10%+ profit growth! 2 FTSE 250 stocks dropped in turbocharge shares

Image source: Getty Images

Are you looking for stocks to buy? Here are two FTSE 250 income shares I think deserve serious consideration.

Both are promised to grow annual dividends by double-digit percentages over the next two years.

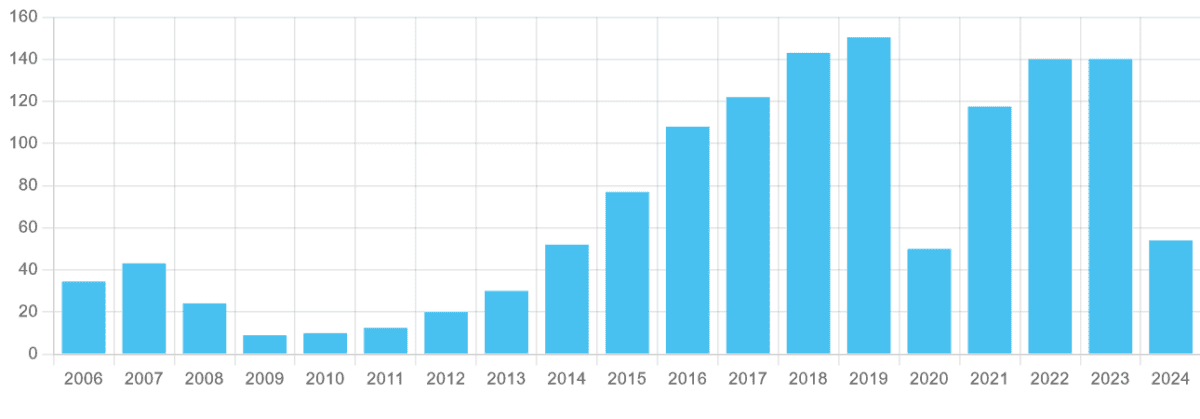

Bellway

Benefits of shares: 2.6% in 2025, 3.4% in 2026

Assignments to Bellway (LSE:BWY) has been going up and up like a saw in recent years. In the last financial year (ending July 2024), shareholder payouts more than halved due to the UK housing market slump.

Such volatility can be part and parcel of investing in cyclical stocks. And the battle has not been won for the likes of Bellway, with stubborn inflation leading economists to revise their interest rate expectations. Higher prices will reduce demand for corporate housing.

However, City analysts still expect profits to rise again. This comes as no surprise to me given the continuing power of industry data. New Office for National Statistics data showed house prices in September rose at the fastest rate since February 2023.

City analysts think Bellway’s profits will rise 18% this financial year. And so annual dividends are expected to jump 18%, to 63.9p per share.

A further 32% pay rise is predicted for financial 2026, to 84.5p. This is supported by forecasts of a 31% increase in profits.

Forecasts can turn out to be wrong, of course, but I’m optimistic that Bellway will do well this time around, given its strong profit margin. Predicted cash prizes are covered 2.5 times more by expected earnings for both the next two years.

This is more than twice the widely accepted safety margin. So Bellway would have plenty of room to maneuver even if the housing market recovery begins to cool.

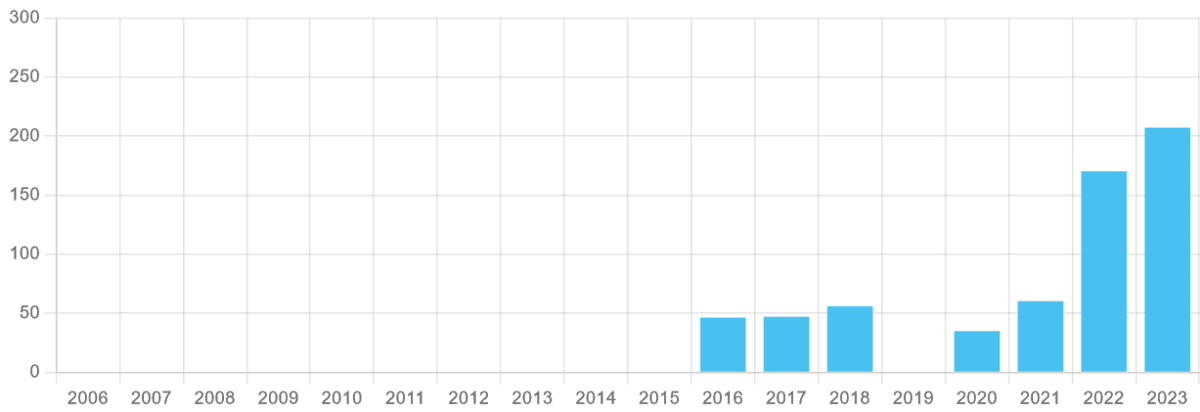

TBC Bank Group

Benefits of shares: 6.7% in 2024, 8.1% in 2025

Assignments to TBC Bank Group (LSE:TBCG) has rebounded significantly from the depths of the Covid-19 crisis. As a homebuilder, City analysts predict strong pay growth over the next two years.

In 2024, a total dividend of 7.56 Georgian lari (£2.18) per share is forecast. That’s up 5% from last year’s levels. Dividend growth is expected to increase to 20% next year, too, resulting in a dividend of 9.10 lari.

Forecasts are supported by expected earnings growth of 11% and 20% in 2024 and 2025.

These outstanding ratings reflect the stability of Georgia’s economy and the development it offers to financial services providers. TBC’s latest financials showed pre-tax profit rose 19.1% in the September quarter.

Shares are not guaranteed, as we have seen. But I expect the company to meet these predictions. As with Bellway, TBC enjoys excellent dividend coverage for the period, with three high readings. This provides a broad buffer if economic conditions worsen, for example, and a drop in loan demand reaches profitability.

On top of this, TBC has a strong balance sheet which it uses to help it pay dividends. As of September, the bank’s CET1 capital ratio was 16.6%, above regulatory requirements.

Source link