How is the inventory and ready for your business?

The lower run of the capital to achieve large orders or meet the annual demand can put your business in a difficult place. In addition to adequate cash flow, complying with orders are difficult, and puts them at risk of loss of growth opportunities.

Funding can be a solution to get you the money you need when you need it most. In this article, we will investigate how money money works and how it can help your business to stay on, even for season.

Content

What is the money to invent money?

Inventory Differing Credit Type that offers businesses with a short period of time using the inventory. Includes the Inventory Loan and Business lines of credit.

Lenders are often financially 50% -85% of the inventory value. If the company is funny, the borrower can hold the inventory on behalf of other goods.

This method of funding prepared for businesses that require immediate return or to achieve large orders, especially the smallest smaller business businesses or the need for the year.

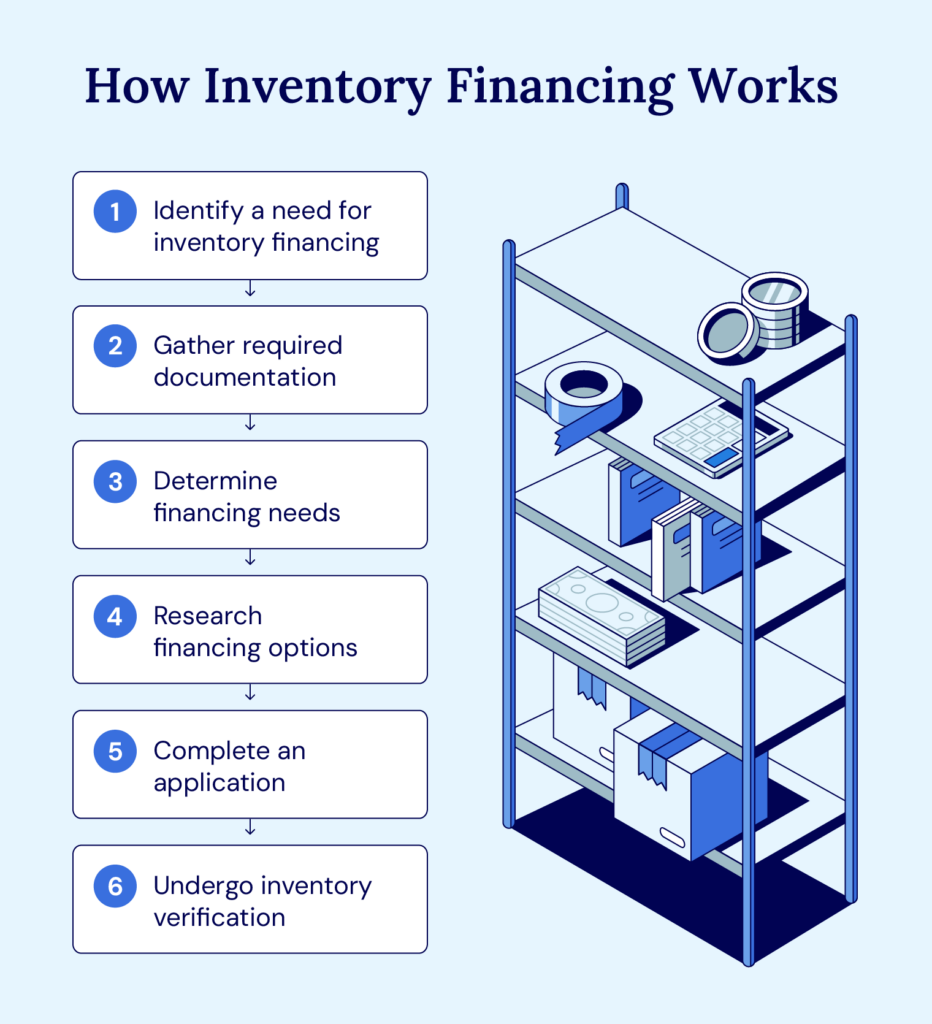

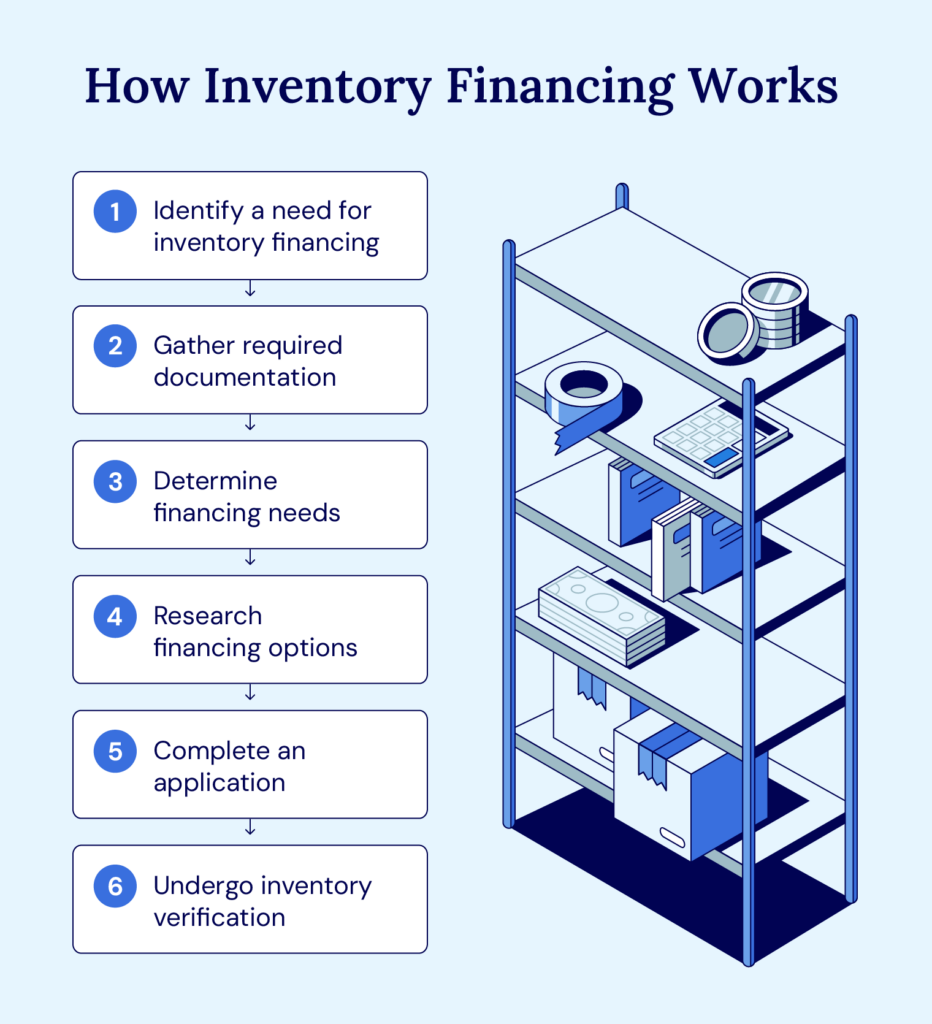

How does inventory work?

Funding can be a change of business game, especially during Peak Season or when an emergency order arrives. Here is how the process works:

- Identify the need for money: They when you need a great retardation fee, to fulfill the larger orders, or prepare busy seasons.

- Combine required documents: Mix the required documents including business financial statements, tax returns, inventory records, and much to show how much money will support growth.

- Determine the financial requirements: Count exactly how much you need based on current inventory levels, sales speculation, and purchase requirements. Be ridden at the price and time to avoid overconfidence.

- Research for funding for research: Analyze different options from traditional banks and private credit borrowers to get the best and values.

- Complete the application: Submit your electronic system, generally including online forms and documentation, followed by potential or visible meeting to discuss your needs and answer the questions.

- Establishment confirmation: Allow the lender to conduct the right diligence in your inventory, which can include physical examination, and the verification of your access to the amount of money.

Establishment of businesses that ensure businesses are not missing growth due to lack of funding. Provides flexibility to Treat cash flow and make money with opportunities before selling the inventory.

What types of investment?

Two main types of inventory funds have loans to establish a loan and credit rows. Let’s review the best features of these financial options:

- Inventory Loans: This applies to the same time for traditional time but focus on removal as a coincidence. The lenders check the amount of your inventory to determine how appropriate. They then distributed loan amount as a heap, which replacing usual installation.

- Estimated credit lines: This type of financial system provides continuous access to capital. Can draw money from a line of credit As required, and reinstated, debt is available to use it again. The lenders only apply interest on the amount you draw – not the full limit of credit.

The choice between the Business Loans or Credit line Depending on your cash flows requirements and the intentions of growth.

What are the benefits of creating money?

Inventory Maxing provides valuable benefits of large business prices, including the following:

- Unlocking money from Inxentory Exercer: Instead of allowing the inventory to take space, you can use access to the most needed.

- Improving Tasks at a busy season: Find your inventory to increase the profit and make sure you have the money to use your highest energy during the highest periods.

- BYPASS credit barriers: Your credit score does not play a major role in the borrower can take inventions in the event possible.

- Improve the ability to buy: Establishment of an unsteading can be a hidden asset. You get access to the capital by installing these products, strengthens your business purchases.

- Take the possibility soon: The chances do not always come at the right time. Inventory Dianing allows you to quickly create money and hold opportunities to grow.

While it may not be appropriate for all businesses, inventory money can be a powerful tool to help you stay before the competition.

What is the reporting of money laundering?

There is a number of lowly under consideration before choosing the inventory, such as:

- Estimated Inventory Installation: The lenders can only provide percentage of your inventory, which can leave the lower-capital higher than expected.

- Agree Costs: If you continue to hold loans, a great interest you can find, which may affect your benefit.

- The risk of unity: If you cannot restore, your establishment is at risk of taking, affecting your functions.

- Failure to limited situations: Unlike standard loan, inventory savings can be controlled in some movement, reducing your capacity to find other ways in the capital.

Understanding how different Types of Unit Business funding is important when processing the risks associated with investment.

Check your best financial options

Financial resolution can be a powerful business solution that need to open the money immediately immediately. Allows you to get your existing inventory to cover operating costs and take advantage of opportunities to grow.

Understanding the Ins and the Inventory Loan and Credit Lines is important, as each option contain its benefits and challenges. For privileged relationships, you can confirm that you make a good decision for your business health.

The direction of a schematic from the National Business capital will help you to wander for investigating financial technology.

Apply now To reduce your business growth with Inveeding Affing!