Do you want to earn money by investing passively? Here are 3 top dividend stocks to consider

Image source: Getty Images

I'm a big fan of using dividends as a way to generate additional income. But not all companies pay reliable dividends. Vodafone it disappointed me recently by cutting its 10% yield in half, prompting me to sell my stake in the company.

I am now very careful about the income I invest in. Right now, my top three picks Phoenix Group (LSE: PHNX), British American cigars (LSE: Bats) and Legal & General (LSE: LGEN).

That's why I think investors should be considered.

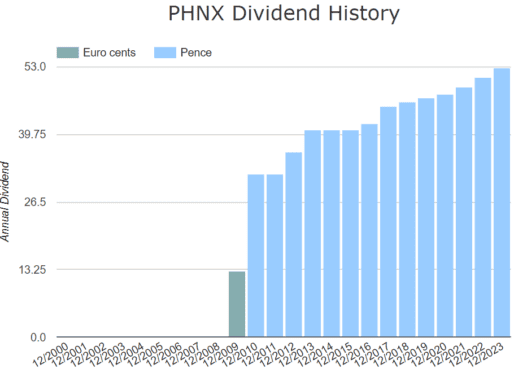

Phoenix Group

Phoenix Group's 9.5% yield may be too high FTSE 100 after Vodafone fell to 5.2%. The insurer has not paid dividends for a long time but has raised them every year for the past six years.

As one of the UK's largest insurance companies, it faces stiff competition from Legal & General as well Prudential. Unfortunately, there is one obvious problem, it is currently useless. Years of low incomes have increased their debt, which is now almost double its figure.

That doesn't sound very promising.

But a recent rise in revenue has helped return the company to profitability. It could be profitable again next year, with revenues likely to reach £280m by the end of 2025.

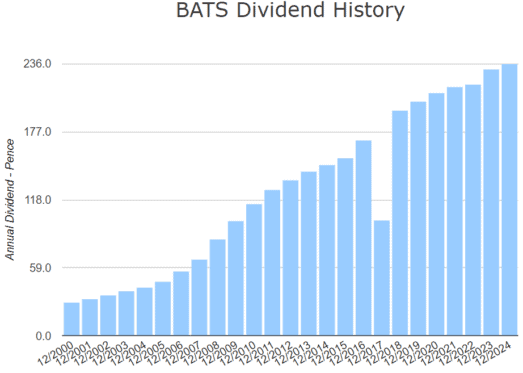

British American cigars

With a yield of 8.5%, British American Tobacco may be the fourth highest yielding FTSE 100 after that. Burberry reduce its dividends. Apart from a brief drawdown in 2017, it has been paying a reliable and growing dividend for over 20 years.

Currently, it is unprofitable but weathering earnings growth gives it a forward price-to-earnings (P/E) ratio of 8.3. And with future cash flows expected to increase, the shares are estimated to be about 60% undervalued.

But tobacco is a dying industry so it's hard to put too much faith in the company's long-term prospects. Not to mention the moral implications.

However, British American Tobacco is focusing on switching to tobacco-free products as stricter regulations threaten its bottom line. Its Vuse brand is the most popular vaping brand in the world, according to the company. Enacts stricter laws and bans on disposable vapes and child-friendly flavors to help reduce child smoking.

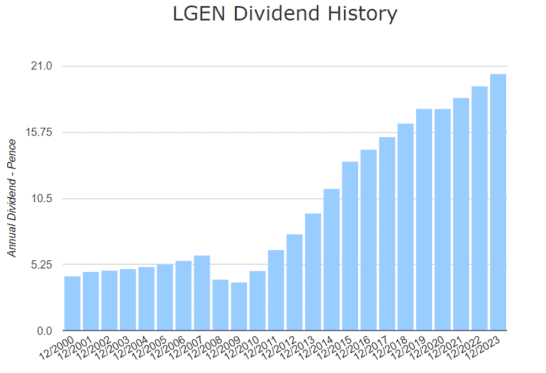

Legal & General

At 8.9%, Legal & General is the third highest yielder in the FTSE 100, slightly below its peer insurer. IM&G. But as a stock focused solely on income, it doesn't offer much in the way of price growth. It has increased by only 1.6% over the past five years.

Payments are very reliable though, having risen consistently since 2009 with only a brief pause in 2020. Its earnings boast a compound annual growth rate (CAGR) of 13.3%, and the yield is expected to reach 10% over the next three years.

Like Phoenix, low earnings pushed its P/E ratio to 48 and leaves it with a lot of debt. If forecasts are correct, improved earnings could bring us closer to an industry average of 11. But with a debt load of twice its market-cap, it still has a long way to go.

If it wasn't for the amazing record of paying dividends, I wouldn't miss it. But in this case, I think the reward is worth the risk.

Source link