10% profit growth! 2 FTSE 100 stocks that have been asked to pay a premium

Image source: Getty Images

Looking for a dividend growth stock? These FTSE 100 the shares are expected to deliver strong dividend growth over the next few years at least.

BAE Systems

Share profit: 2.5% in 2024, 2.7% in 2025

The steady state of arms use means that defense is often a strong sector for gains. This is especially true today, as the breakdown of the global system drives rapid rearmament in the West.

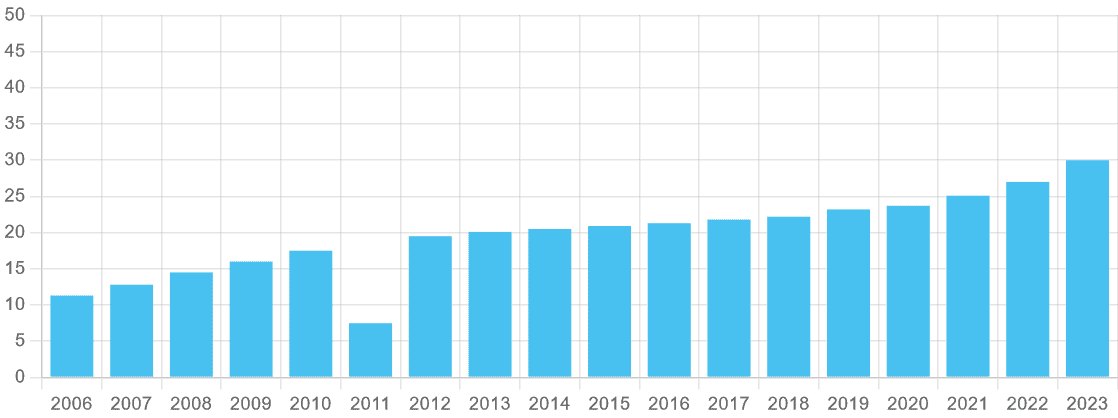

BAE Systems (LSE:BA.) is one contractor with a long track record of exceptional profit growth. It has increased shareholder payouts every year since 2011. It’s a trend City analysts expect to continue, which makes it worth a closer look in my opinion.

Payouts are expected to rise 8%, to 32.3p per share, this year. Dividend growth is expected to increase to 10% by 2025, resulting in an annual premium of 35.5p.

Forecasts for the coming year are supported by expected profit growth of 7% and 12% in 2024 and 2025 respectively. As a result, the estimated profits for both years are covered 2.1 times by the forecast profit.

Both readings are above the 2-times safety benchmark, giving stock forecasts more irony.

BAE also has a strong financial base to fund dividends if earnings disappoint. Profits may fall on average due to supply chain issues, for example, a major threat to the annual revenue of defense companies today.

The Footsie company had £2.8bn of cash on its balance sheet as of June.

BAE Systems’ order backlog is growing, reaching a record £74.1bn by mid-2025. It looks set to continue rising again, which bodes well for long-term gains.

Airtel Africa

Share profit: 5.4% in 2025, 5.5% in 2026

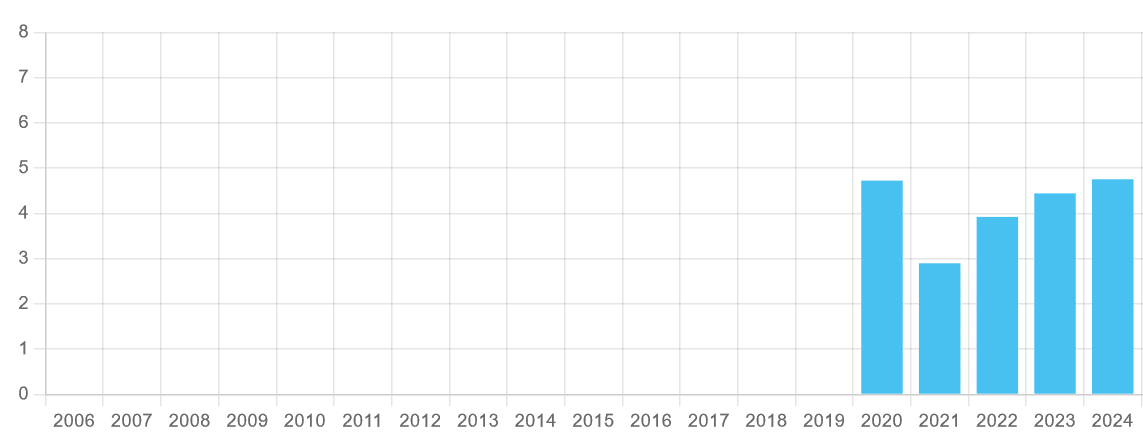

Telecoms Provider Airtel Africa (LSE:AAF) doesn’t have as long a track record of dividend growth as BAE. Listed only London Stock Exchange five years. It also lowered the annual payment in 2021 as it also reduced benefits to reduce debt.

However, cash payments have increased since then, and by more than double-digit percentages at times. It’s a trend City retailers expect to continue.

For this fiscal year (until March 2025), the total dividend is forecast to be 6.52 US cents per share, up 10% year-on-year. Another 3% increase is expected in 2026, to 6.70 cents.

However, I must warn that Airtel’s forecasts are not as strong as I would like.

Profits are decreasing due to negative financial movements (EBITDA decreased by 16.5% between April and September). And the ratio levels are increasing significantly, with the net-debt-to-EBITDA rising to 2.3 times since September.

The decline in earnings also means that the dividend coverage turns negative this year, with a forecasted profit of 46.7 US cents per share forecast. On the other hand, City analysts expect profits to grow again significantly in fiscal 2026, leaving a strong dividend coverage of 2.7 times.

However, despite the near-term uncertainty, I still believe that Airtel Africa shares are worth considering for risk-tolerant investors.

In addition, I believe that the long-term picture here remains very attractive. Telecoms demand in Africa continues to grow, with Airtel’s customer base up 6.1% year-on-year to 156.6m in September.

Source link