Is the stock market about to turn upside down?

Image source: Getty Images

In general, the stock market has done very well in 2024 FTSE 100 up about 7% again S&P 500 gained about 23%.

However, with stock prices, very sharp declines often follow periods of very large returns. So can investors be fearful in the near future?

Horrible symptoms

There are two main reasons why the stock market may crash. The first is that stocks look expensive – not just in the US.

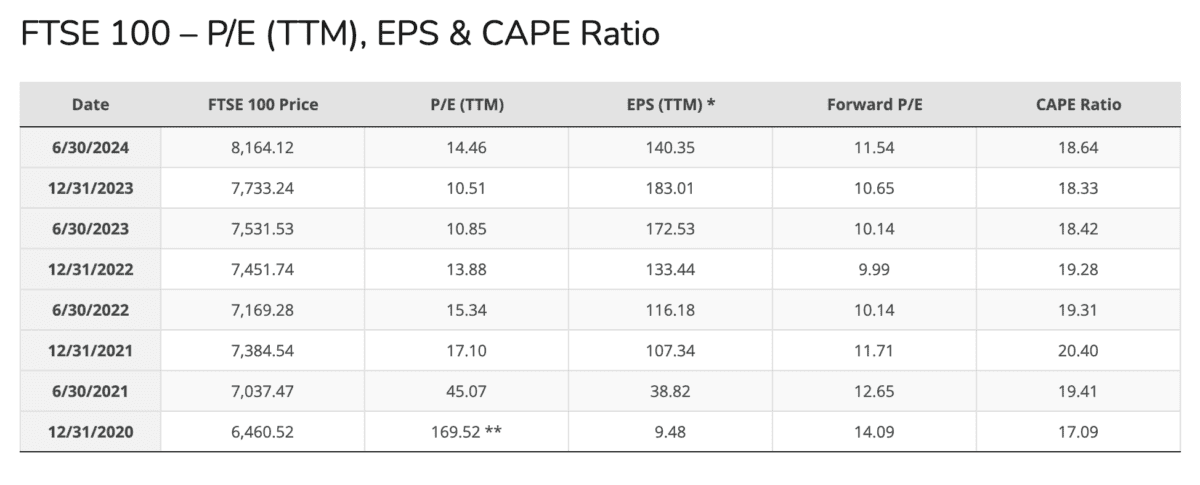

At the end of June, the FTSE 100 was trading at a forward-earnings (P/E) ratio of 11.5. That is the highest since 2022 and the index has risen since then.

On top of this, the macroeconomic environment does not look particularly friendly for stocks. After cutting interest rates in August, the Bank of England decided to hold interest slightly in September.

If the US Federal Reserve does the same, then investors who have been expecting rates to fall may have to rethink their buying decisions. And that can be bad for stock prices.

This is a real possibility – a decline in bond prices indicates that investors are worried about the prospect of inflation. If that is seen, the central bank may have to change course.

Nothing is guaranteed, but investors looking to buy stocks this Halloween may have a chance. Fortunately, like witches and ghosts, there is almost nothing to be afraid of.

Don't run away

Stock market crashes can be scary. But the rewards for investors who avoid running away when things get scary can be dire.

For example, Warren Buffett is done buying stocks Coca-Cola (NYSE:KO) in 1994. Since then, the stock market crashed three times – in 2001, 2008 and 2020.

Despite this, the investment is that Berkshire Hathaway paid $1.3bn because it has a market value of around $27bn today. And that doesn't include dividends, which go up every year.

Buffett didn't need to predict what the stock market would do to produce that amazing result. The only thing required is to find an outstanding company and stick with it.

Coca-Cola absolutely fits the bill in this regard. At today's prices, I think there are better opportunities, but the quality of the underlying business is undeniable.

Selling the Coke investment in anticipation of a market crash at any point in the last 30 years would have been a huge mistake. And I think that's a lesson that investors can take note of.

happy Halloween

Halloween is a great reminder that it can be fun to feel scared. But a stock market crash is almost never fun for investors who see their stocks fall.

Like Halloween though, the scary part doesn't last forever. And fear at the prospect of a short-term panic can cause investors to miss out on other long-term prospects.

Source link