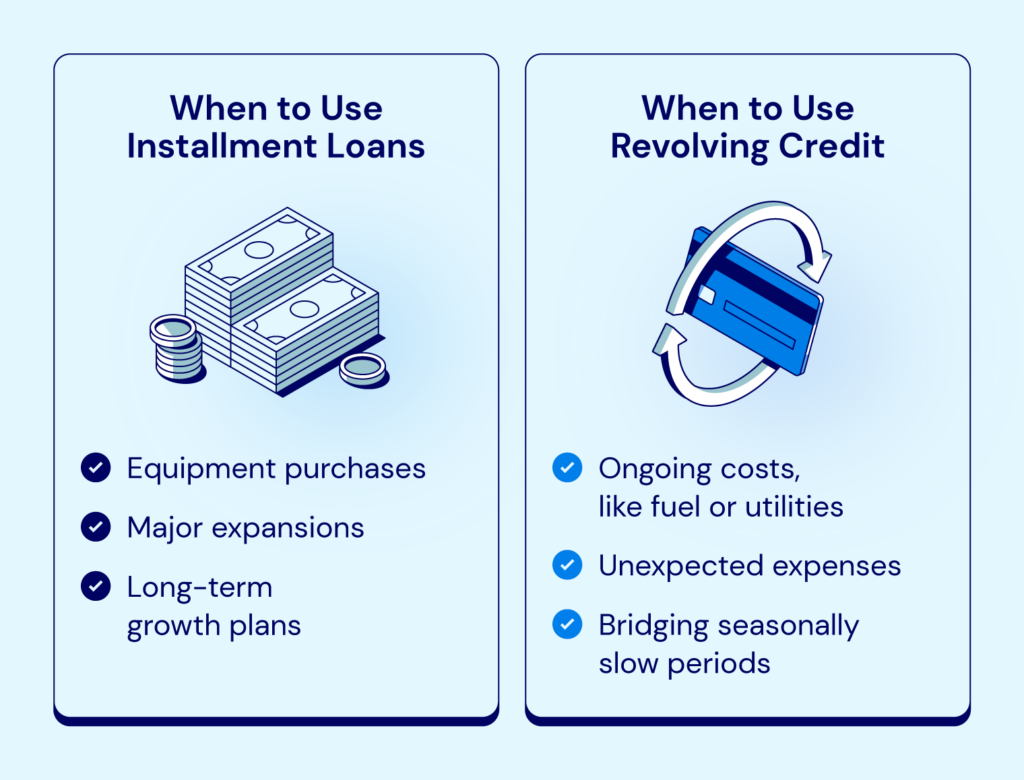

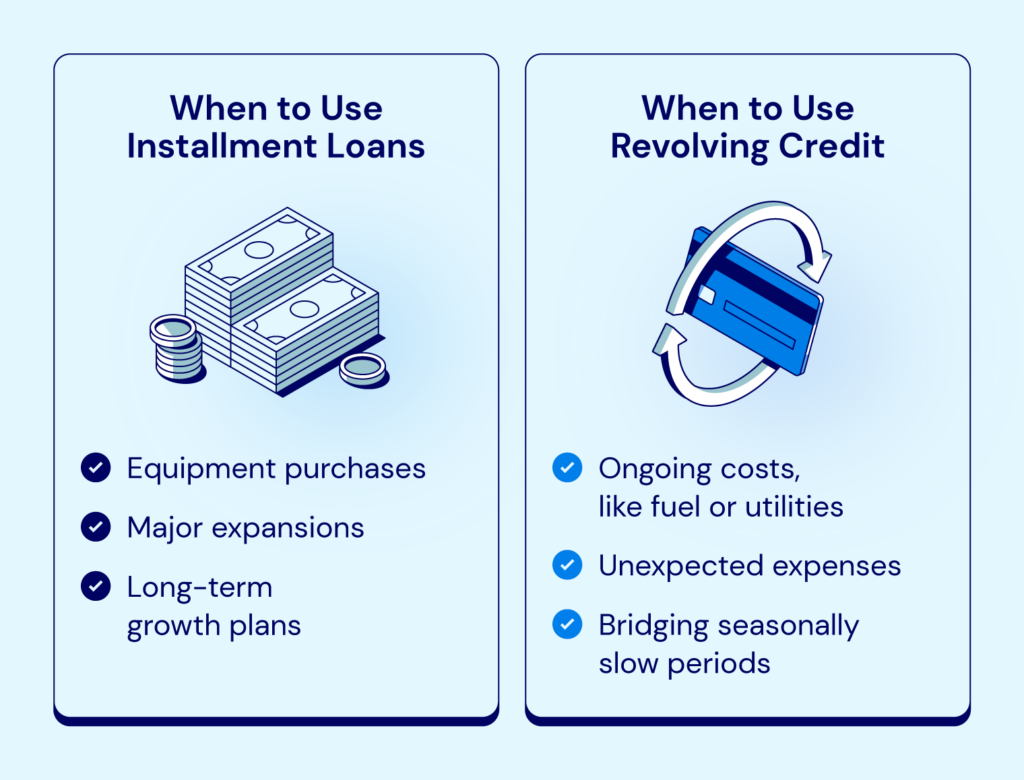

To use the loans or credit that is willing

Although both installation loans and rebels lines can help you grow your business, they can have different charges of using. Lending money entries is ok when you need a prime amount of money. This can include:

- Buying equipment

- The purchase of a large purchases that may not immediately refuse ROI

- To reopen your existing office

These loans provide you with monthly custom payments and allow you to break the cost of borrowing over a long time, which can set small difficulties on your budget.

Credit deperations can be a good choice of business owners who need flexibility. You Can Seek Use a Credit Business Line In:

- To cover costs during slow year.

- Achieve the capital on a folding basis rather than earn money before.

- Create an Emergency bag fencing unpredictable profits.

Remember that many business owners choose to use a combination of installation loan and a rotating debt. Before you can decide, think about the amount you need, what extent you will have to access the money, and how much you can pay.

Compare and get help with your small business options

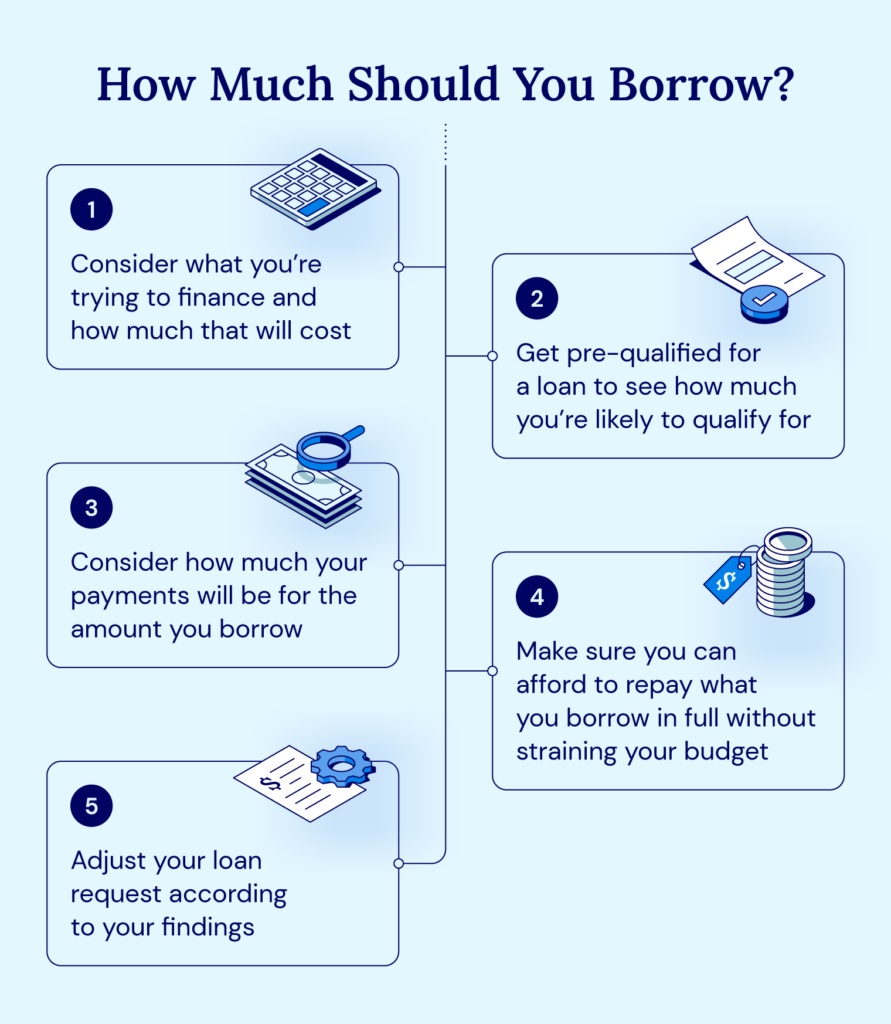

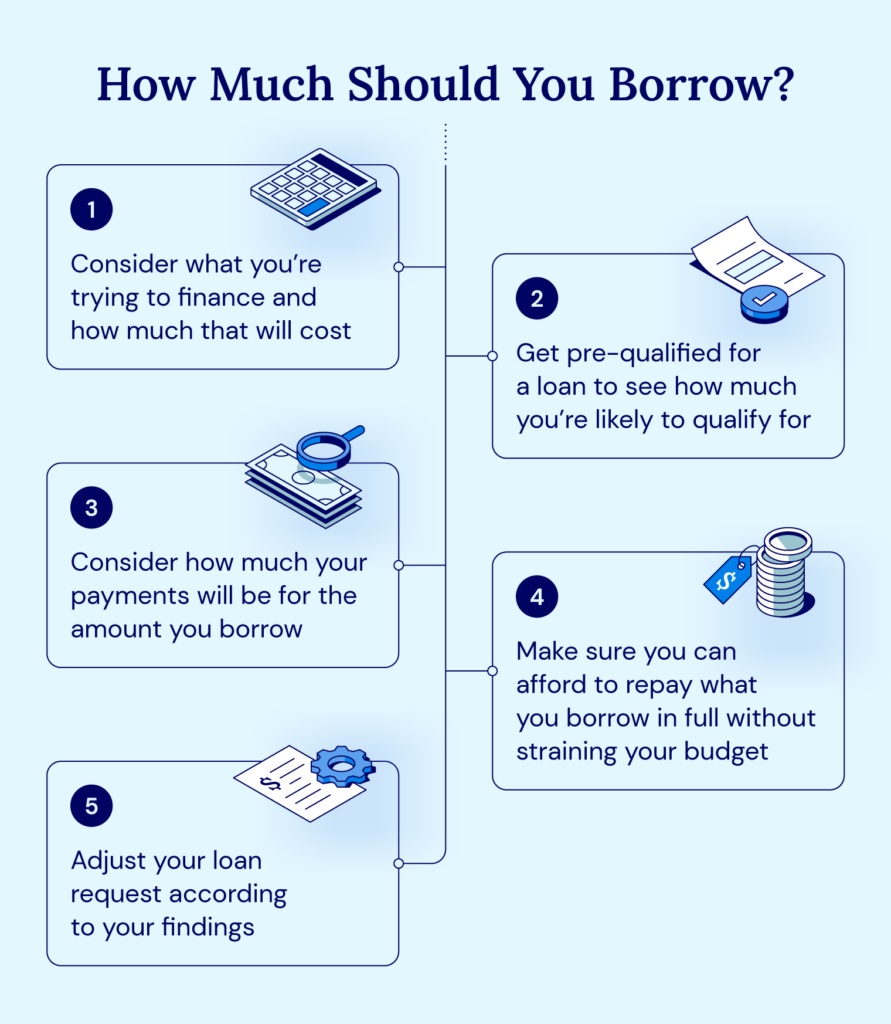

Understanding whether a small business loan is added or the rebellious debt is the first place. He will still need a borrower and apply for a loan or a credit balance that supports the objectives of your business.

National Business Money

When you are ready to grow your business and want to check your options, our team is here to help. Apply now And talk to an experienced business counselor to learn more about the loans and credit rows.