What on earth has happened to Rolls-Royce's share price lately?

Image source: Getty Images

I Rolls-Royce (LSE: RR) share price continued its impressive run in August with strength above 500p. This meant that FTSE 100 the stock is up over 600% in just 22 months!

However, after an 11% increase in August, the beginning of this month has brought a big upheaval. Yesterday (2 September), the share price fell 6.5% to 464p. As I type though, it's up 3.1% to 478p.

What's going on here?

Low planes

Yesterday's drop follows an incident where a Cathay Pacific Airways a flight from Hong Kong to Zurich encountered problems, forcing it to circle twice over the ocean to dump fuel before landing safely.

The A350-1000 was powered by Rolls-Royce XWB-97 engines and the problem appears to be related to the fuel port. In response, several flights have been canceled by Hong Kong's Cathay Pacific as extensive fleet inspections and repairs are carried out.

This highlights how problems like these can appear out of nowhere and make investors panic. If there was a major engine manufacturing error, the financial liability could be significant.

Indeed, Rolls took a major hit in 2018 when it had to inspect and repair engines after finding cracks in the fuel blades.

Fortunately, this doesn't seem to be that serious. The airline operator says it expects the grounded flights to be out of service for a while”a few days“. Hence the rise in Rolls-Royce shares today.

Amazing business performance

Back in August, the company won an order from Cathay Pacific for 60 Trent 7000 engines. It will make the airline the world's largest supplier of this type of engine, which is expected to reduce emissions by 14% when combined with Airbus's aircraft A330-900.

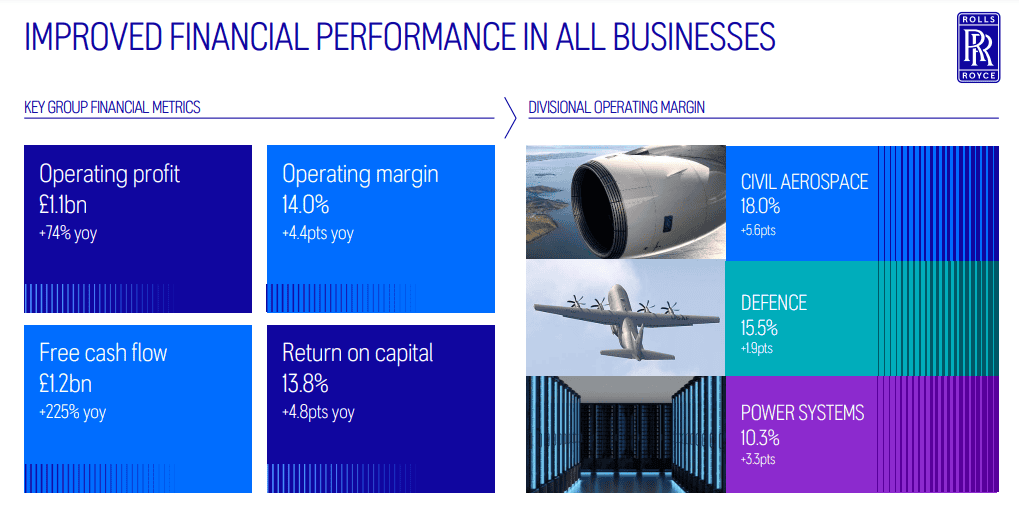

This announcement builds on the company's incredible commercial momentum. In H1, we saw financial improvement in all areas.

By the end of 2024, management expects to have cumulatively delivered more than 75% of its mid-term operating profit target (£2.5bn–£2.8bn).

Meanwhile, net debt has been reduced to its lowest level in more than five years, prompting a return to profitability.

This progress is reflected in the stock count. The forward price-to-earnings ratio is 28 (a large premium to the FTSE 100). So there is still a lot of hope invested in the share price.

The growth story still looks strong

On the engine issue, dealers don't seem overly concerned at the moment. Deutsche Bankfor example, it recognizes that the financial impact will be manageable: “Although the news raises some concerns, our initial analysis is that financial debt may exist. Thus, our positive view on the issue of equality has not changed.”

The bank maintained its price target at 555p, which is 16% above the current level.

Looking forward, I am still doing well. The number of flights is expected to double in the next 20 years due to the increase in international travel. This growth could lead to a significant increase in the Rolls-Royce engine fleet and the lucrative aftermarket services that come with it.

Last month, I bought more stocks for the first time in 18 months. I'm happy to hold that position for the next few years as I hope this long-term growth story plays out.

Source link