£10,000 of Phoenix Group shares would earn me a monthly income of £1,009!

Image source: Getty Images

Phoenix Group (LSE:PHNX) shares have proved an exceptional investment for diversification investors for over a decade.

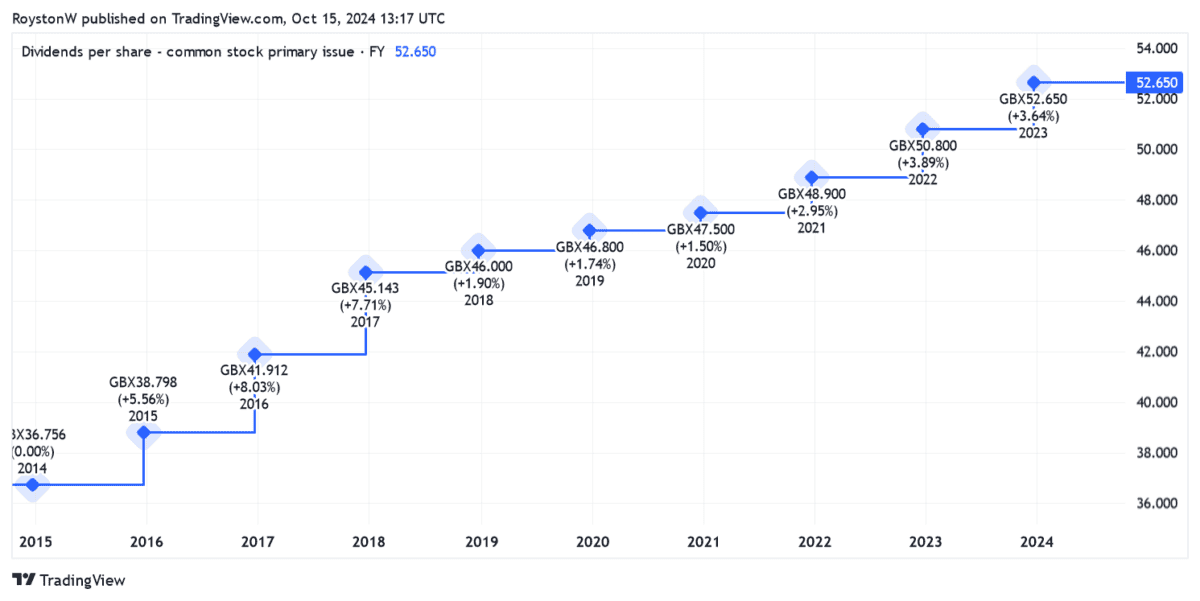

Shareholder payouts rose steadily during that time. And the harvest on the FTSE 100 the company has long beaten the index average of 3% to 4% during that period.

Past performance is no guarantee of future returns. But encouragingly for money chasers, the City analyst community expects dividends from Phoenix stocks to continue marching upward.

So how much money can I make by investing £10,000 today?

annual yield of 11.1%.

Phoenix's long record of generous and growing dividends reflects its commitment to a healthy balance sheet. Even when wages have fallen — which has happened three times in the past five years — prize money has risen steadily.

Last year, the Footsie company increased its shareholder payout by 4% to 52.65p per share. And as the table below shows, dividends are projected by City buyers to continue rising until at least 2026:

| A year | Share of each share | Share growth | Return yield |

|---|---|---|---|

| 2024 | 54 p | 3% | 10.4% |

| 2025 | 55.6 p | 3% | 10.8% |

| 2026 | 57.3 p | 3% | 11.1% |

As you can see, the dividend yield on Phoenix shares is two to three times larger than the FTSE 100 average.

And even if the dividends fail to grow past 2026, I can still make four-figure monthly dividend income with a lump sum investment.

Combined benefits

Let's say I have £10,000 ready to invest. If the seller's predictions are accurate, this would help me:

- £1,040 in dividends in 2024

- £1,080 in dividends by 2025

- Dividends of £1,110 in 2026

If profits remain locked at 2026 levels, over the next ten years I could enjoy dividends of £11,100. Over 30 years, I could make £33,300 in passive income.

That's not bad, I'm sure you'll agree. But there's not much I can do about reinvesting my earnings, or compounding my returns.

Great income

If I used this traditional investment strategy, I would – after 10 years, and based on that 11.1% interest yield – make £22,208 in dividends. That's it more than doubled £11,100 I would have made otherwise.

On a 30 year basis, the difference is very noticeable. With dividends reinvested, I would have made an income of £291,653. That makes an income of £33,300 that I could have made without the reinvestment.

With the £10,000 I invested initially, my portfolio would be worth a staggering £302,653 (assuming zero share price growth). With annual withdrawals of 4%, I would have £12,106 in income, which equates to £1,009 a year.

A bright idea

That being said, I am waiting for Phoenix's share price again dividends per share will increase significantly during this time, too, a situation that could give me an even bigger second income.

I expect profits here to balloon in the coming decades, as the aging population in the UK drives demand for pensions and other retirement products.

If it can maintain a strong balance sheet, Phoenix can continue to pay big dividends while investing for growth, too. Encouragingly, its Solvency II ratio is a staggering 168%, according to its latest financials.

The company is facing intense competitive pressure that could erode earnings and profits. But all things considered, I think Phoenix shares are worth a closer look right now.

Source link