The Santa Claus Rally Phenomenon and Its Origins

I Santa Claus Rally refers to a historically observed stock market situation in which US stock markets tend to perform well during the last five days of the year and the first two trading days of the new year. Historically, the average profit during this seven-day period is close 1.3%.

As time went on, mainly due to good hope, the Santa Claus Rally was extended both in duration and in length. Today, i Santa Claus Rally the rally begins on November 25 and continues until the end of the year. With this modern version of Santa Claus Rallythe average return of the S&P 500 doubled to 2.6%.

The origin of the Santa Claus Rally

The term was popularized by Yale Hirsch, founder of the Stock Trader’s Almanac, in the 1970s. Hirsch noted this ongoing pattern of market tightening during the holiday season and called it the “Santa Claus Rally.”

Although the exact origin is not tied to any single event, this phenomenon has been known for decades and has been widely studied in financial markets.

Santa Claus Rally Historical Trends

- Time: The meeting usually covers the last five days of the calendar year and the first two trading days of the new year.

- Performance: Historically, the S&P 500 has shown average gains of about 1.3% during this seven-day period, which is significantly higher than the average weekly performance for the entire year.

- Frequency: More than 70% of the time, markets posted positive returns during this period. It’s the same as in any given year, the S&P 500 closes 70% of the time.

Ideas Behind The Santa Claus Rally

Several theories try to explain why the Santa Claus Rally happened:

- Hope and Holiday Cheer: The holiday season often promotes a sense of optimism among investors, leading to increased buying activity. As humans, most of us are willing to wait for better times to come in order to survive.

- Tax considerations: Some investors sell losing positions before the end of the year to take advantage of tax losses, followed by reinvestment in the market. However, this sale needs to take place before November, usually in October, so that the Santa Claus Rally has the best chance of happening. Tax loss harvesting may be one of the reasons why October tends to be the weakest trading month of the year.

- Low Trading Volume: With many institutional investors and traders on vacation, retail investors can have a significant impact on the market, often to the upside.

- Year End Bonuses: An influx of year-end bonuses can lead to increased investment activity.

- Rebalancing the portfolio: Fund managers may adjust the portfolio to improve year-end performance metrics, adding to market gains.

- Expectations for the New Year: Investors are positioning themselves for a strong start to the new year, contributing to this rally.

Wall Street Almost Remains Optimistic in Fourth Quarter

When I worked on Wall Street at Goldman Sachs and Credit Suisse, the talk of Santa Claus Rally will begin in mid-November. As the year came to an end, the atmosphere turned festive, and the anticipation for year-end bonuses grew. These bonuses usually range from 20% to 250% of our base salaries, which creates a buzz around the office.

November through February was arguably the best time to be an investment banker or Wall Street trader. The pace of work slowed, the holiday parties became more intense, and the big bonus checks made it more rewarding. It was a time to celebrate the year’s hard work and enjoy the fruits of our labor.

When bonus checks arrived at the end of February, hungry workers would often jump to a competing company for a guaranteed payday. Somehow I regret not taking the money for jumping ship. I was an underwriter at Credit Suisse for 11 years, taking an opportunity in New York City at a start-up bank that offered me a two-year cash guarantee.

For those of you with full-time jobs, welcome the fourth quarter! Once you retire, you will lose the luxury of taking full paychecks with ease, thereby increasing your ROE. It’s like being on parental leave while earning your full salary. Oh, how I wish I had enjoyed those benefits back when I was working!

The Importance of the Santa Claus Rally

I Santa Claus Rally it is often seen as a barometer of short-term market sentiment. When the rally fails to happen, it can indicate bearish sentiment or broader economic concerns for the coming year. Investors, often influenced by superstition, tend to act quickly—for better or for worse.

Negative momentum in the stock market tends to persist until a significant catalyst changes sentiment. Similarly, positive momentum can stabilize, especially when uncertainty about the future is reduced, creating a feedback loop that brings more benefits.

For example, markets sometimes rally after a new president is elected, building on existing momentum and triggering the end of the year. Santa Claus Rally.

The S&P 500 has generally done well under the Biden/Harris administration, except for the bear market in 2022. Looking ahead, with Donald Trump’s return to office, there is optimism associated with his policies favoring lower taxes and reduced regulations—both of which could boost corporate earnings and stock prices.

If Harris had won, the stock market momentum would have continued, as his victory would have removed uncertainty for the next four years. His policies are likely to be similar to Biden’s, possibly in a more moderate way.

Invest For The Long Term

Although the Santa Claus Rally has been around for a long time, its predictive power is far from perfect, especially in volatile markets. Events such as national tensions, unexpected economic data, or Federal Reserve policy changes can easily overshadow this seasonal trend. However, some short-term traders may be tempted to capitalize on the rally, looking to day trade at this time.

The Santa Claus Rally remains an interesting and much-discussed phenomenon, emphasizing the cognitive and behavioral patterns that influence market movements. It serves as a reminder of how culture and emotion can drive investor behavior, even in complex financial markets.

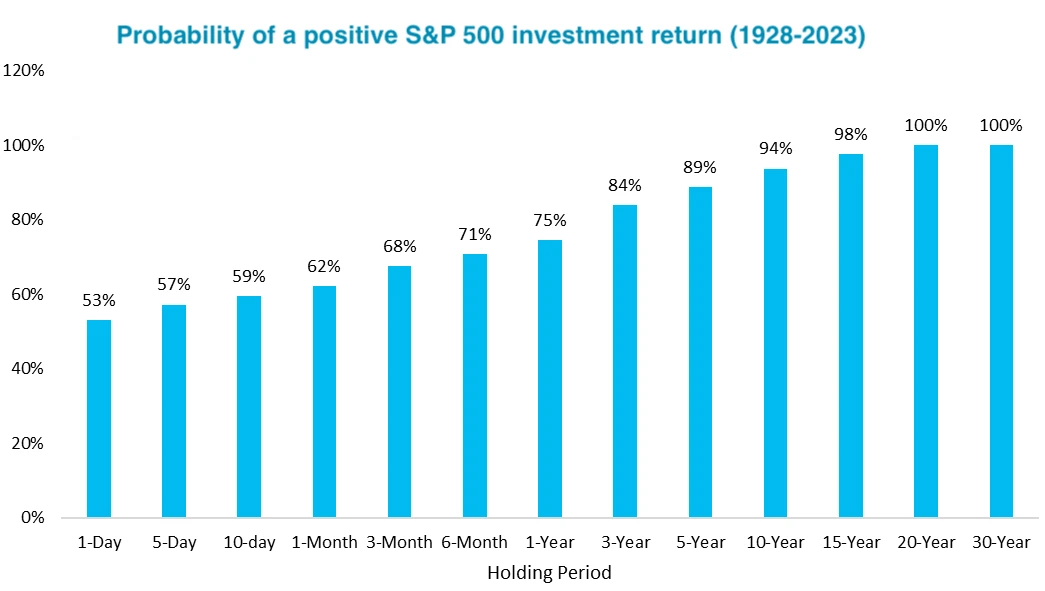

That said, being overly sensitive to either method is rarely beneficial for investors. The best way is to stay balanced—weigh the dollar cost of the market with your available cash flow and maintain a long-term investment perspective. Over time, consistency often trumps chasing seasonal trends.

Readers, what do you think about the chances of a Santa Claus Rally this year, given the strong performance of the S&P 500 so far? Do you engage in any additional trading or year-end rebalancing that may contribute to market volatility?

Sign up for Financial Samurai

Listen and subscribe to the Financial Samurai podcast on an apple or Spotify. I interview experts in their fields and discuss some of the most interesting topics on this site. Thanks for your shares, rates, and reviews!

To accelerate your journey to financial freedom, join over 60,000 others and sign up Financial Samurai’s free newsletter. Financial Samurai is among the largest private equity websites, founded in 2009.

Source link