What do you need to know about the time loan?

Getting appropriate money can make or break business. Whether you buy machines, performance expanding, or managing cash flow, a time loan provides a formal loan and billing.

In businesses requiring a heavy amount of visual payments, the time loan provides a clear path of funding. But how do they work, and what should you consider before applying?

This guide breaks important things – types of business loans, billing structures, the features of the condition, and how you can choose the right option for your business.

Content

What is the business loan loan?

Loan Loans provides businesses with a significant amount of money, restored during interest-committed period. Companies often use this kind of financial systems of important, one-time spending. It deals with an important role in growing businesses, funding for more money, and improving work force.

He is known as “Term, this loan structure allows businesses to pay regularly. The updated revenue schedule makes it preferable for the preferences of your want companies Treat cash flow While the growth of money.

Under this loan structure, lenders receive the lead and return it by installation. Banks, Private lendersOther financial institutions determine the money loans according to credit, loan size, and Loan loan amounts.

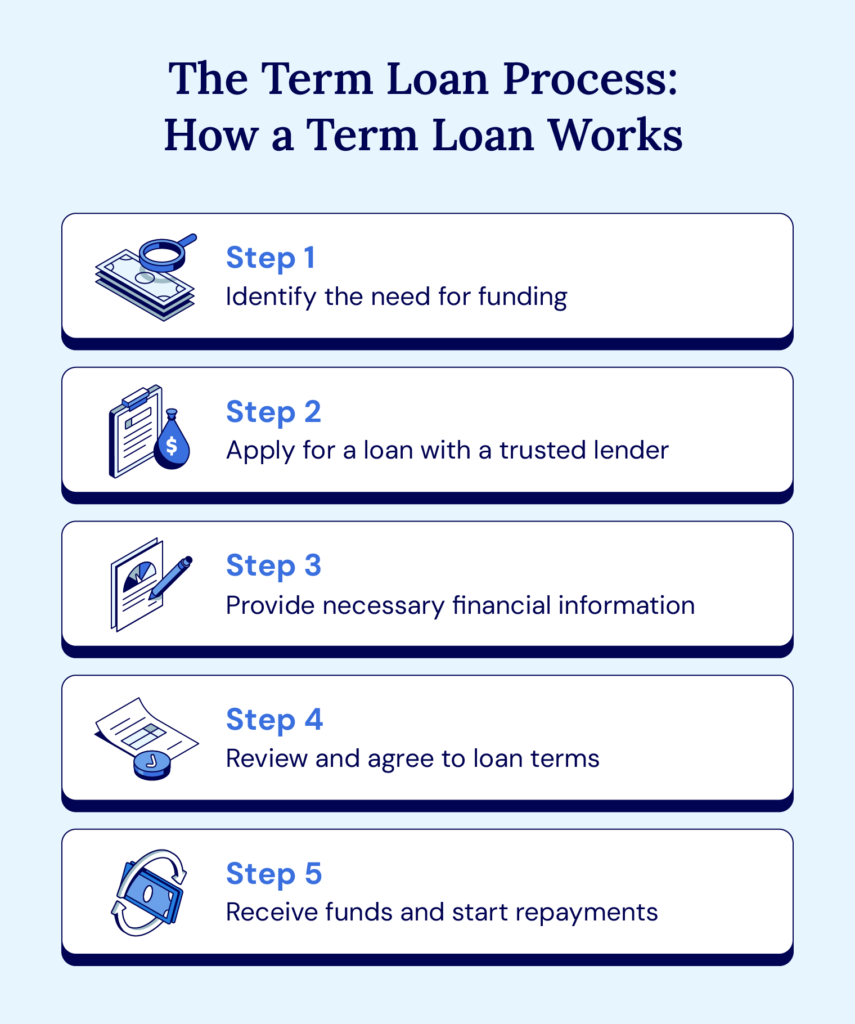

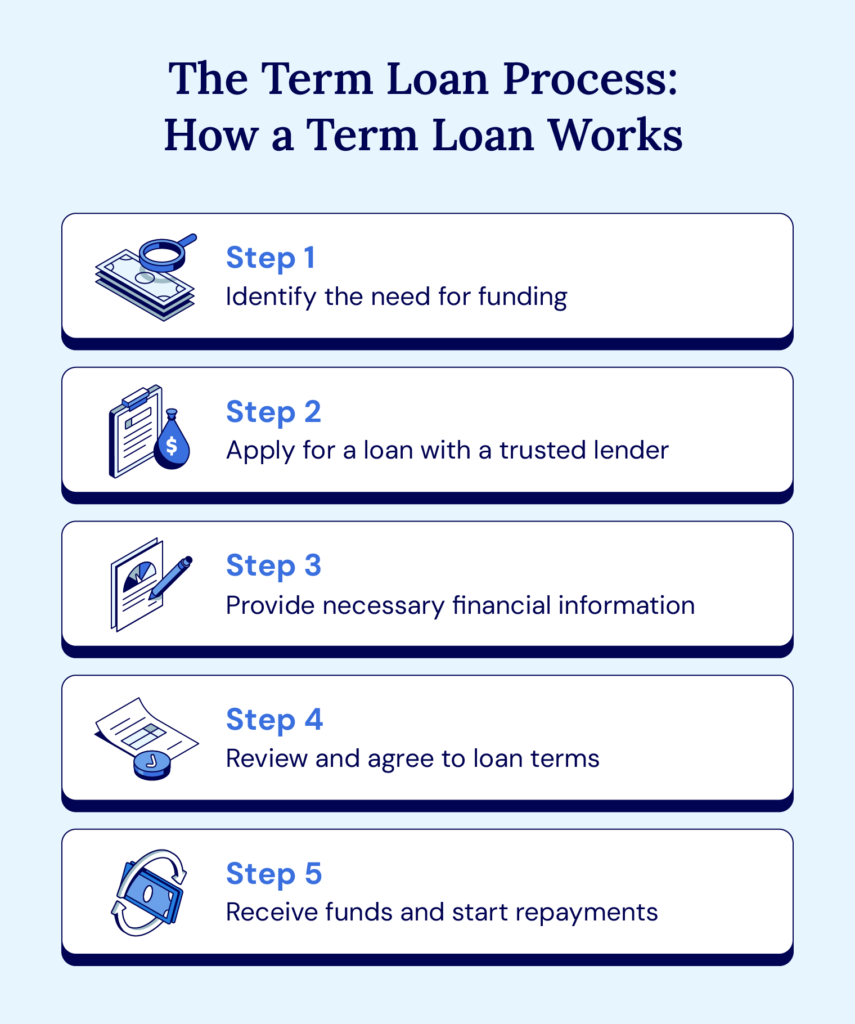

How does the loan work?

A business loan offers a business with a large amount of money, which is a fixed entity of the installation of the specified period, including interest.

Defense of the time loan, an entity must first identify its funding requirements and apply by a bank, a debtor, or private credit head. The application process requires details such as the purpose of the loan, the requested amount, and financial records. Lenders examine the risk using this information and credit check before approval of the loan. Two lenders draw soft debt to allow apps, however. It is important to ask questions about the credit test before you avoid the credit burery is expecting.

When approved, the borrower issues a loan agreement that defines key words, including the payment schedule, interest rates, and funds. After signing, the borrower gets money and starts making scheduled payments.

How long is the time loan?

The amount loan may be spher-, medium, or longer, to the payment period:

- Short term Business loan usually lasts less than a year.

- Medium Business loans range from five to five years.

- Long term Business loan goes beyond five years.

Each option uses different business needs, from covering quick cash flows to fund the increase in large quality.

Comprehension Different types of time loan helps businesses make the right decision.

What is the example of the time loan?

– Example of time-based loan It is a secure resort company for $ 1.1 million to solve the repetitive infrastructure problem.

Each winter, a critical bridge in their property will be broken and restricts access to the event spaces, cost more than $ 100 000 per year is repaired. These continuous costs create challenges of cash flow and restricted growth opportunities.

Traditional lenders need resort retail unpleasant Support. Loans allowed them to rebuild the bridge forever, remove repairs, and open new income streams.

The trial meeting shows how long loans can give businesses by the capital to overcome financial obstacles and succeed.

Why can loans cause your business

The term loan may be a solution to business strategies to monitor the greater cost while keeping the stability of the cash flow.

Whether you need a great investment income, extends jobs, or cover unexpected expenses, organized funding for visual payments – Growth and grow easily accessible.

In changing words, a group of professional business counselors, and the process of approval directed at the meeting, receiving a complex national business loan.

Start your Application for a time loan Today to test financial options for the needs of your business.