2 great deals I’m considering for my Stocks & Shares ISA!

Image source: Getty Images

I FTSE 100 again FTSE 250 increased by about 7% from the beginning of 2024. This has allowed many Stock and Shares ISA investors like myself to enjoy strong returns over that period.

Right now, I’m looking for a non-core share that hasn’t enjoyed solid returns.

Warren Buffett’s investment advice is “fearing when others are greedy and being greedy only when others are afraid.” Like him, I aim to buy quality stocks when they trade at low prices, which in the long run will lead to huge capital gains.

Buffett’s fortune of $144bn shows the enormous power of this stock buying strategy.

Bank of Georgia

In my list of the best deals to consider in my stocks and shares ISA, Bank of Georgia (LSE:BGEO) is probably close to the top.

This FTSE 250 share has dropped 30% in value over the past six months. Once a regional rival TBC Bankis declining in value as Georgia’s political system has experienced new upheavals.

Both were embroiled in the aftermath of last month’s general election, an event marred by allegations of vote-rigging and violence. It creates a new rift between the country’s prime minister and the president, and casts doubt on Georgia’s economic trajectory (and its potential membership of the European Union).

I would argue, however, that this troubling background has been factored into the decline in Bank of Georgia shares.

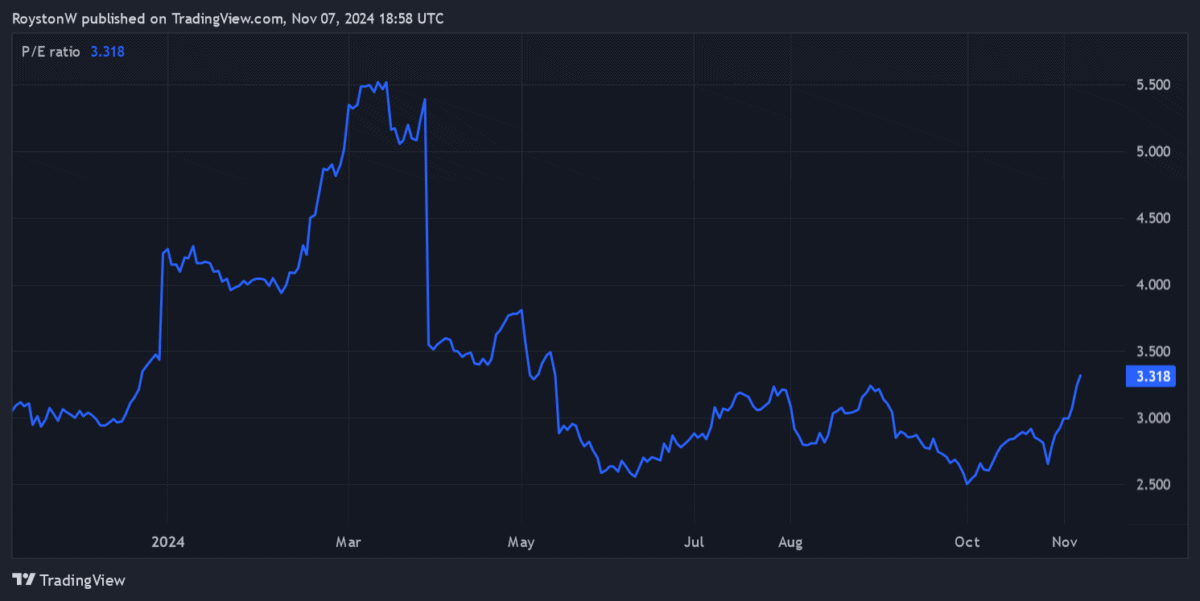

The emerging market bank trades at a forward price-to-earnings (P/E) ratio of 3.3 times

The bank also has a huge profit of 6.2% this year.

At these levels, I find the FTSE 250 share very attractive, even accounting for the uncertain political environment. Profits here jumped 16% in the first quarter of 2024, as Georgia’s strong economy fueled growth in the country’s booming banking sector.

Vodafone

Telecommunications is generally not considered a highly cyclical industry. In fact, income tends to be more stable these days as our lives become more digital, which in turn protects the demand for broadband and mobile data services.

Such companies are not completely immune to economic downturns, however. And with President-elect Trump threatening Europe with higher trade tariffs, local businesses are interested Vodafone (LSE:VOD) is facing a potential regional downturn.

This situation could seriously hamper the firm’s plans to change in the important German market. However at current prices, I still find the telecoms titan an attractive stock to buy.

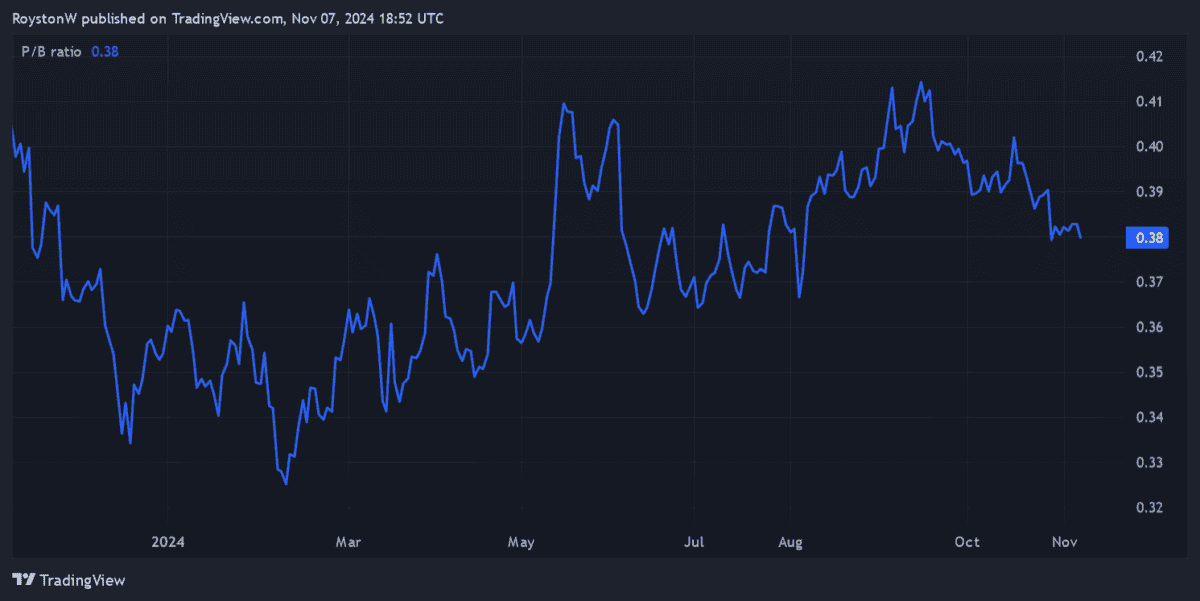

Its price-to-book (P/B) value of 0.4 is below the value threshold of 1. This shows that Vodafone is trading at a huge discount to the value of its assets.

The business also offers excellent value from an income perspective, with its forward dividend yield standing at 5.2%.

Vodafone is facing challenges in the near term. But I am always optimistic to look ahead as the trend of digitalization continues. I am also optimistic about the company’s fastest growing African location in the telecommunications and mobile money services sector.

If I buy Vodafone shares today, they can deliver significant long-term returns.

Source link