2 excellent shares recently taken by Scottish Mortgage

Image source: Getty Images

Scottish Mortgage Investment Trust (LSE: SMT) aims to invest in the world's best growth stocks. These come in different forms, from established businesses to new businesses making waves somewhere in the world.

A few days ago, the trust revealed its new portfolio – and they are very different companies. One was founded in Paris in 1837, and the other was founded in 2013 in Brazil.

Here's the lowdown on this latest move.

Branded luxury goods

The first new addition Hermès Internationalluxury French brand known for silk scarves and leather goods such as the Birkin bag.

Scottish Mortgage said Hermès is 187 “still has exceptional potential for growth… supported by the strategic marriage of its storied brand with the strong growth of emerging Asian economies“.

Love Ferrari (another catch), Hermès customers must be invited to buy their high-quality products, which helps maintain its aura of exclusivity. Both are consistently ranked as the world's most valuable luxury brands.

Of course, the company faces competition from the likes of Louis Vuitton, while future shifts in consumer preferences are always possible. However, this looks like a solid portfolio addition to me.

Other places to stay in Nu

The second assignment is Nu Holdings share price (NYSE: NU). This is the fastest growing digital bank (better known as Nubank) in Latin America. This is reflected in its share price, which has increased by 215% in two years.

Scottish Mortgage said Brazil's Nubank “attracted and retained younger customers who are expected to increase their incomes significantly over the next decade“.

Surprisingly, the company now has more than 104 million customers, although it operates in only three countries (Brazil, Mexico, and Colombia). Continued international growth seems certain.

As of the second quarter, it has added more customers in the past 12 months than Brazil's five largest incumbents combined. More than half of Brazilian adults are now customers of Nu!

By 2023, revenue is up 67% year-on-year to $8bn. Analysts expect the top line to rise another 45% this year, then rise to around $20bn by 2026. So this is a fast growing fintech company.

And very profitable

But it's not just revenue growth. Nubank's revenue more than doubled in the second quarter, reaching $487m. The overall profit margin here is not far from 20%. That's very attractive for an innovative company that's growing revenue by 40-60% a year.

The company also boasts the highest return on equity (ROE) in the industry at 28%. This shows that it uses shareholders' equity in the most effective way to generate profit.

Interestingly, the stock is owned by Warren Buffett's Berkshire Hathaway again. And although Latin America offers higher currency risk and economic volatility, which could affect Nubank's earnings, Buffett will still sell one share since he invested in 2021.

Set up to win?

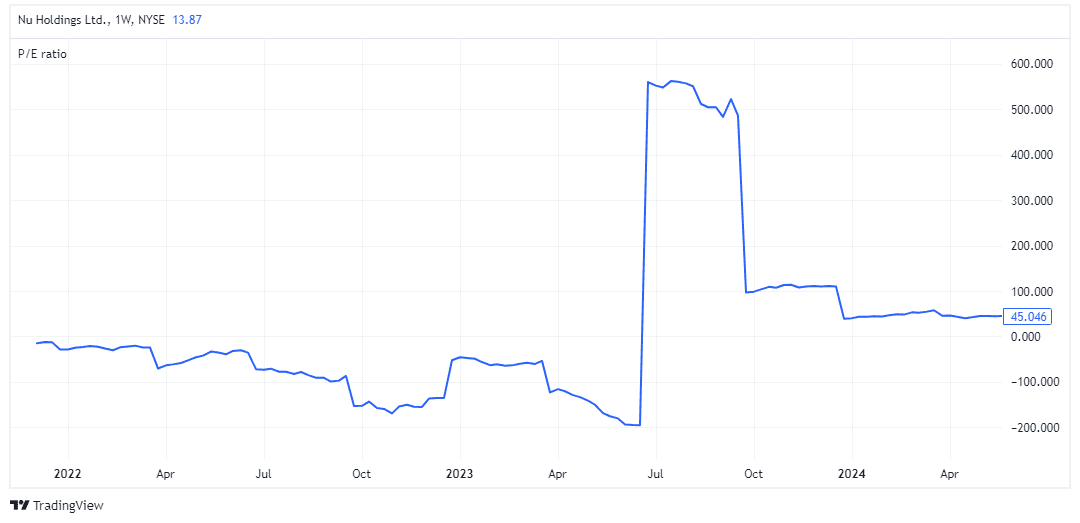

At first glance, the stock isn't cheap at 45 times earnings.

However, the company's growing revenue is growing so fast that it will look like a profit in the future. Based on forecasts for 2026, for example, the forward P/E ratio is just 16.

As a shareholder in Scottish Mortgage, I think this looks like two very interesting acquisitions. And while a sharp market selloff in growth stocks is an ever-present risk, the portfolio looks set for long-term wins.

Source link