Up 45% for the year with a 4% yield, this REIT recently entered the FTSE 250. Is it a buy?

Image source: Getty Images

I FTSE 250 recently completed its quarterly review of which stocks should be added or removed from the index based on changes in their market capitalization. The reshuffle saw Burberry join index after fall FTSE 100again EasyJet narrowly escaping the position. A popular addition was that of a small computer manufacturer Raspberry Piwhich rose to prominence after going public four months ago.

But today I'm looking at a little-known real estate investment trust (REIT) that joined the index last month. Its share price rose 30% in Q3 2024, so I had to find the story.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice.

PRS change

PRS change (LSE: PRSR) is a closed-end investment trust focused on building single-family homes marketed in the private rented sector (PRS). Launched in 2017, it now has the largest building to rent portfolio in the UK. In total, more than 5,600 homes are scheduled for completion by the end of Q1 2025, with an estimated rental value of £66.5m once fully let.

Recent performance has been impressive, with revenue up 17% year-over-year and net income up 106%. Also, it has a dividend yield of 4% and a low price-to-earnings (P/E) ratio of 9.5. Another concern is that it has a limit on interest payments, so if the income drops, there is a risk of defaulting on the loan.

Earners are not reliable

I'm a big fan of real estate investments so REITs are very attractive to me. For small investors who cannot afford to buy entire properties, REITs can provide exposure to the market. The rules applied to them are also attractive. In order to receive favorable tax benefits, REITs must return 90% of their profits to shareholders in the form of dividends.

This makes them an excellent addition to an income portfolio. What I already have, Basic Health Structuresit has a dividend yield of 6.7% and a strong payout record. Like many REITs, it has grown in the past month as the new Labor government promises a renewed focus on housing.

Real estate, real risk

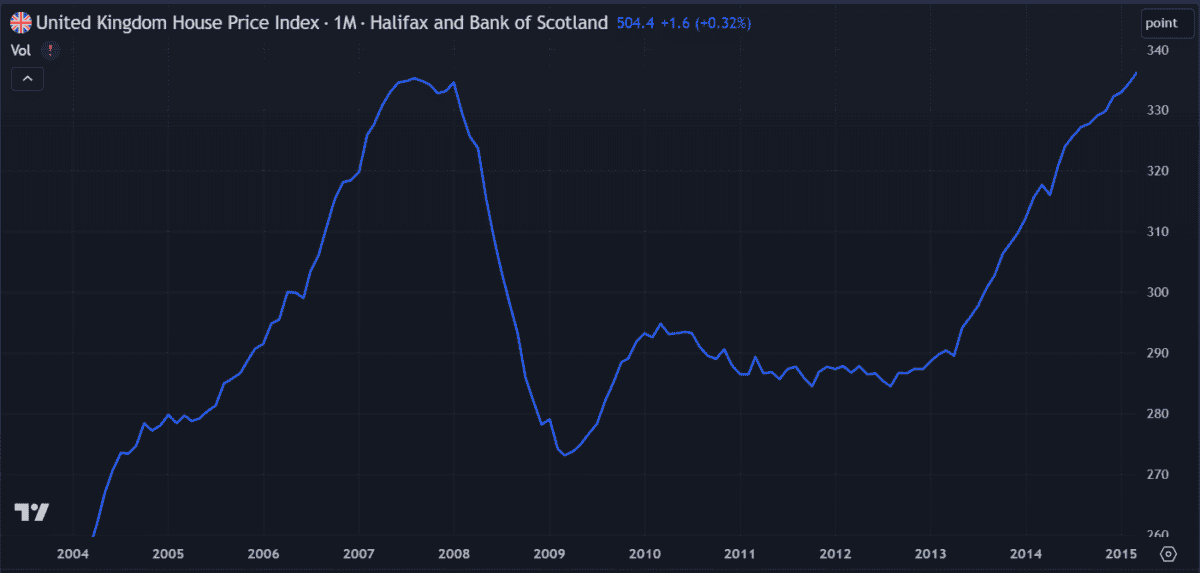

The events of the 2008 financial crisis are testament to the dangers associated with the housing market. The price chart of any global asset shows a significant decline that year but real estate stocks took the brunt of the losses, many losing more than 90% of their value in a 12-month period.

The crash has been described as a 'black swan' event, suggesting it was unique and unexpected. One event or not, it highlights the weakness of the housing market. This is a big risk when it comes to REITs. Remember, they are only required to return 90%. profit for shareholders – no profit, no profit.

Favorable market

Right now, the housing market looks pretty good to me. The first interest rate cut of the year has already increased mortgage approvals and may reduce further. Also, the Labor government's new enthusiasm for property development is encouraging.

These factors have rekindled my interest in REITs, especially small, up and coming ones. That's why I think PRS is a great opportunity and I plan to buy shares soon.

Source link