Up 8% today, is this FTSE 100 stock a slam-dunk buy for me?

Image source: Getty Images

Halma (LSE:HLMA) has enjoyed another fantastic year in 2024 FTSE 100 The stock — which manufactures security tools and risk detection gear — continues to deliver record performance despite a tough economic backdrop.

Another bright trading update on Thursday (November 21) sent Halma shares up 8%. This takes the total gains since the beginning of the year to 20%.

Is this the best Footsie growth stock to buy today?

A £1bn sales milestone

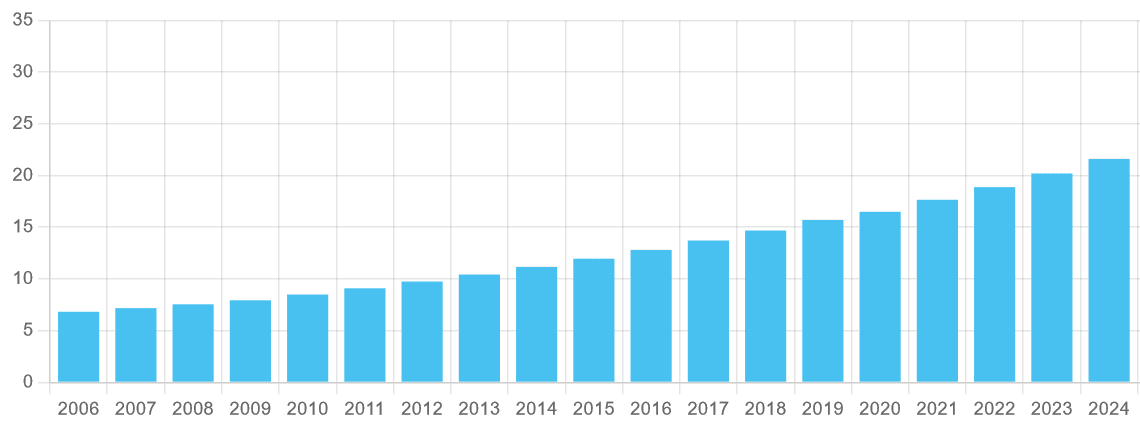

Halma is a master at identifying lucrative acquisitions and squeezing every drop of value out of them. That’s why the M&A-driven business has delivered 21 consecutive years of record profits.

Thursday’s update showed that this strategy continues to pay off handsomely. Revenue rose 13% between April and September to an all-time high of £1.07bn. Organic revenue was up 11.5% over the period, with new acquisitions making up the rest.

Halma’s adjusted EBIT margin rose 70 basis points, to 20.7%, thanks to the strength of its Environmental and Analytics unit. Combined with those increased sales, adjusted EBIT increased by 17% to £222.5m.

Pre-tax profit was up 16% at £174m, also a new all-time high.

Reasons to be happy

Unsurprisingly, this record-setting performance – beating even Halma’s highest expectations – has taken the market by storm. But this is only part of the story.

As well as delivering impressive profit and profit growth, Footsie’s company also reported impressive cash generation in the first quarter.

Currency conversion came in at 108%, up from 96% in the same period of 2023. It also exceeded the company’s target by 90%.

This is important for two reasons. First, it gives Halma more power to make acquisitions to develop more capital. Unfortunately, the company’s net-to-adjusted-EBITDA ratio also fell to 1.27 times from 1.42 times, within its target of two times and less.

Second, Halma’s increase in revenue enabled him to deliver another dramatic budget increase.

At 9p per share, the interim dividend was up 7% year-on-year. This reinforces the company’s appeal as one of the best growth stocks in the FTSE 100 (annual earnings have risen for 45 straight years).

Top buys?

Obviously there is a lot to be excited about in Halma then. But would I buy its shares today? I’m not so sure.

This is clearly a high quality company with a bright vision. It has a lot of financial power to use what is described as “a healthy pipeline of potential acquisitions“. And it has many opportunities for growth in all its developed and emerging markets.

However, I feel that much of this is now baked into Halma’s share price. Following today’s earnings, the company now trades at a massive forward price-to-earnings (P/E) ratio of 30.2 times.

This is more than double Footsie’s average of 14.2 times.

Halma’s high valuation may limit any further gains in the share price. It may cause a change in the share price if the blockbuster trade updates dry up. This could happen, for example, if the world economy experiences a new recession.

I will give Halma a closer look when it drops in price. But for now I’m happy to sit on the sidelines.

Source link