4 reasons to avoid cheap Lloyds shares in December!

Image source: Getty Images

You want the cheapest the best FTSE 100 stocks to buy this month? We might think of a highway bank Lloyds‘ (LSE:LLOY) shares are worth a close look at the current price of 53.06p.

At this rate, Black Horse Bank is trading at a price-to-earnings (P/E) ratio of 7.9 times by 2025. This is well below Footsie’s average of 14.3 times.

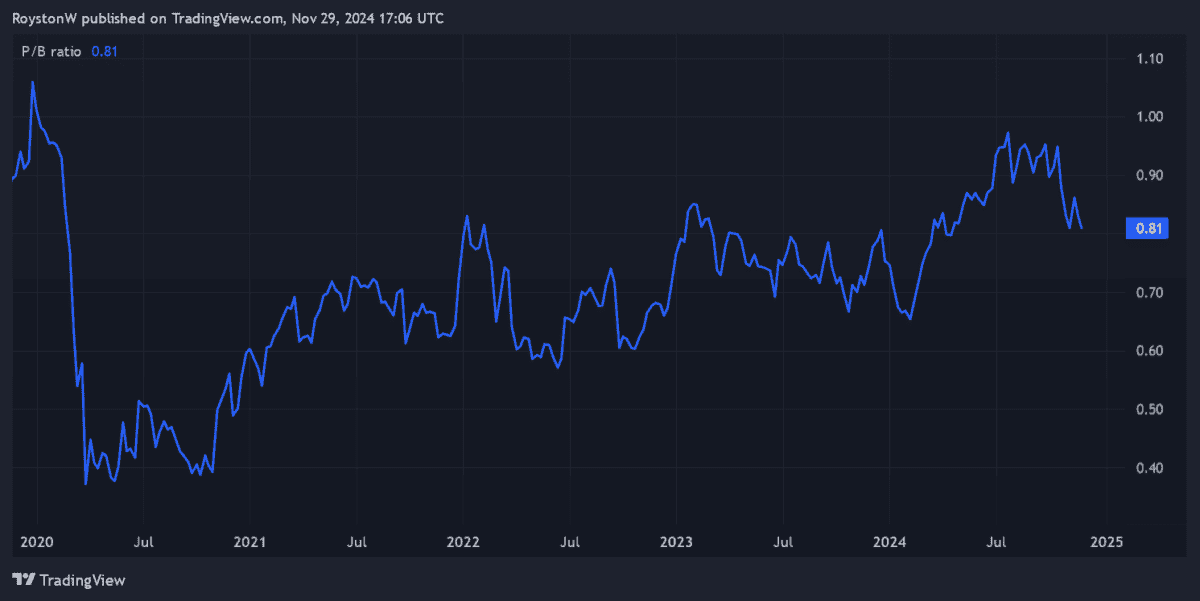

Lloyds shares also trade at a discount to the bank’s asset value. At 0.8, your price-to-book (P/B) score sits comfortably below the 1 watermark value.

Finally, at 6.4%, the 2025 dividend yield here on Lloyds shares outperforms the FTSE 100 average of 3.7%.

On the plus side

These numbers are amazing. But as a potential investor, I need to consider whether the low rating here indicates significant, and potentially unacceptable, internal and/or external threats.

There’s a lot I like about Lloyds. It has significant brand recognition, an important quality in an industry where human capital is involved. It is also the market leader in mortgages, a sector that could be set for strong growth if (as expected) UK housebuilding accelerates.

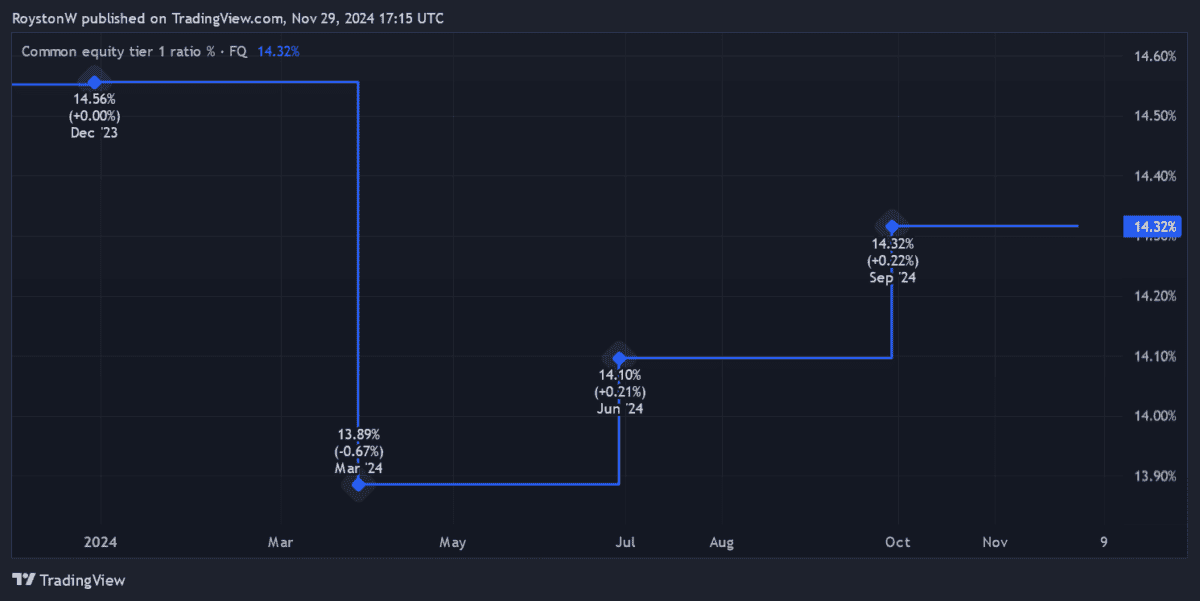

I also like the strong financial foundations of the bank. With a CET1 capital ratio of around 14.3% – ahead of its target of 13% – Lloyds has a huge task to invest in growth while continuing to pay huge dividends.

Yet despite these qualities, I believe the risks of buying Lloyds shares today outweigh these benefits.

Poor sales and increased spoilage

First, UK-focused banks such as these may find it difficult to grow revenue as the domestic economy stagnates. The news that Britain’s GDP grew by just 0.1% in the third quarter following the end of the September shock bodes ill for 2025.

As economic conditions remain difficult, Lloyds is also facing another major decline in credit losses. I am more concerned about the potential for mortgage-related costs – the Bank of England (BoE) thinks that half of UK mortgages, estimated at around 4.4m, will be more expensive for borrowers to service over the next three years, as a result. at high interest rates.

Competition and car loan costs

I am also concerned about the demand for Lloyds’ credit and savings products going forward as competition increases in the UK banking sector.

Challenger banks are expanding their product range to attract customers from traditional users. And they could have more firepower to take on the likes of Lloyds, with the BoE eyeing changes to Basel III capital requirement rules.

Finally, the profits from Lloyds could be taken seriously if it is found guilty of illegal car lending. The bank has set aside £450m to deal with the situation, but this figure is still under review as the Financial Conduct Authority (FCA) investigates.

Ratings agency Moody’s reckons total applications for car finance – a market in which Lloyds is a leading player – could total £30bn. In this situation, stock prices in the entire financial services industry may fall.

On balance, I’m happy to avoid Lloyds shares despite their cheapness. I prefer to find other shares to buy.

Source link