9.8% yield! Can this popular FTSE 250 stock deliver its amazing returns for decades?

Image source: Getty Images

What is the difference between the annual yield of 3.1 %. FTSE 250 average) and another 9.8%? In the short term, it's £6.70 a year for every £100 I invest.

I am a long term investor though. Over time, that difference is huge.

Imagine I invest £1,000 today and compound it at 3.1% per annum at 3.1%. After 30 years, it should cost £2,499. If I invest that £1,000 today and compound it at 9.8% per annum over the same period, after 30 years it should £16,522!

Looking at it for a long time

Partial consolidation works on the basis of the price at which I can buy the share in the future. Actually, no one knows yet. But it also depends on the return on the given budget, in this case, 9.8% stable for 30 years.

One well-known FTSE 250 stock currently offers such a yield abrdn (LSE: ABDN). Can it sustain that charge for decades to come?

Strong track record of benefits

While past performance is not a guide to what may happen in the future, it can provide investors with useful context.

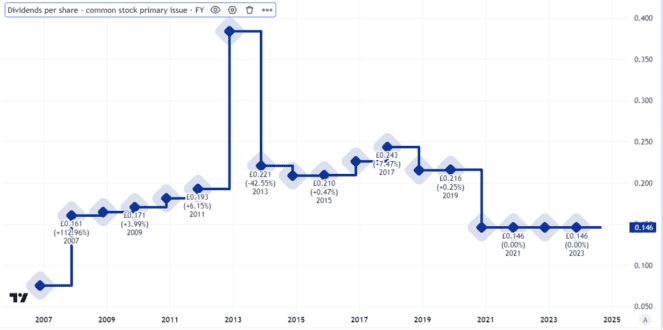

Over the past seven years, the FTSE 250 financial services company has not raised its dividend per share, but has cut it twice.

Created using TradingView

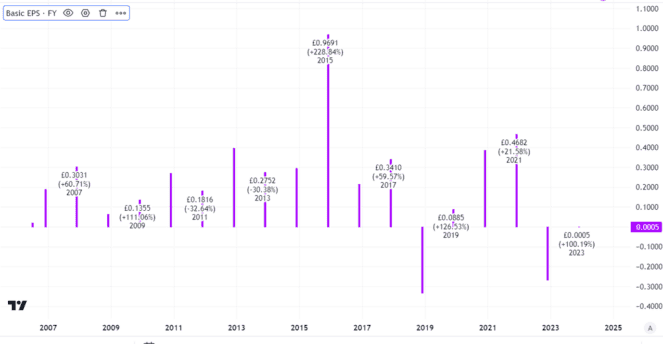

The reason? Basically, business performance was very inconsistent. Indeed, a quick look at the firm's history of basic earnings per share makes the point.

Created using TradingView

It is difficult to judge where things can go

On the other hand, earnings per share is not a good metric to use when evaluating a financial services company. Things like asset valuation changes can dramatically affect profits, even though they may not affect cash flow.

On the other hand, such consistent earnings (including some significant losses) do not strike me as consistent with a successful, well-managed company that is charting its way to sunlit heights or increasing shareholder payouts. There's a reason abrdn has broken its dividend repeatedly over the past seven years.

I think that partly reflected a poor business strategy that was changed over time. As its daft name suggests, the company has experienced an identity crisis, which may not be a good way to attract customers in an industry where consistency is paramount.

However, the company has a large client base. In the first quarter of the year, assets under management and administration grew slightly compared to the previous quarter, reaching more than half a trillion pounds. This is no FTSE 250 minnow.

A cost-cutting program can help increase profits (although I also see the risk that it could backfire if it reduces employee productivity). I co-investor the platform can help increase abrdn's long-term potential as more investors choose to invest digitally.

Continuous high income opportunities

A financial downturn could hurt that performance, if investors lose enthusiasm just as abrdn loses its vowels.

However, even though the dividend may decrease and if the business is weak, if the company maintains its performance, the high payout may remain.

So from an income perspective, I see abrdn as an FTSE 250 stock investors should consider buying.

Source link