FTSE 250 shares I can buy with passive income during a recession

Image source: Getty Images

Concerns about a possible recession in the US sent stock markets into a frenzy. Many FTSE 100 again FTSE 250 stocks derive significant portions of their profits from the global economy. In addition, problems in the US will have major consequences around the world.

This means that investors who rely on capital gains for their investment strategy or daily expenses should be careful about which stocks they invest in.

In this situation, it would be a good idea to invest in companies with strong balance sheets, operating in stable industries, and enjoying leading market positions and multiple sources of income.

The highest value of the FTSE 250

This list does not limit me to a small selection of UK stocks, however. The FTSE 250 alone is full of stocks that meet some or all of the above criteria.

Here is one I would buy for my own portfolio if I had the cash to invest.

Property powerhouse

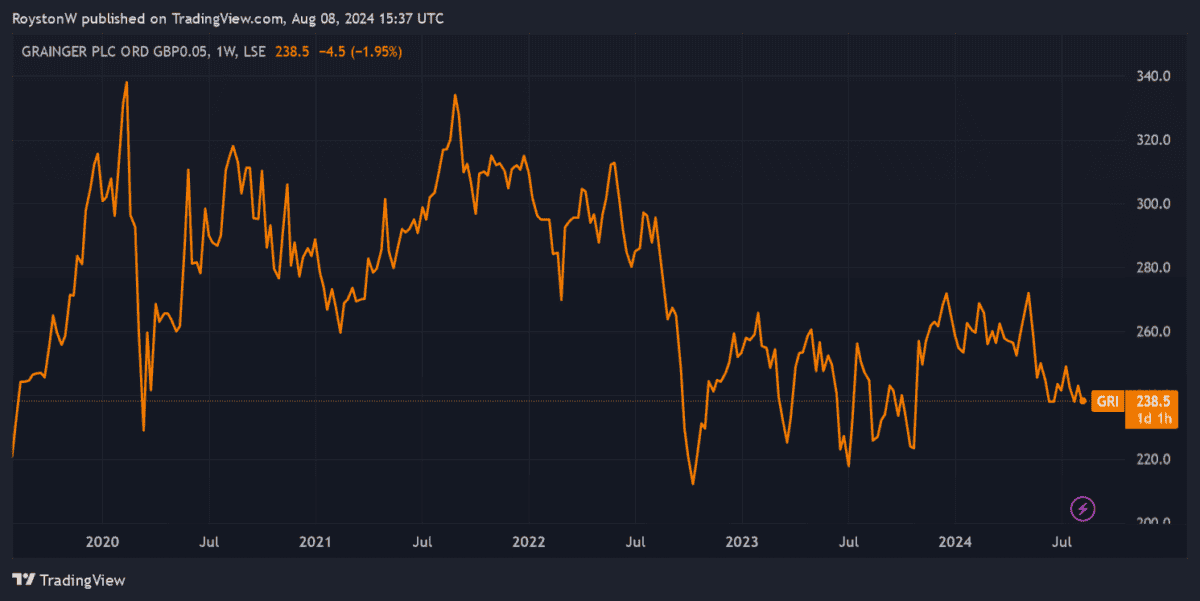

As I said, buying defensive stocks can be a good idea during a recession. In this case, Grainger (LSE:GRI) could be one of the best London stock markets today.

Shelter and food are two things that people cannot do without. And as a residential property owner, this FTSE 250 company can expect a steady flow of income at all points of the economic cycle. The latest figures showed its occupancy rate was 97.7% as of March, despite ongoing cost-of-living issues.

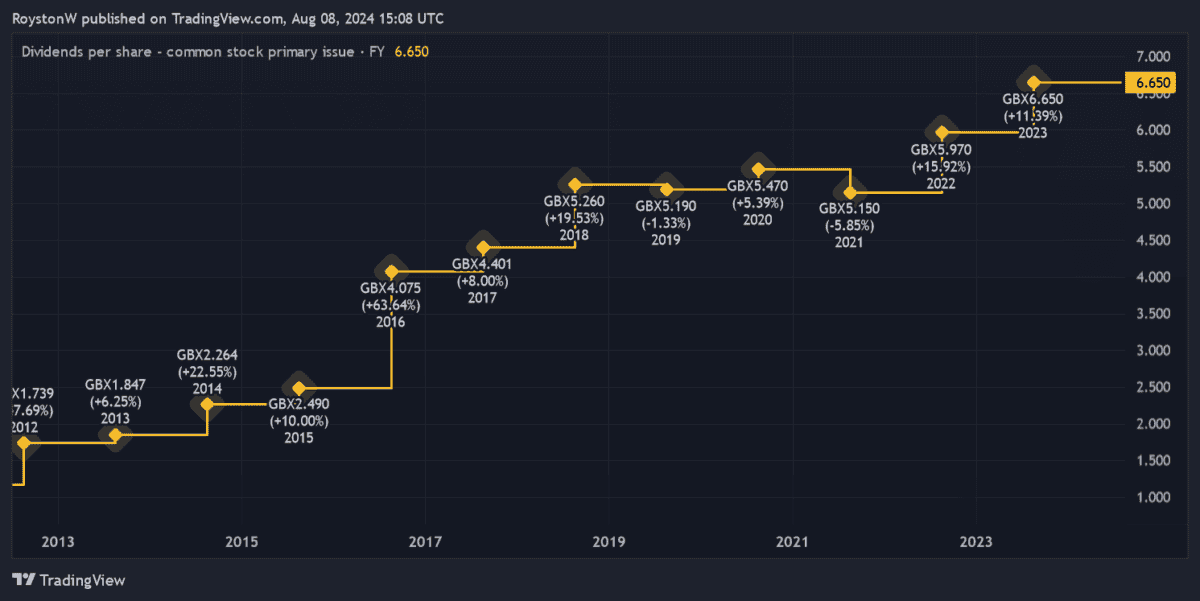

This stability has allowed you to – with the exception of 2019 and 2021 – grow profits for more than a decade. Indeed, shareholder payouts have improved as UK rent growth has picked up.

Like-for-like rentals increased 8.1% in Grainger's first quarter. This also prompted the company to increase its interim dividend by 11% year-on-year, to 2.54p per share.

Share growth

The lack of available rental properties, causing rents to rise, is expected to continue for several years at least. So City analysts expect Grainger's earnings to continue to grow rapidly over the next three financial periods, as shown below.

| Financial year* | Dividends per share | Return yield |

|---|---|---|

| 2024 | 7.29p | 3.1% |

| 2025 | 8.24p | 3.5% |

| 2026 | 9.11p | 3.9% |

The real estate giant is growing fast to take advantage of these favorable conditions. As of March it had nearly 5,000 rental homes in its development pipeline to add to its existing portfolio of just over 11,000.

This could provide the foundations for continued profit (and thus profit) growth over the next few years. In addition, Grainger's growth strategy should get a boost from Labour's promise to reduce planning regulations.

Having said this, future returns are not completely protected against risk. Another concern I have is the company's debt pile, which has risen by 6% year-on-year to £1.5bn since March. This could threaten payout growth as the company reinvests more in its property portfolio.

On balance though, I still believe that Grainger is still one of the best stocks to consider in these uncertain times.

Source link